Restoring the American Dream

The path to home ownership for millennials and Gen Z

Over Christmas and the Holiday season, I noticed a recurring theme among my peers in the mid-20s to early-30s age group. There’s a widespread desire to own a home, yet a belief and understanding that goal is unattainable any time soon.

When looking at home prices and interest rates these days, it’s easy to become discouraged. Homes are objectively unaffordable for most people.

What was once a reasonable feat to accomplish in one’s 20s is now often deferred until the 30s or perhaps even another decade.

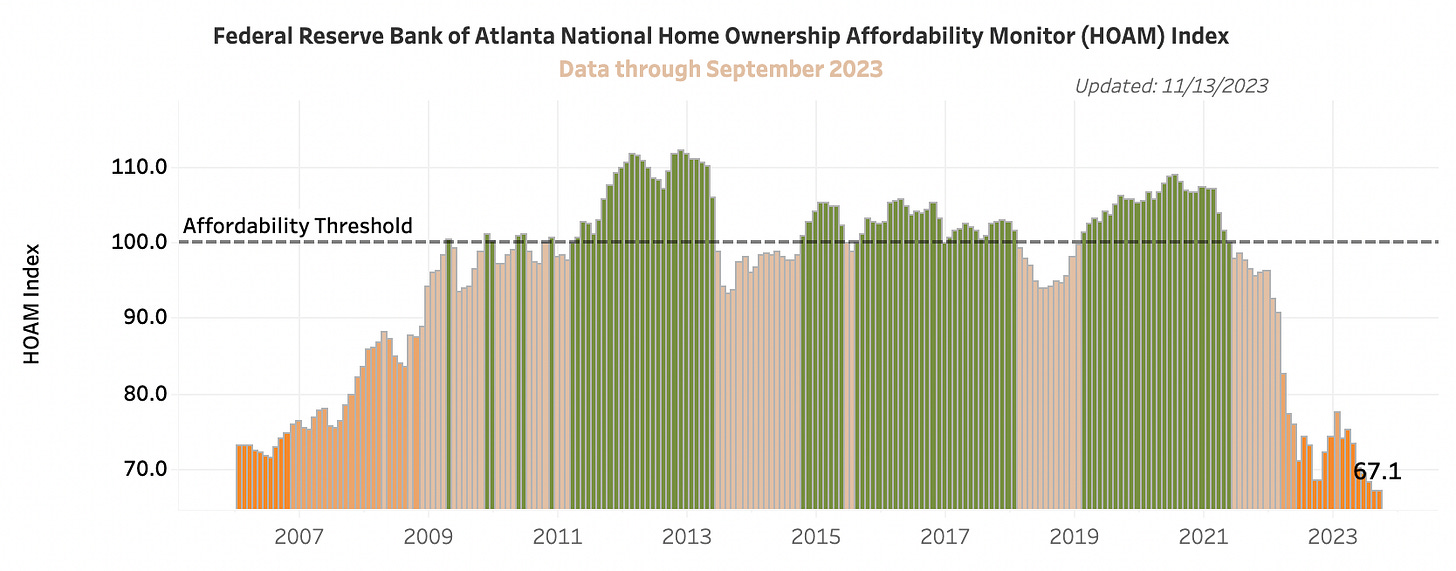

The Federal Reserve Bank of Atlanta’s Home Ownership Affordability Monitor (HOAM) Index can help illustrate just how unaffordable homes are in the US. During the housing crisis in the mid-2000s, this data set was launched, and the latest reading of data through September 2023 shows that home affordability is at record highs. According to the Atlanta Fed, a median-income household would spend 44% of its pre-tax income to own a median-priced home.

I’ve previously delved into the contributing factors behind the widespread decline in home ownership, and among the myriad issues, one stands out prominently—the fiat monetary system.

The devaluation of the dollar, the linchpin of not just the American but the global economy, by the US Government and the Federal Reserve is the most important factor to consider when evaluating the home affordability crisis.

The continued creation of new dollars at an accelerating rate by a select few, at the expense of the public, is the root cause of this crisis. This phenomenon is called inflation, which is simply the expansion of the money supply.

As new dollars are created and enter the financial plumbing and economy, prices of consumer goods and asset prices increase. The surge in home prices is a reflection of the decrease in the value of the dollar.

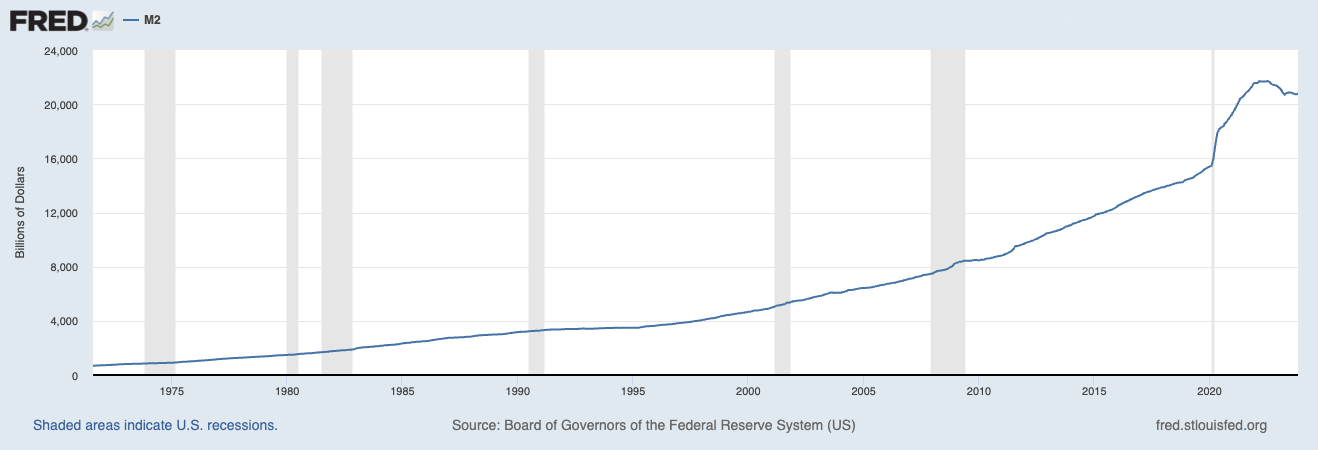

This has become glaringly apparent in the 2020s, where over $6 TRILLION of new dollars were created in less than two years in the United States alone.

At the close of 2022, the median sale price for a home in the United States reached $467,700, compared to $327,100 at the close of 2019. For reference, at the inception of the fiat monetary system in 1971, the median home price was $25,500.

Aside from looking at the stunning growth in home prices, or should I say, the stunning devaluation of the dollar, one can look at the ratio of median home price compared to the median household income to get a sense of affordability. In 1971, a home was 2.5x more than an annual income, and today, that figure is closer to 7x.

In essence, homes are no longer affordable because those who control interest rates and government spending have debauched the currency. With no regard for the consequences and the general well-being of the country, the US Government and the Federal Reserve have looted the pockets of their own citizens.

Most people’s wages do not increase at a rate commensurate with the rate of inflation… in 2020-2021, the US M2 money supply grew by 27% YoY; do you know people who received a 27% raise in that time? Likely not.

Most business owners also struggle during inflationary environments. As the costs to produce their goods skyrocket due to the currency debasement, they must raise prices to keep the same margins… meanwhile, people like Elizabeth Warren have convinced half the country that you (the business owner) are price gouging their customers, adding to the confusion and anger in the country.

Younger generations are particularly feeling the pressure of inflation. Asset prices such as equities and real estate, two primary investment vehicles in America, have inflated tremendously over the past two decades, especially post-2020. Again, this is due to the currency debasement; when more dollars enter the system, anything relatively scarce to the currency increases in price.

Older generations have been able to accumulate assets over the past 20-50 years at much cheaper prices. As the currency has been devalued and home prices have increased, they've benefitted, at least to some degree.

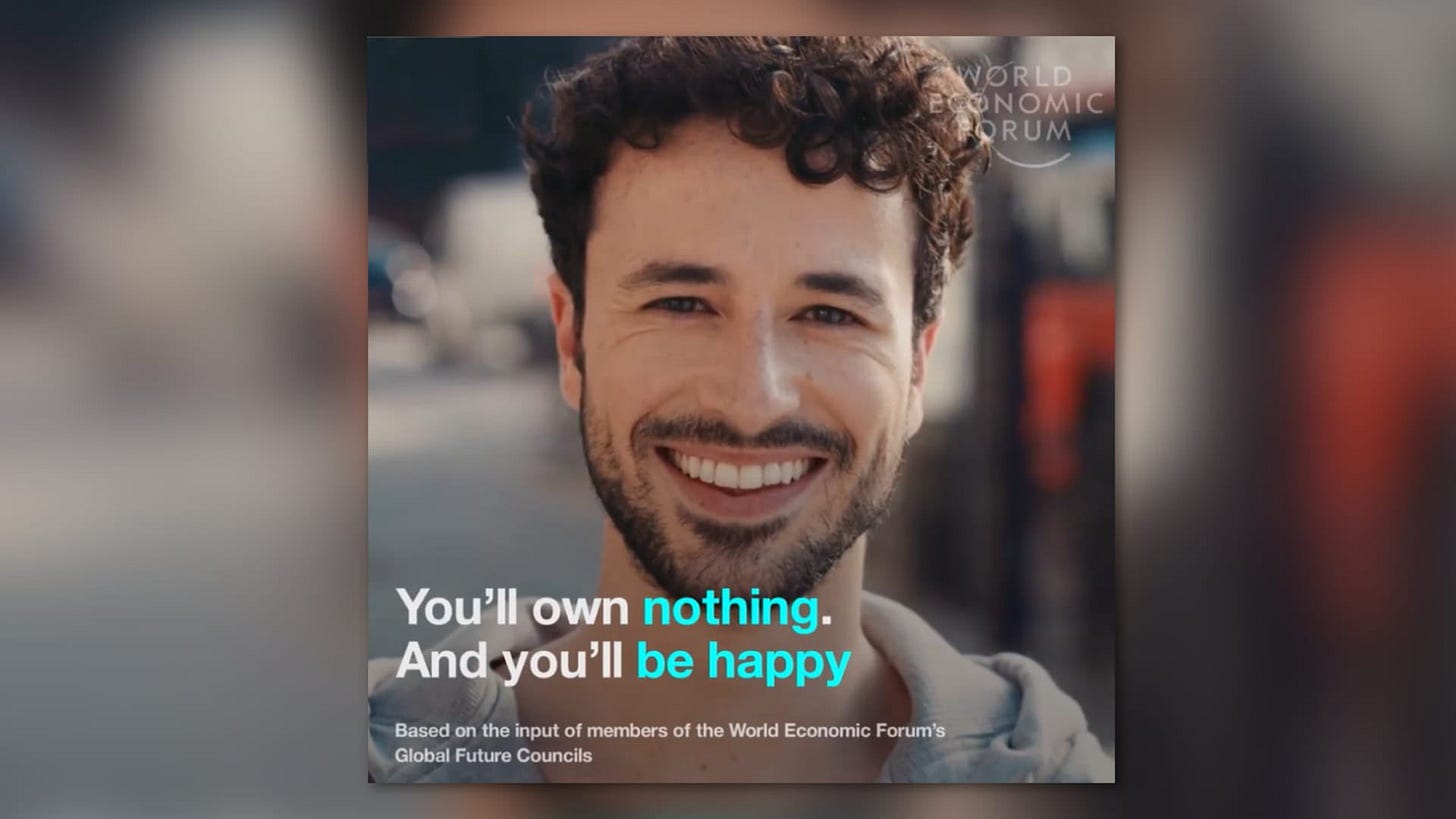

Yet, the millennials and Gen Z are considerably lagging in home ownership because the money is broken, and home prices reflect that. At this rate, the World Economic Forum may be right about 2030… younger generations will "own nothing…” but I don’t think they will "be happy."

Unless there’s something that can be done to restore the American Dream?

Maybe you saw the answer from a mile away… bitcoin.

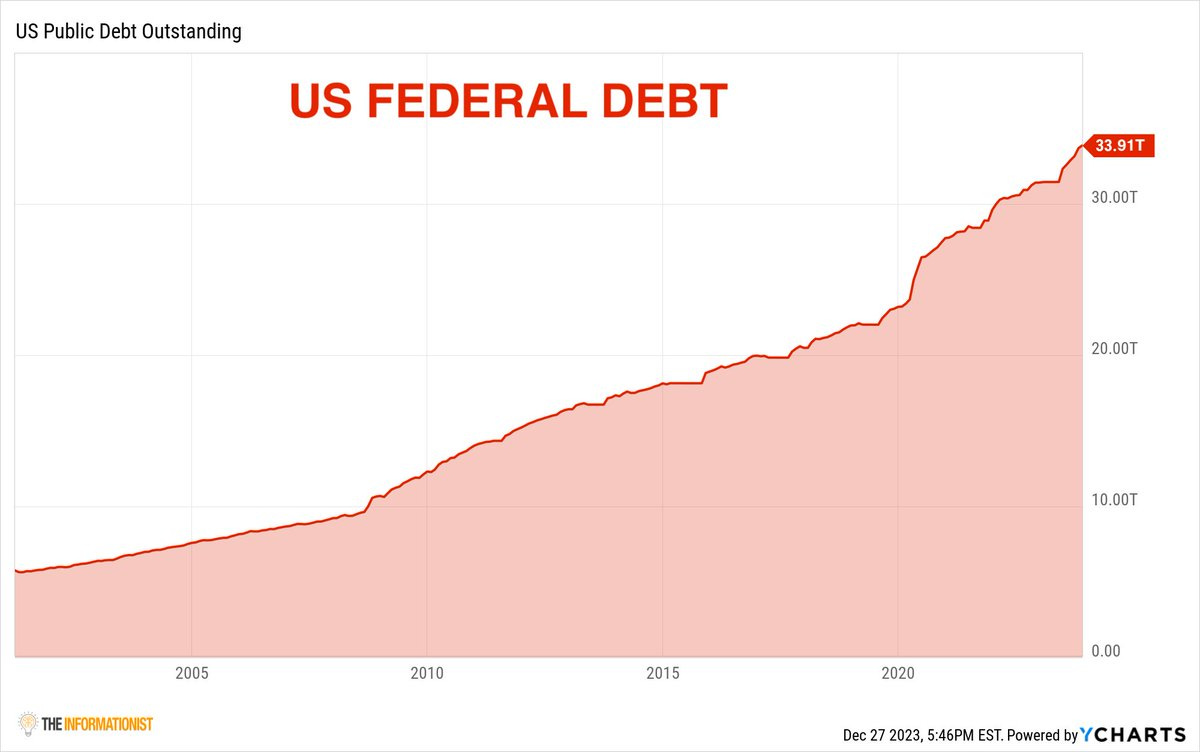

Unfortunately, it’s inevitable that the US government and the Federal Reserve will continue on the path of currency debasement. The Federal Debt to GDP ratio is over 120%, which means that the government will either need to default on their obligations or print the money to fulfill the obligations, which will further destroy the value of the currency.

It’s critical to understand this. The talking heads have told you that inflation has been defeated… while YoY increases measured by CPI have decreased. You don’t need me to tell you that prices are much higher than two or four years ago.

And guess what? They’re not going down from here. We just lived through only one of many periods of high inflation on the horizon.

If you can internalize that we’re living in an inflationary regime due to crooks in the government and the central banks, then you need to take appropriate action to protect yourself and your family.

This reality means that the costs of your basic necessities like a home are going to increase and potentially become even more unaffordable on a dollar basis.

That’s where bitcoin comes into play. It may be a challenge to grow your income faster than inflation; your traditional investments may keep pace with inflation, so you need a way to grow your wealth faster than the inflation rate.

Fortunately for all of us, bitcoin exists, and its fifteen-year track record as a savings mechanism is extremely compelling despite being ~37% below its all-time high of ~ $69,000. These annualized returns will look even better a year from now in the bull market.

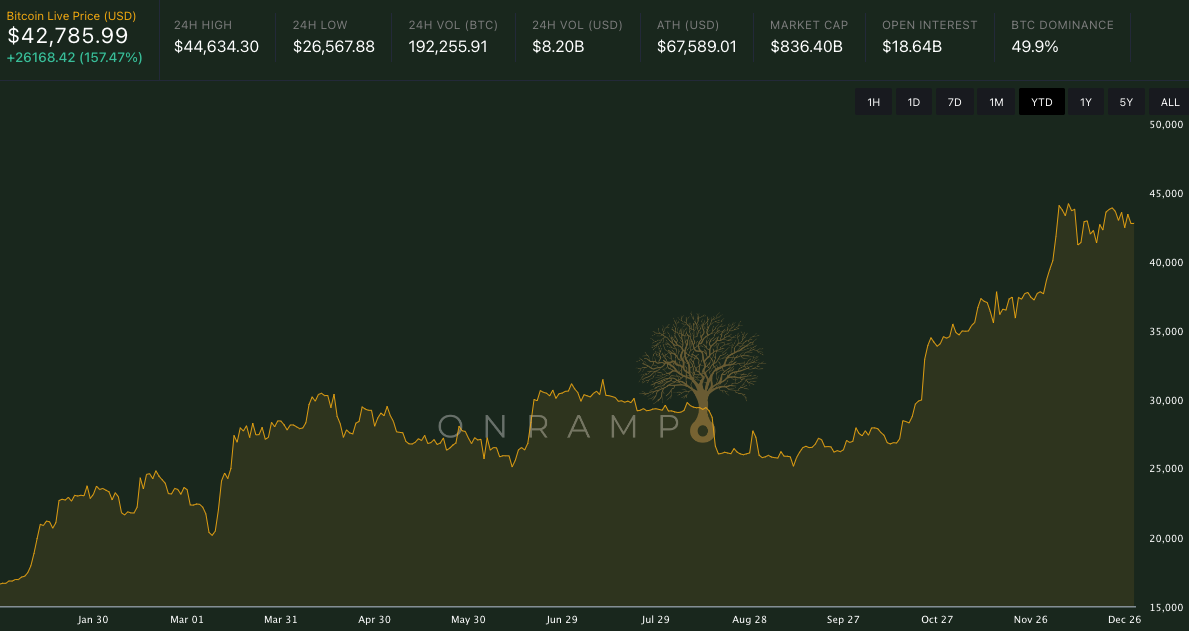

Bitcoin’s historical returns (as of 12/29/23):

2023: 157%

3-year annualized: 16%

5-year annualized: 62%

10-year annualized: 50%

Bitcoin’s absolute scarcity, 21 million fixed supply, and increasing scarcity every four years, the halving, stand in stark contrast to the infinite amount of dollars, or for that matter, any fiat currency, which can be created.

Ultimately, whether one realizes it or not, we’re all looking to invest our dollars in other assets because dollars do not hold their value. That is why the S&P 500 and real estate have become de-facto savings accounts, at least in America.

That might work for the Boomers, but for us millennials and Generation Zs that need to play catch up, we need a vehicle that will compound our savings at a faster rate.

Bitcoin is the savings vehicle that restores the American Dream. In fact, it restores the dream of inviolable private property rights and sound money, not only in the US, but globally. It’s digital hard money that cannot be devalued or confiscated from you - it will become increasingly clear that this is the path to protecting and growing one’s wealth in the 21st century.

Bitcoin makes widespread home ownership attainable once again.

Without bitcoin, the younger generations' outlook on life is bleak. Due to the currency debasement perpetrated by the state, we are living through increasingly unaffordable, polarized, and unstable times… there's not much hope. A home seems to be a distant dream.

Unless you’ve found bitcoin.

Thanks for reading! I hope you enjoyed today’s article. If you did, consider sharing the article or the newsletter with family, friends, and colleagues. It’s a huge help, and I greatly appreciate it.

Also, before you go on with your day…. this is a reader-supported column.

If you have the financial means ($6.40/month with a discount) and are interested in supporting my work directly, use the link below to access a Christmas discount and become a paid subscriber.

Next year, I will be rolling out more features for paid subscribers and may try some other formats, such as audio, and organizing virtual meet-ups for us to foster more of a community. Thanks for your support.

All proceeds will be used to buy bitcoin (and eventually a home)!

All the best in the new year!

Jackson