Why Home Ownership is Declining

A consequence of a broken monetary system.

Homeownership was once an attainable goal. Yet, in the past 50 years, we have regressed as a society, making home ownership out of reach for most.

There's no shortage of headlines mentioning the millennial generation's declining trends of home ownership. Yet, there isn't much thought about this issue's root cause and possible solutions.

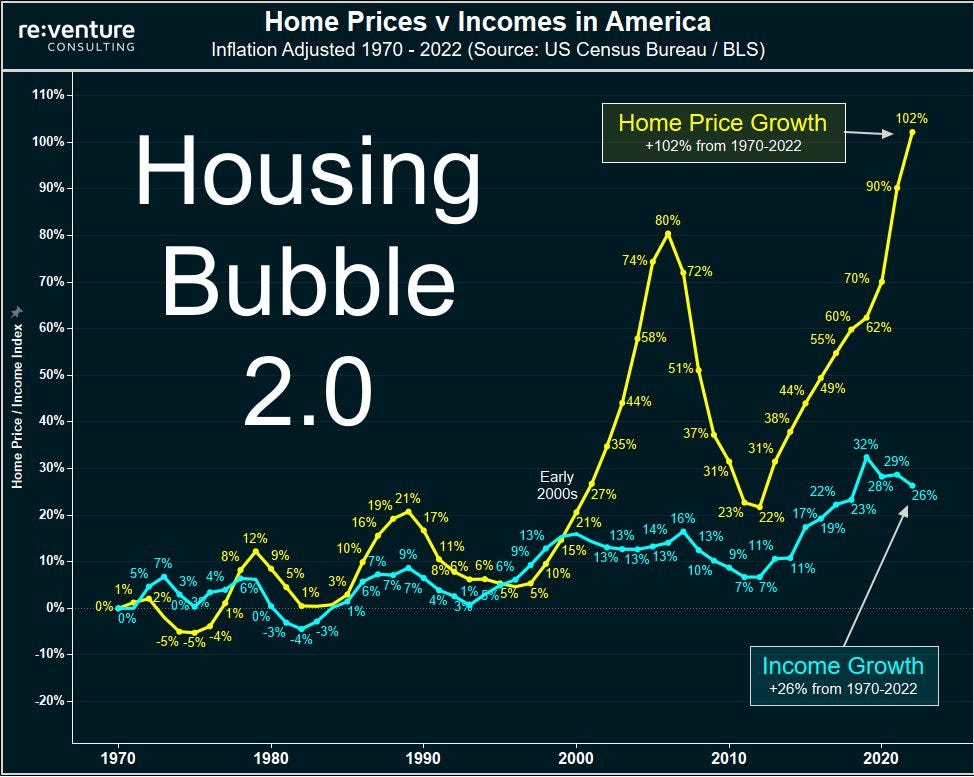

It's quite clear to me that one of the salient reasons that home ownership is declining is because of the diversion between wages and home prices. Real wages, adjusted for fake government inflation metrics, have been relatively stagnant over the past 50 years compared to real (inflation-adjusted) housing prices.

Domestic wages have been under pressure for some time now as working and middle-class labor was replaced by workers overseas. While corporations virtue signal about their Diversity, Equity, and Inclusion programs, they use slave labor in China, which obviously costs virtually nothing. The result of which is an American middle class that has seen so many well-paying jobs and careers vanish to overseas entities. These job losses and wage stagnation have certainly been a main contributor to the loss of hope in so many communities and the concurrent rampant opioid crisis - perhaps an article for another time.

Even for those who can make good incomes, many of them are saddled with excessive college debts as tuition rates have skyrocketed. There are, of course, people who have done well financially in the past 50 years. For the most part, white-collar workers in the blossoming industries such as technology and finance have done extremely well. And finally, I'd be remiss to not mention how wealthy the parasitic elite in Washington DC have become in the past 50 years, driven by the structure and incentives of the corrupt fiat monetary system.

Admittedly, several factors should be accounted for when assessing the earnings side of this housing equation; however, it's safe to say that real wage growth has been much lower than the increase in housing prices across the board.

So why the rising cost of housing? The answer to that question is readily identifiable and can be attributed directly to one factor - fiat money

In 1971, the United States, under the leadership of President Nixon, abandoned the gold standard, and since all other currencies were tied to the USD, the entire world's currencies were no longer linked to gold.

The consequences of this money-for-nothing system, where the government can continue to issue debt unchecked, and the Fed can purchase that debt with money printed from thin air, are vast.

While in theory, there are limits to the US Government's spending, in reality, they don't exist. As cited in a previous article, Congress has raised the debt ceiling 78 times since 1960. The monetary system is based on debt issuance, and that will not stop because if it did, the entire economy would collapse into a Great Depression 2.0.

Ok, back to housing. Since there has been no constraint on creating new dollars since 1971, we've seen a massive increase in the money supply. The expansion of the money supply, commonly called inflation, has driven up the prices of goods and services. We have been programmed to accept that "moderate inflation" is needed for a healthy and productive economy. Global central banks pulled the 2% target out of a hat, but in reality, it's nothing more than "A "Mostly Peaceful" Heist" over the past century.

The reality of "moderate inflation" is that it's a constant and steady transfer of wealth from laborers and savers to those who benefit from creating new money. After decades of "moderate inflation," the stakes of the heist have increased. We are now being blatantly robbed by inflation over the past few years.

Home prices have reflected the increasing amount of dollars in the economy due to the Fed colluding with the US Government. Not only that, but homes are highly interest rate-sensitive goods. Since houses have become so expensive, it is customary to put only a small amount of cash down on the house and finance the rest.

These highly interest rate-sensitive assets have increased in price due to the Fed's monetary policy. For the past few decades, each time there's been distress in the financial markets or real economy, the Fed's solution is to lower interest rates. And more recently, during and after the Great Financial Crisis, they began "Quantitative Easing," effectively money printing.

The chart below showcases the low-interest rate environment due to Fed policy. In response to the Dot Com bubble in 2001, the Federal Reserve lowered the Fed Funds rate from 6% in 2001 to 1% by 2003. Since then, interest rates have been pegged at 0% or close to it, and all assets, such as equities, bonds, and real estate, have benefitted.

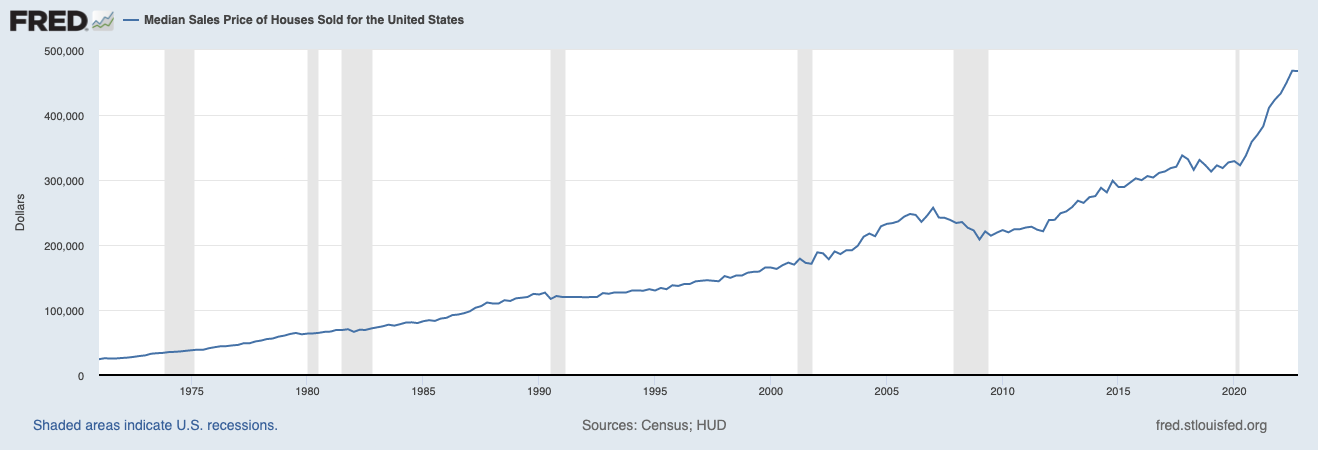

As such, home prices have ballooned in the 2020s due to the massive amounts of new money created and the zero-interest rate policy. In the United States alone, the money supply was increased by $6.4 TRILLION in less than two years.

The median sale price for a home in the United States at the end of 2022 was $467,700 compared to $327,100 at the end of 2019. For reference, at the end of 1971, it was $25,500. To put this in perspective, the median household income in 1971 was $10,290 compared to $70,784 in 2022. Home prices in 1971 were approximately 2.5x of household incomes. Today that figure is closer to 7x.

Did the houses become more valuable, or did the dollar become worth less? The answer is clear.

There's another aspect to the housing affordability crisis, which is also a consequence of the broken monetary system. Because there's a constant devaluation of the dollar and all fiat currencies, people cannot simply save their money. They must invest those savings in an attempt to outpace inflation.

One of the main places people invest their savings is in housing. People purchase homes for reasons beyond the house's utility, such as shelter and a place to gather family and friends. Housing has become another investment for those looking to escape the evils of the central bank and government-driven time theft.

Not only are individuals and families purchasing additional homes to safeguard their savings, but also behemoth investment management firms, such as Blackstone, are buying massive amounts of residential real estate.

While the housing affordability crisis is a complex issue with several contributing factors, it's safe to say that the root cause is the fiat monetary system.

Thanks for reading the article. I genuinely believe that to fix the world, we must first fix the money. Sound money is an economic and moral imperative.

If you agree, please help spread the word and share “The Fiat Cave” or this article. We need as many people to understand the corruption of money and the dangerous path we are continuing down.