Navigating the Complexities of Securing Six-Figure Bitcoin

How to protect your bitcoin wealth from $100k to $1MM

We made it to 2025 - a highly anticipated year for bitcoin investors.

Several catalysts are anticipated to drive the bitcoin price and adoption higher, including:

Favorable US political & regulatory environment

Increased global adoption among corporates & sovereigns

Growing institutional demand for bitcoin

In 2024, Bitcoin appreciated 120%, driven by the halving, insatiable ETF demand, and a decisive Trump victory in the US.

It was a big year for bitcoin in many ways, but perhaps most importantly, bitcoin breaking through the psychological barrier of $100k was the most significant.

The public discourse is shifting from what could cause bitcoin to catastrophically collapse to what could cause bitcoin to go to $1MM.

While there is much discourse about why and how the price will reach $250k, $500k, or $1MM in 2025, I rarely see people discussing practical solutions and strategies for securing the asset from six to seven figures.

That’s a problem because as the price appreciates, more challenges and risks will present themselves to bitcoin investors.

The two prevailing custody forms, third-party custody and self-custody, have significant trade-offs that make them suboptimal and risky for securing six-figure bitcoin.

Trade-offs of Single Institution Custody

Leaving Bitcoin with a single institution creates a single point of failure. Your bitcoin could be permanently lost if the institution is compromised, mismanages keys, or acts maliciously.

There is no shortage of examples, from offshore exchanges to qualified custodians in the United States, that have lost, stolen, or had client assets hacked.

Other drawbacks and risks include:

Weak forms of authentication: malicious actors can access your account credentials and steal your bitcoin.

Social engineering attacks: malicious actors impersonating staff at bitcoin and crypto companies to steal your bitcoin.

Lack of transparency into your bitcoin holdings: you cannot audit your holdings on-chain and your bitcoin could be compromised or rehypothecated (lent) without your knowing.

Lack of inheritance planning: creates uncertainty about your family's ability to access bitcoin in case of emergencies or death.

Account restriction: the exchange could prevent the movement of funds or force you to close your account.

Limited access to financial services such as bitcoin-baked loans.

Poor customer service: stuck dealing with email or chatbots.

While leaving a small amount of bitcoin in an exchange is fine and can offer benefits of convenience and liquidity, there are far too many risks to leaving considerable amounts of bitcoin with a single institution.

Trade-offs of Self-Custody

This will be controversial for some, but I am compelled to share the realities of self-custody and the challenges of safeguarding six-figure bitcoin.

Self-custody has long been seen as a cornerstone of bitcoin’s ethos, and for good reason, allowing individuals to hold their keys and maintain complete control over their assets. However, as bitcoin’s value appreciates, the risks and responsibilities of self-custody increase significantly.1

There is a tiny percentage of investors where self-custody is the most optimal way to secure significant amounts of bitcoin. Those people dedicate serious time and resources on an ongoing basis, are extremely technically savvy, and their families are proficient at managing keys as well.

For the rest of us, managing private keys requires technical expertise and a meticulous approach to security, which most of us lack. Losing access to keys or having them compromised can result in the permanent loss of bitcoin.

Most people who have done self-custody have done it out of necessity to protect it against the counterparty risk of a single institution, but that does not mean their setup is bulletproof — there’s still a lot of risk and room for error.

As bitcoin’s price rises, the burden of self-custody becomes heavier. Individuals become single points of failure, meaning that if something happens to the key holder, there may be no way for family members or beneficiaries to access the funds. Also, most people are busy with work, family, friends, community obligations, travel, etc, and do not have enough time to manage their custody properly.

Additionally, the physical risks associated with self-custody cannot be ignored. Hardware wallets and seed phrases stored in homes or personal safes become targets for theft or coercion, especially as bitcoin’s value attracts more attention.

As bitcoin continues its journey in the six-figure territory, investors ought to weigh the risks and pitfalls of self-custody, as their protocol to manage $10,000 bitcoin should not be the same as $100,00 bitcoin. Some risks to consider below:

Ongoing management of keys leading to forgotten passcodes or lost seed phrases for hardware wallets

High vulnerability to physical threats, especially as the price appreciates

Lack of inheritance plan for families to access the bitcoin

Human error and risk of accidental loss

Troubles managing self-custody when traveling

The Standard for Securing Six-Figure Bitcoin

While many discussions focus on bitcoin’s price trajectory—whether it’s $250k, $500k, or $1MM—far fewer address the practical solutions for securing bitcoin as its value appreciates.

This gap in the conversation is a critical oversight, as the risks of holding bitcoin grow alongside its price. Multi-institution custody (MIC) is the standard for securing six-figure bitcoin.

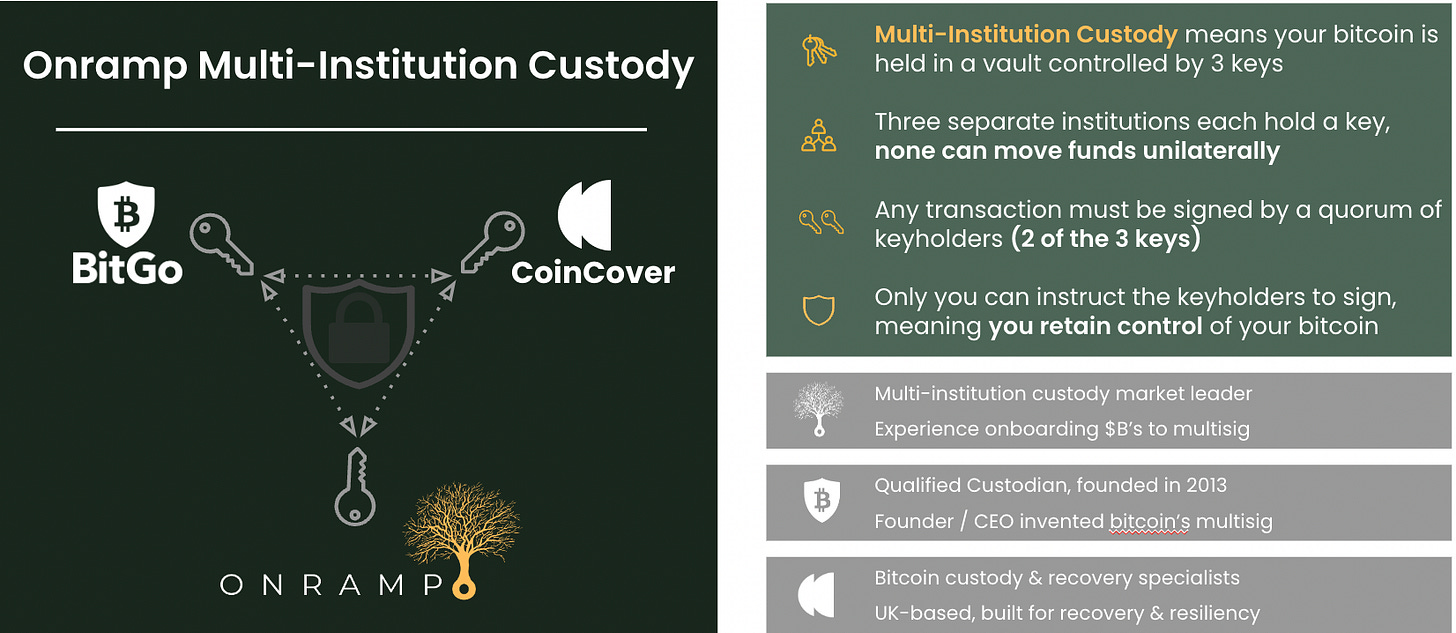

At its core, MIC involves distributing private key management and oversight responsibilities across multiple independent entities.

This means no single party has unilateral control over your bitcoin. Instead, multiple parties must coordinate to authorize transactions, creating a robust system of checks and balances that enhances security and trust.

Also, MIC allows for increased transparency and seamless access to financial services.

Think of MIC as a private bitcoin bank, where only you control the bitcoin and multiple independent entities work on your behalf to safeguard your family’s or business’ bitcoin for the long term.

These are some of the reasons why I am confident that MIC is the standard:

Elimination of Single Points of Failure

MIC distributes the responsibility for key management across independent entities, ensuring that no institution controls the bitcoin. This means no institution can be compromised, act maliciously, or lose the bitcoin. MIC provides redundancy through its distributed setup, ensuring that your bitcoin remains accessible even if one custodian is unavailable, compromised, etc.Built-In Redundancy and Accountability

MIC setups establish natural checks and balances by involving independent custodians. Each institution is incentivized to act responsibly, knowing its reputation is at stake. This distributed model reduces the risk of mismanagement, fraud, or internal compromise while allowing seamless coordination for client transactions.Lower Burden on the Individual

Self-custody can be overwhelming, especially as the stakes rise with bitcoin’s price. Managing private keys, updating firmware, and safeguarding seed phrases all demand technical expertise and constant vigilance. Multi-institution custody alleviates this burden, letting professionals handle the complexities while you maintain peace of mind and secure access.Built-In Inheritance Planning

Inheritance planning is a critical consideration for bitcoin investors. MIC simplifies this process by ensuring that your family or beneficiaries can access your bitcoin seamlessly if something happens to you. Unlike self-custody, where the burden of transferring access can be fraught with technical and logistical challenges, MIC setups integrate inheritance solutions into their frameworks.Enhanced Physical and Digital Security

Rising bitcoin prices increase incentives for physical theft and violence and hackers attempting to steal the bitcoin. With MIC, clients no longer hold key material, significantly reducing the risk of coercion or compromise.Access to a Dedicated Team

Along with the technical benefits, with MIC you can access a dedicated team of professionals who can guide and support you throughout your bitcoin journey. No longer are you on an island managing significant bitcoin all alone.

The Standard for Serious Investors

As Bitcoin crosses six figures, the trade-offs of both single-institution and self-custody models become untenable for most investors.

MIC combines the best of both worlds, offering institutional-grade security, operational simplicity, and access to financial services — it’s the standard for securing six-figure bitcoin.

For me, MIC gives me peace of mind and allows me to enjoy the ride from $100k to $1MM. Hopefully, this piece today gave you more to think about how to protect your bitcoin in 2025 and beyond.

Sign up for Onramp using my link to receive $150 off.

If you want to learn more about MIC, discuss the custody landscape, or chat about bitcoin markets, feel free to book some time to chat with me.

If you know of any friends, family, or people in your network who could benefit from reading this, please share it. It would mean a lot to me.

Disclosure: Those who follow my publication know that I work for Onramp, the leading provider of multi-institution custody. I chose to work here for the reasons outlined above and use Onramp to secure majority of my Bitcoin.

I’m speaking about the risks of self-custody for an investor’s entire bitcoin position. There is still great merit to having some bitcoin in self-custody and that is for the individual to decide how much based on the risk assessment of the above.