Bitcoin is the Premier Global Savings Tech

Bitcoin has already proven itself as the 21st century savings technology

This may sound outlandish to say, but bitcoin is the premier global savings technology of the 21st century. I believe that in the next one to two decades, bitcoin will be the pillar of families' financial plans - the primary savings account.

Rather than investing in a basket of equities or purchasing additional real estate as one's savings vehicle, bitcoin will serve as the primary store of value.

Perhaps it's not radical to say, as bitcoin has already proven itself to be the best savings technology in its fifteen-year history, outperforming every other asset tremendously due to its absolute scarcity, increasing scarcity, and growing network effect.

Depending on your background, I know the idea of bitcoin being a savings account is quite controversial or outright ridiculous. If I told 100 people on the street that bitcoin is the premier global savings technology of the 21st century, I would get a lot of soft smiles and nods, strange looks, and laughs in my face.

And understandably so, the media’s coverage of it in the past fifteen years has been overwhelmingly negative and so focused on the short-term volatility of the asset.

But here’s the thing, I think I’m on to something. And there are millions of other people who think the same. I promise you that I am not writing this article from an institution that my family checked me into for my strange enthusiasm about magic internet money.

At this time, whether you agree with my thesis or not, is not important. What is important, however, is maintaining an open mind and evaluating the data.

It’s crucial to tune out the mainstream coverage of bitcoin. Expand your time horizon (zoom out) and ignore the short-term volatility, and you’ll soon understand the opportunity ahead.

These ideas are really no different than what a traditional financial advisor would recommend or what you would read on a personal finance forum - stay in the market, don’t get shaken out at the bottom, focus on the long-term plan… you get the idea.

The Failure of Fiat Savings

Why am I even writing about this topic, you may be wondering? Well because there’s an urgency to get these ideas out into the world. Savings accounts are failing people globally. I wrote about this in another post:

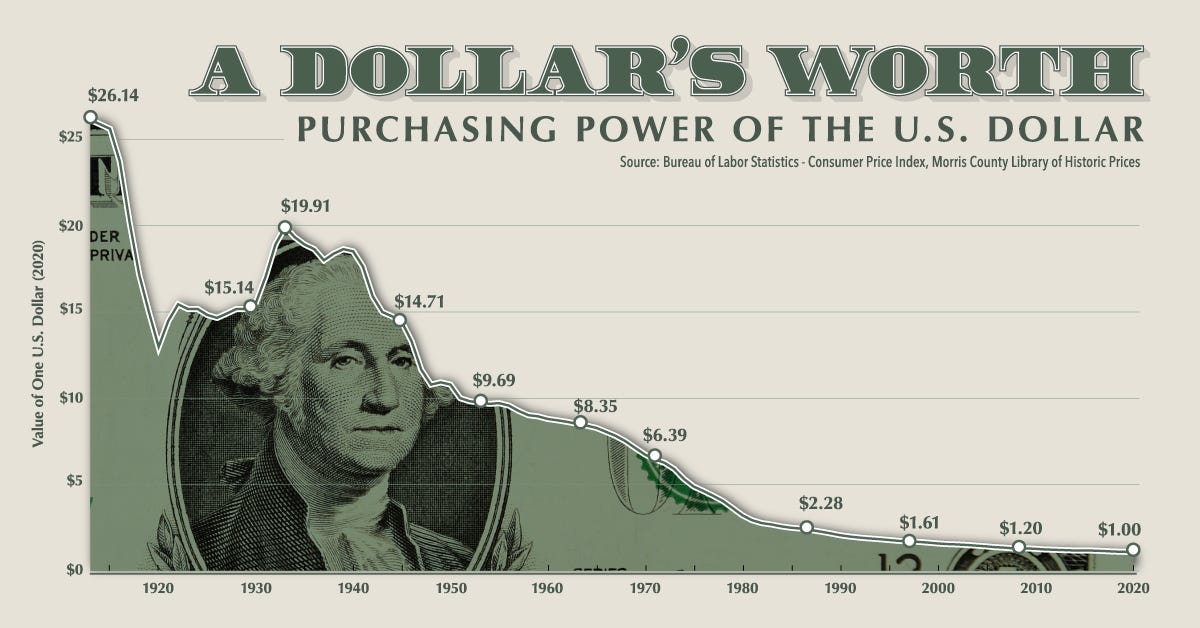

Simply put, since the supply of fiat currencies is being expanded constantly at increasing rates, we cannot save money. Saving has become complicated because it requires investing to preserve our purchasing power against inflation.

Fundamentally, the reason why stocks, bonds, and real estate have become such ubiquitous investable assets is because fiat money is a very poor store of value.

We cannot earn dollars and save them to preserve our long-term wealth. Fiat money mandates that we become investors, which demands our time, or we must outsource this task to someone whom we trust.

Choosing to bypass this crucial step of investing will lead to a certain and potentially rapid decline of your purchasing power, essentially diminishing the value of that time you spent to earn the money - insidious inflation.

A bank savings account no longer serves a purpose, and only those who can purchase financial or real assets can protect themselves against inflation. However, they do not offer the same protection as bitcoin.

Those who find themselves fortunate to have savings, but not fortunate enough to have substantial amounts to invest, the middle class, are ultimately those who suffer the worst from inflation.

The fiat financial system is fundamentally flawed because it’s centrally controlled by the governments and central banks interested in creating more monetary units at the public’s expense. Any long-term savings held in dollars or any fiat currency are guaranteed to decline in purchasing power.

Addressing Bitcoin’s Volatility

First, I must acknowledge that bitcoin is far more volatile than traditional investments people utilize for long-term savings - why is that?

There are several reasons. First and foremost, the erratic price action reflects the instability of the fiat financial system. A system of rampant speculation, massive leverage, and central planners seeking to manage interest rates for a global economy of over 7 billion people. Not only that, but there’s a lack of understanding surrounding bitcoin, which adds a substantial amount of noise.

Is it a tool for laundering money? Is it a poker chip? Is it a risky investment? Is it a geopolitical chess piece? Is it a savings technology? All of these narratives are competing in the market and can translate to a healthy amount of volatility. And, of course, the excessive leverage available in the industry can accentuate that.

And finally, the industry is filled with scammers and fraudsters like Sam Bankman-Fried. All of this causes noise, diluting the bitcoin signal.

The volatility can certainly be difficult to stomach; however, it presents itself as an opportunity for those who remain convicted. Each drawdown is an opportunity to purchase bitcoin below its fair value.

And again, bitcoin is a fifteen-year asset and technology, so it’s going to take some time for the volatility to dampen substantially. The good news is that the bear market drawdowns are already lessening, making it a bit less painful for those who are holding.

The Premier Global Savings Technology

Bitcoin is the premier savings technology because only 21 million bitcoin will ever exist. Not only that, it’s monetary policy, the rate at which new bitcoin enters circulation is known and fixed - every four years, the issuance rate of bitcoin is halved.

It’s a simple supply and demand chart. As demand for a scarce digital asset and payments network increases globally and the rate at which those enter the market decreases, the price can only go up.

Juxtapose this to the dollar or any other fiat currency, built on a foundation of expanding credit, which requires inflation to make good on those debts - a horrible savings technology. Saving in fiat is like trying to fill a leaky bucket; there’s a force actively at odds with your goal.

Bitcoin’s monetary properties, on the other hand, were established in code over fifteen years ago and remain true to this day. It’s intuitive. Given the scarcity of our time, we seek a scarce asset like bitcoin to safeguard our savings, a representation of the time we spent to earn that income.

It’s actually good money - objectively. It has superior monetary properties to all monies that came before or it: seashells, glass beads, silver, gold, pounds, dollars. You get the point. There’s no central issuer that can increase the units of bitcoin and destroy your savings’ value.

I really like how

author of Once in a Species and my colleague at Onramp writes about “what does bitcoin mean for you?”For users (meaning, any individual or entity who stores value in this “digital gold”), Bitcoin is a savings technology. (Credit to Pierre Rochard for this idea.)

What does this mean? The simple (and implausible-sounding) reality of Bitcoin is that it is designed to increase in purchasing power over time, specifically because of its increasing scarcity — pre-programmed and guaranteed every 4 years.

The reasons this sounds so impossible to us is that there’s never been an asset that reliably grows in purchasing power over time, specifically because it has never been possible in the physical world to immutably guarantee increasing scarcity of new supply issuance.

In other words, the way to think about what Bitcoin means for you is that it is a tool for you to leverage. This asset is designed to get more scarce every 4 years, and these supply-demand mechanics result in Bitcoin becoming more valuable over time.

So that's the thing, bitcoin is already and will be globally recognized as the best savings technology. Especially since there are minimal barriers to entry ( internet and a smartphone) and it's available globally. It's programmed to increase purchasing power, as Jesse highlights.

The data speaks for itself too - bitcoin is a fantastic savings technology for those willing to adopt it as a long-term storage of their wealth.

Since bitcoin began trading on exchanges in 2010, and at its current price of ~ $42,000, you could have bought bitcoin any day between now and then, and 94% of those days, you would be in the green. Simply put, this means that the current price is higher than the past price on 94% of nearly 5,000 days.

It's an oversimplification since it does not account for inflation; however, it shows that despite the price swings on any given day or week, buying bitcoin almost always netted a positive return (nominally). And once you have conviction those big price dislocations to the downside are a great opportunity to buy.

The annualized returns demonstrate the same results - that bitcoin is an excellent long-term savings technology. The 1 year return is 80%, 3 year is 9% (annualized), and 5 year is 65% (annualized). Mind you bitcoin's price is still 38% below its all-time high.

So, I hope I've helped make the case that I am not a crazy person writing this from an institution; I am simply living in the future.

Like an early adopter of the internet, I've realized, along with millions of others (I'm not special), that bitcoin is the best savings technology.

With each passing day of bitcoin's existence and growing adoption, the likelihood of bitcoin becoming the standard for savings globally becomes more likely.

As more people realize that their stocks or real estate are proxies for money (savings) and there's a better form of money out there, the floodgates will open.

Thanks for reading! If you found this article valuable, you can share it with your family, friends, and network with the link below. It’s crucial to do what we can to help people understand bitcoin as inflation continues to destroy savings.

To get bitcoin-focused commentary, research, analysis, and more direct to your inbox, subscribe to The Fiat Cave.