Bitcoin Crashes & Investor Behavior

Bank of Japan spurs global market sell off impacting bitcoin. What can we learn?

The global financial markets, including bitcoin, have undergone significant volatility in the past few days. In a week, bitcoin’s price decreased from $70,000 to briefly below $50,000, a correction of more than 20%. As of this writing, bitcoin sits at ~ $55,000.

The swift and steep correction was not isolated to bitcoin. Japan’s Nikkei 225 had its worst trading day since “Black Monday” in 1987, falling by 12.7%, and the S&P500 decreased by 3% led by technology stocks.

The global sell-off was largely driven by the Bank of Japan’s decision to raise interest rates by 0.25% last week. If you want more details, I’d recommend

’s recent publication “Godzilla Returns.”If anything, the takeaway here should be that the fiat financial system is insanely over-leveraged (massive debts), and when central banks change their policy, i.e., increase or decrease interest rates, it can have outsized impacts on global markets.

In addition, there are increasing fears of a recession in the US and heightened geopolitical conflict in the Middle East. Between these three factors, we saw investors selling 'risk assets' and shoring up cash. Bitcoin trades 24/7 and stood as a source of liquidity over the weekend, as it was sold to raise cash.

Bitcoin's volatility is often cited as a criticism of the asset class. Those less familiar with bitcoin's properties and value proposition are quick to point at its major down days and use it to validate critiques that it is nothing more than a speculative casino chip.

However, the opposite is true. Bitcoin's volatility often reflects the instability of the global financial markets and investor behavior. When there is widespread panic, bitcoin is often the first asset to be sold, and when there are issues with the plumbing of the financial system, bitcoin can be impacted.

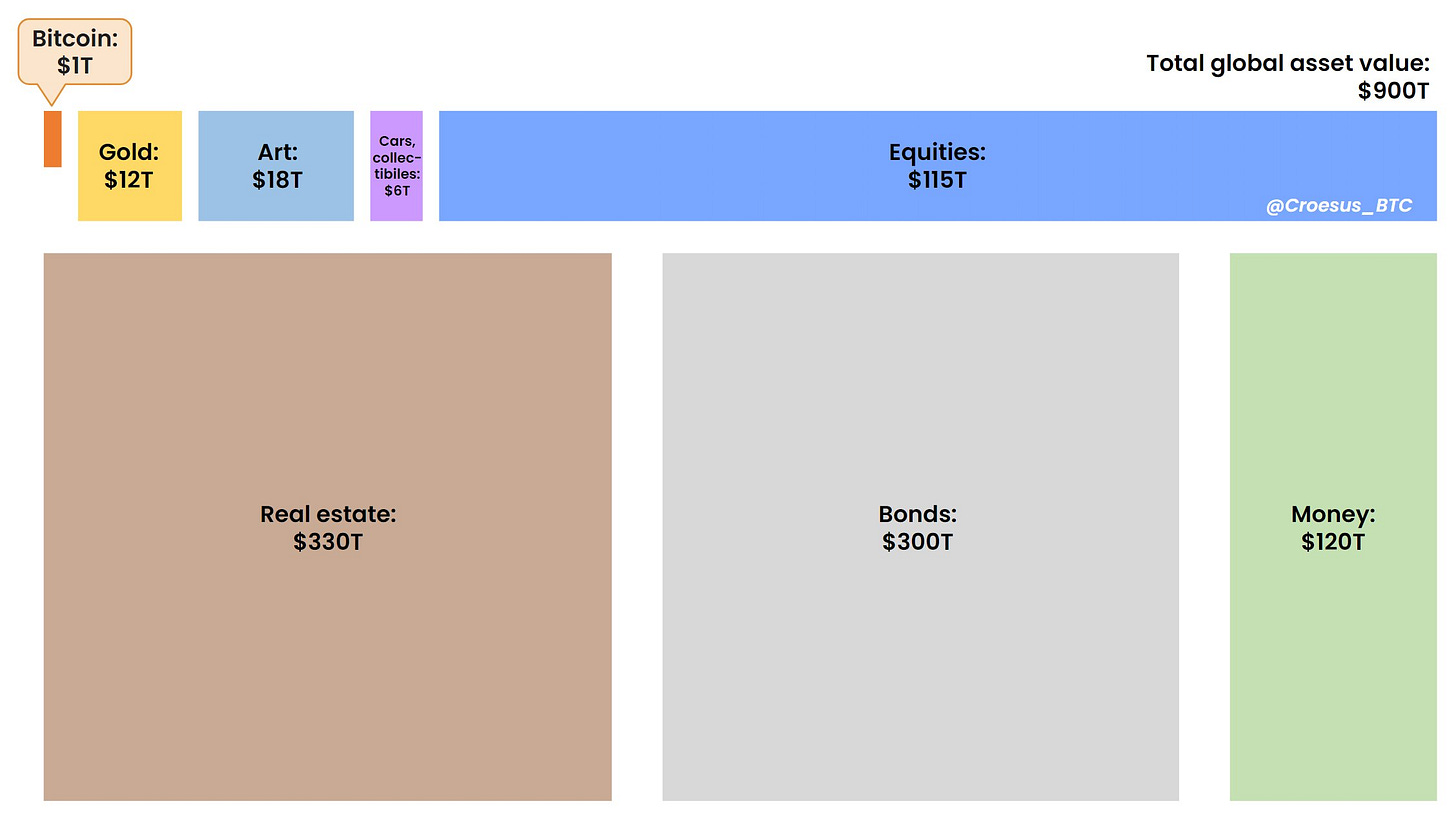

While bitcoin exists outside the dollar-centric financial system, it is merely a $1 trillion asset class in a world of over $900 trillion of assets, i.e., fiat currencies, equities, fixed income, real estate, gold, etc. So unsurprisingly, bitcoin is not impervious to a system that is 900x the size of it.

Bitcoin's resiliency over the past fifteen years in weathering the increasing turbulence of the fiat system is a testament to the investor behavior of those who own the asset. Those who deeply understand bitcoin use it as a long-term savings technology and use opportunities of extreme fear in the market to purchase more bitcoin.

It might sound crazy to those who haven't done their homework, but I am convinced that bitcoin will become a globally utilized savings technology (read more here). In fact, tens of millions, if not hundreds of millions, are already using it as their primary form of savings (including me).

It would have also sounded crazy to tell people after the Great Depression that US Equities would become the de facto savings account of Americans. Yet, here we are, for several decades now, the S&P 500 has been utilized as a savings account.

That brings me to my last point on investor behavior. On a day like yesterday, millions of people are calling their financial advisors panicking about the market crash. What do the advisors tell their clients? They tell them to remain invested and to focus on their long-term financial goals because in a month, a year, or ten years, that correction will be a blip on the radar.

Bitcoin is no different. Bitcoin is best utilized as a savings technology. When it doubt, zoom out, and remember the long-term financial goals that bitcoin can help you achieve. And remember that just because there is volatility in bitcoin's price, bitcoin's fundamentals remain unchanged.

If anything, a day like yesterday (or today) represents an opportunity to buy.

Looking for a secure custody solution, sound inheritance plan, insurance and more? Protect your bitcoin legacy and secure your wealth ahead of this next bull market.

Sign up for Onramp using my link to receive $250 off your multi-institution vault.

If you enjoyed this article, I would greatly appreciate it if you share with one other person who could benefit from it as well.