Why Your Generation Cannot Afford a Home

The housing market is not broken. The money is. Here is what actually happened to the American Dream.

For most of the past century, owning a home has been the foundation of the American Dream and the primary way people built wealth. But each year, that dream is drifting further out of reach for younger generations, and the cause is deeper than most people realize.

The National Association of Realtors’ 2025 Profile of Home Buyers and Sellers report shows exactly how far things have fallen. First-time homebuyers now make up only 20% of purchases, the lowest share since NAR began tracking data in 1981. Before the Great Financial Crisis, this number was consistently around 40%.

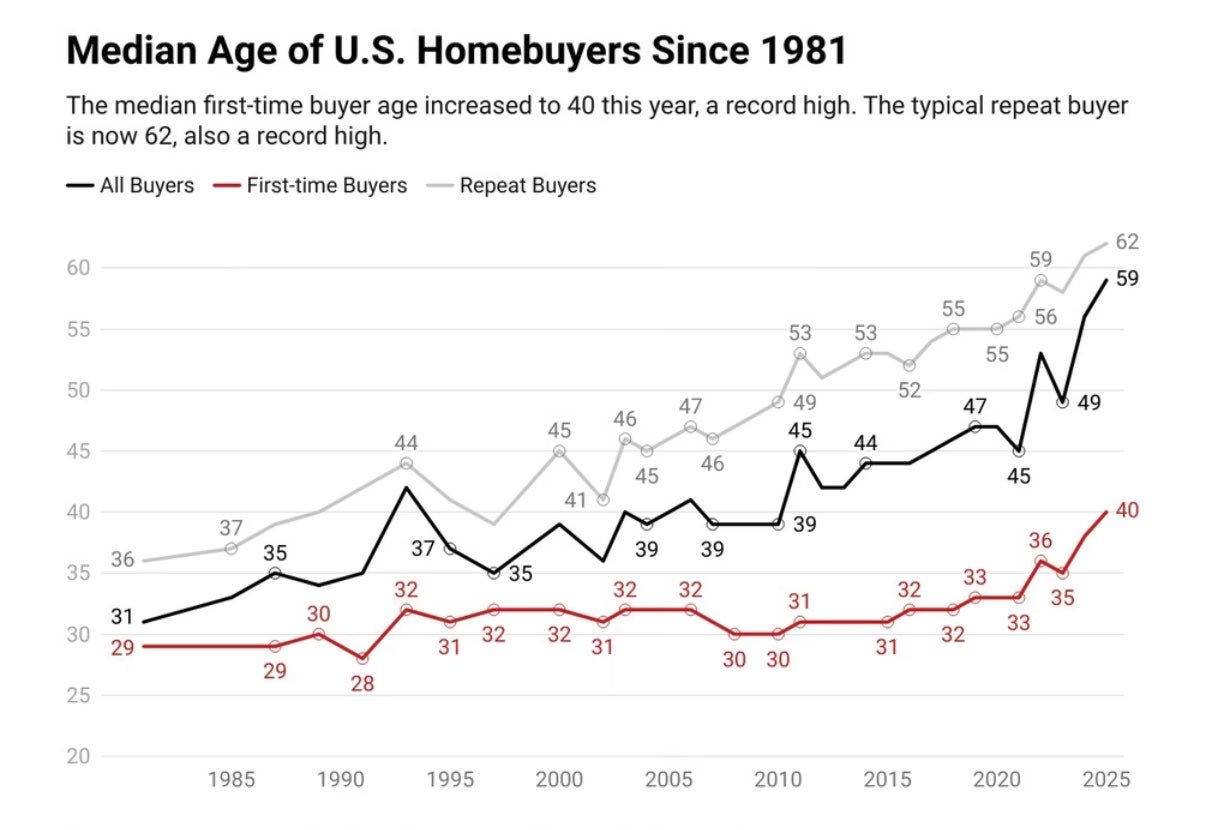

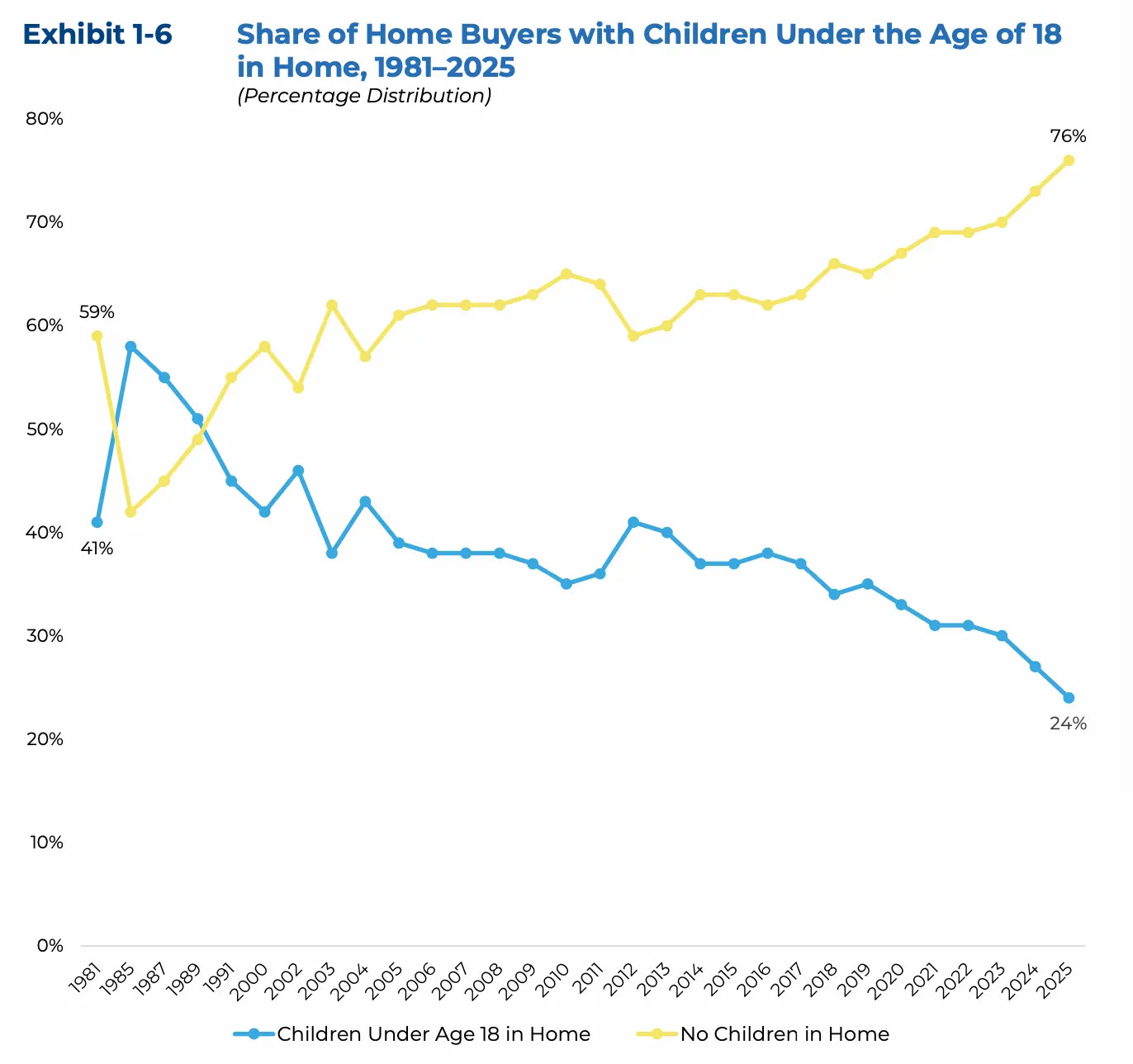

Some other alarming stats from the report (charts below):

• Median age of homebuyer: 59

• Median age of repeat homebuyer: 61

• Median age of first-time buyer: 40

• Only 24 percent of buyers have children under 18 in the home

Most people know the housing market is tough, but I think it is underappreciated just how bad it is out there. And since this is such a widespread issue, there are plenty of opinions about the cause.

It is easy to blame greedy corporations, homebuilders, the current administration, or existing homeowners who are locked into low rates. But these explanations miss the root cause.

The deeper truth is that the American housing crisis is a monetary crisis.

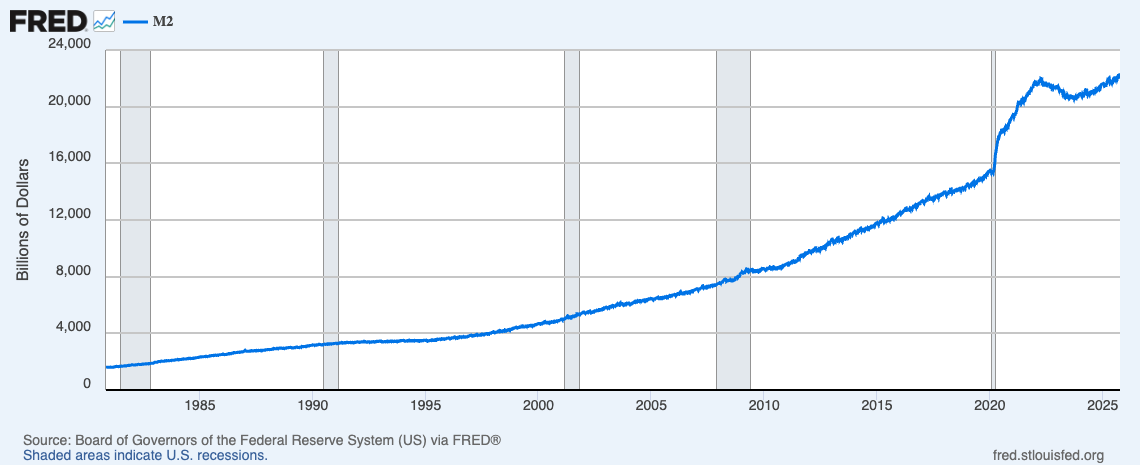

Since the United States abandoned the gold standard in 1971, deficit spending and inflation have far outpaced real wage growth. Each financial crisis has been met with more liquidity and more money creation to bail out the financial system, rather than allowing the excess to be cleared out. The chart below shows the growth of the US money supply.

The latest and most extreme example occurred in 2020 and 2021, when the United States created roughly $6 TRILLION in new dollars. That flood of new money increased the prices of nearly everything, especially housing, the largest asset market in the country.

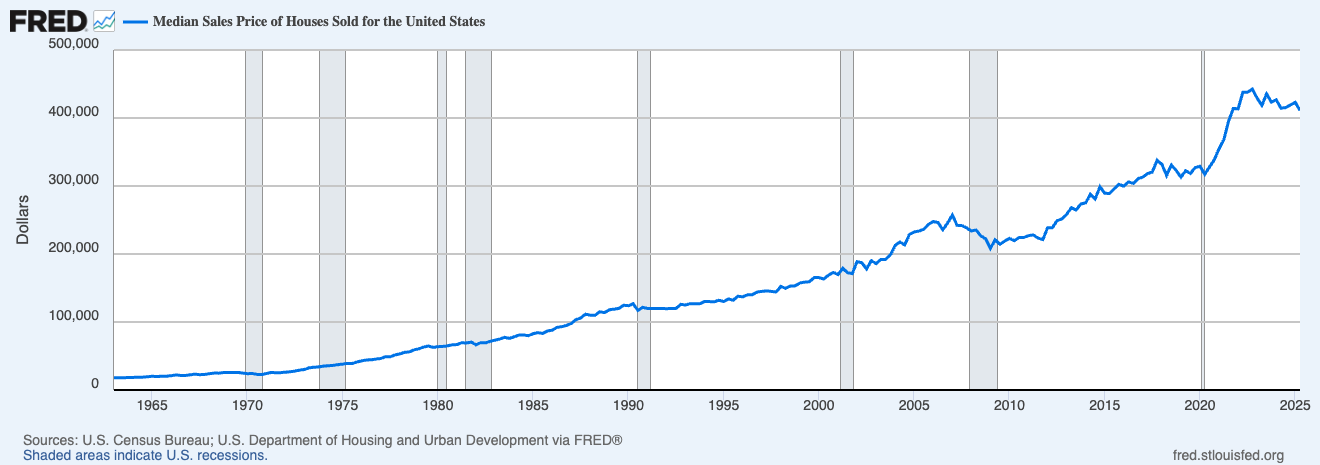

The effect of money printing (inflation) is evident in the increase in the median home price from $18,000 in 1963 to $410,000 earlier this year. That is an increase of more than 22x. Wages did not rise 22x. Productivity did not rise 22x. The purchasing power of the dollar collapsed because it was printed into oblivion.

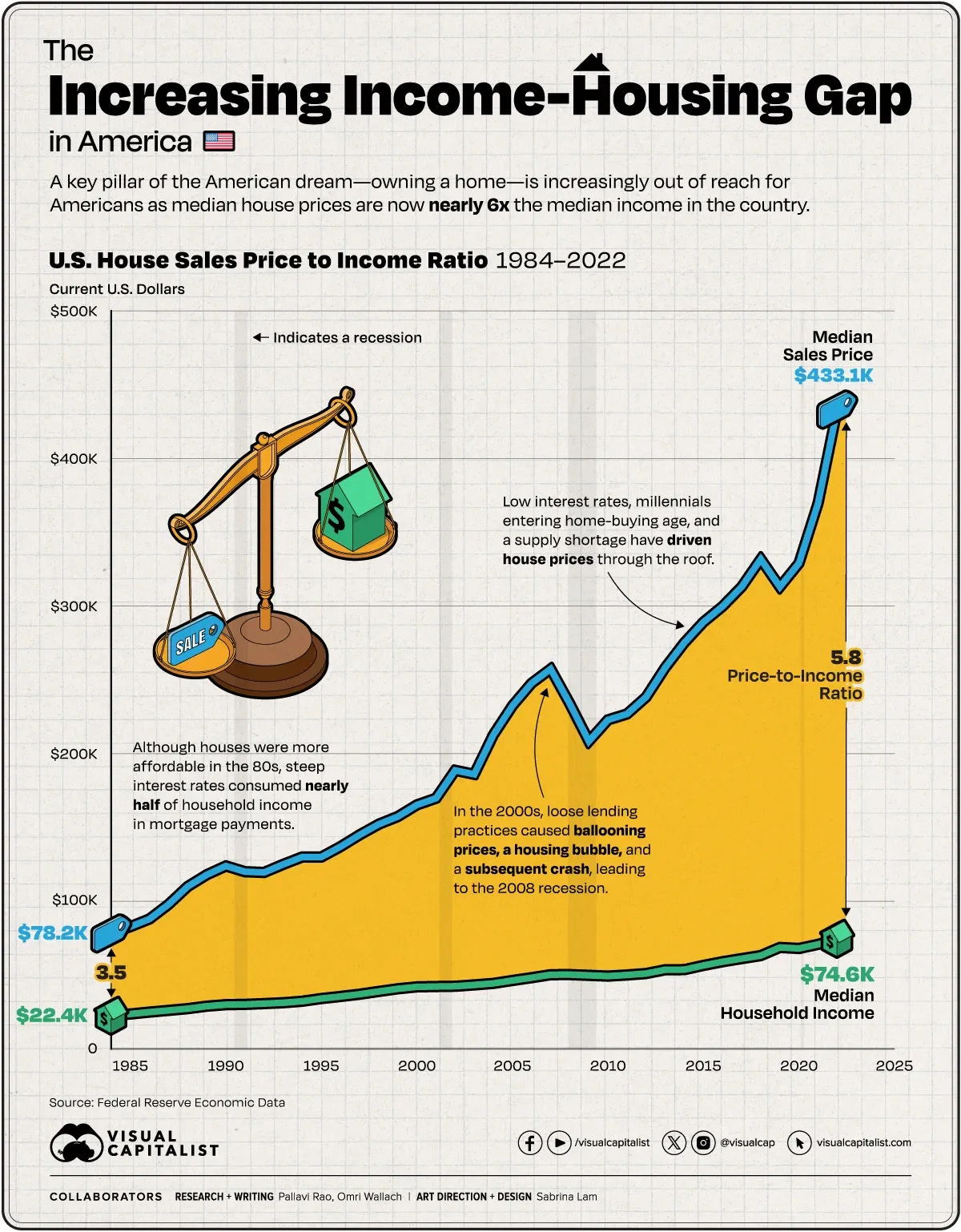

The affordability gap can be further evidenced by house prices relative to income. In 1984, the price-to-income ratio was roughly 3.5x. The median home was $78,000, and the median household income was $22,000. As of 2024, the price-to-income ratio is about 5.8x. The cost of a home has pulled far ahead of what household wages can support.

To exacerbate the affordability crisis, as inflation surged following the money printing in 2020 and 2021, the Federal Reserve hiked interest rates at the fastest pace in history. Home prices were already incredibly high, and with interest rates far above anything seen in the past 15 years, monthly payments exploded.

So what is the solution? Unfortunately, lowering interest rates will not fix this. Rate cuts would likely increase demand and push prices even higher.

You can already see policymakers attempting to patch the problem with cosmetic fixes. Proposals for fifty-year mortgages or portable mortgages, which would allow homeowners to carry their low interest rate into a new purchase, are being floated as if they will solve affordability.

But these are band aids. Stretching loans over half a century or letting people transfer a two or three percent mortgage does nothing to address the root problem. It only covers the effects of an inflationary monetary system and risks pushing prices even higher.

The challenge is structural. It sits at the heart of the fiat system itself.

When the dollar loses purchasing power each year, saving in dollars becomes impossible. People are pushed into assets simply to avoid falling behind. Real estate becomes a store of value, not just a place to call home.

Homes become an investment for many simply to protect their purchasing power as the dollar loses value. This investment-driven demand pushes prices even higher than many incomes can support.

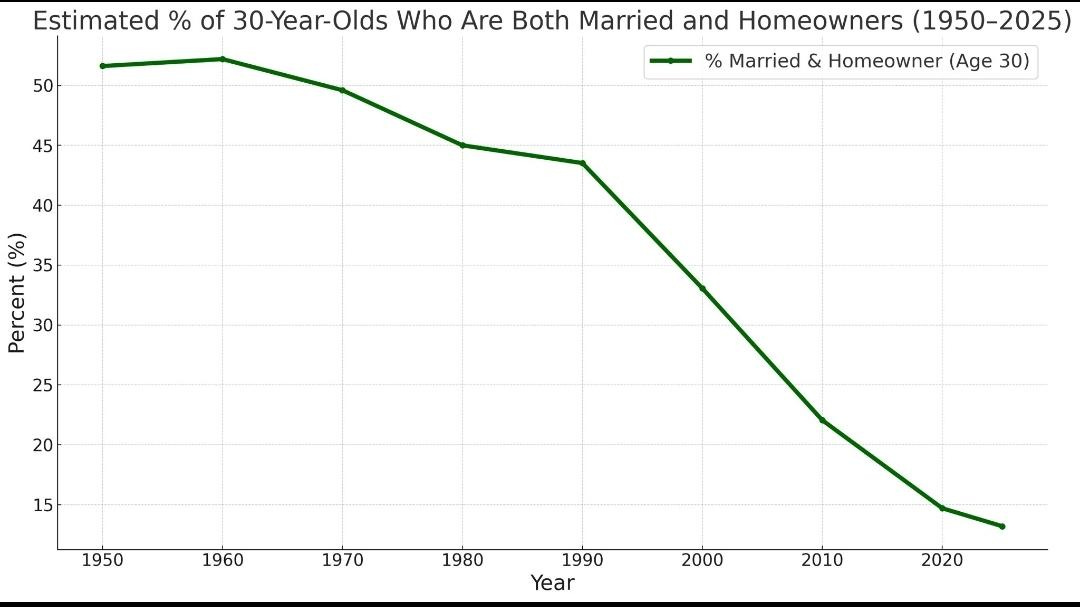

The generational consequences are enormous. Families are not being started anywhere near the rate they once were because people simply cannot afford to.

In 1950, more than half of thirty-year-olds were married and owned a home. In 2025, fewer than fifteen percent do. That is not a small shift. That is a collapse of the American Dream. It has been hollowed out by a system that protects those who already own assets and punishes those who do not.

This is why the issue cannot be solved through small policy adjustments or temporary programs. The structure of the system creates the incentives. As long as the powers that be continue to create more currency, the dollar’s value plummets and home prices rise. Until the monetary system itself changes, the housing market will remain out of reach for the average young family.

But this does not mean the situation is hopeless. It simply means the odds are stacked against you. To achieve the American Dream, it will require hard work, like it always did, but with more intentionality, in industries that are rapidly growing, in entrepreneurial pursuits where real wealth can be created beyond the standard two percent wage bump that most people get each year in corporate America, and the occasional promotion.

And you must save in assets that outpace monetary inflation. Now more than ever, the path to the American Dream requires agency and punishes passivity. You must think in terms of ownership rather than employment. The system leaves you no other choice.

This is the heart of the Sound Life philosophy. If the structure of the world has changed, your strategy must change too. If you want to build a family, own a home, and create generational wealth, you cannot follow the default script. The default was designed for a world that no longer exists.

The path to ownership still exists. It simply requires intention. It requires a refusal to play the losing game of saving in a money that is designed to erode. And it requires the courage to build something that cannot be inflated away.

In a world where the dollar weakens each year and housing is pulled further out of reach, the only rational move is to build outside the system that created the problem. That is where the new American Dream begins.

Subscribe to Sound Money, Sound Life to explore how to build generational health and generational wealth and live a sound life in an unsound world.

If this resonated, please like and leave a comment. It helps me to grow the publication, and I like to hear your thoughts and questions.

Standard great post Jackson. I shared it on Twitter. Trust you are @MacroJack21. I always look forward to your posts. Sincerely, Mike