Time Theft & Despair in the West

Central bank-driven time theft is destroying the American Dream

I came across a Wall Street Journal article yesterday titled “Most Americans Doubt Their Children Will Be Better Off, WSJ-NORC Poll Finds.”

This bleak headline captured my attention as I have been thinking and writing about the deteriorating quality of life in the US and across the globe.

The article centers on the results of an NORC survey. NORC is one of the largest independent social research organizations in the United States. Their latest survey, conducted in March 2023, in conjunction with WSJ, “showed pervasive economic pessimism underpins Americans’ dim hopes for the future.”

WSJ reports that “four in five respondents described the state of the economy as not so good or poor, and nearly half said they expect it will get worse in the next year.”

Nearly 80% of survey respondents don’t feel confident that their children’s generation will be better than it has been for them. The highest percentage since the survey began over three decades ago.

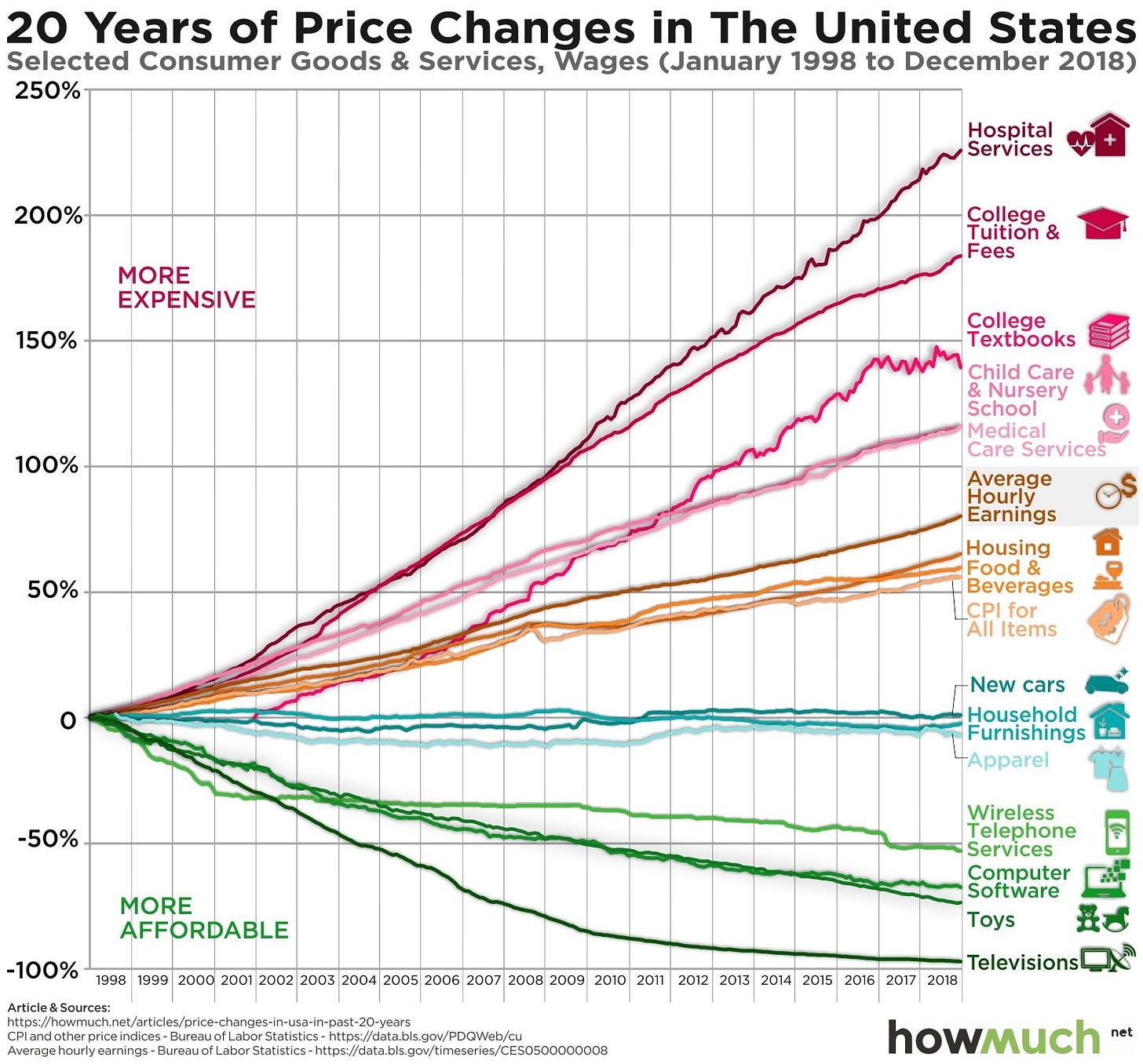

Those surveyed stated their mains concerns were increased cost of living in recent years, a looming recession, the prohibitive costs of healthcare, education, and housing. Their worries are justified. The cost of living in the United States and most developed countries is preposterous; however, a small percentage of the population has actually identified the root cause of their deteriorating quality of life.

Money printing is time theft.

We spend our time earning money. Money is a representation of our labor. Proof of work, meaning we had to produce something, a good or service that others valued and were willing to pay for. Saving money is a representation of our past production exceeding our past consumption. However, the financial system as it exists today grants the ability to create money from nothing to a small group of people, central bankers.

When central bankers increase the money supply and distribute the money into the economy and financial markets, our time is stolen. Simply, if I had $10,000 in my savings account and then the Federal Reserve and US Government decided there was a reason to increase the money supply, that would decrease the purchasing power of my savings. The $10,000 in my account will remain unchanged, but its ability to afford me goods and services has been diminished. Thus the time I spent to earn those savings has been devalued and transferred to those who receive the new money printed.

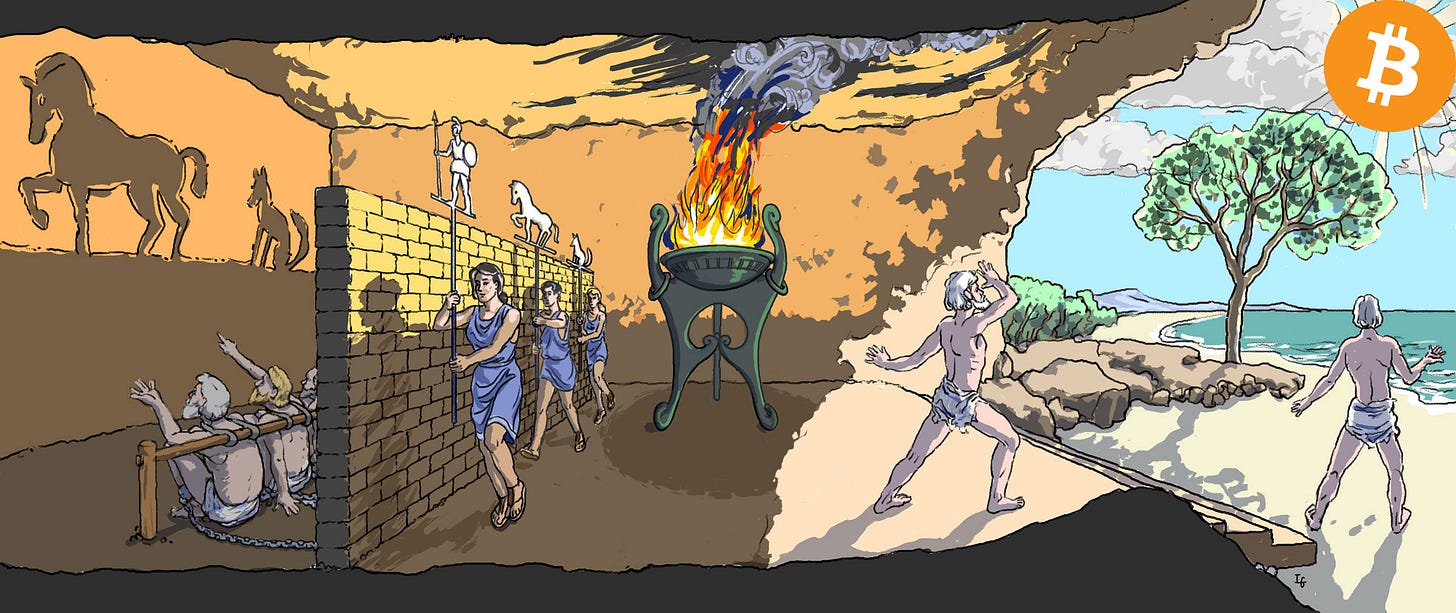

Since 1913, with the creation of the Federal Reserve, we have been prisoners of the monetary system. A small group of bankers and their cronies have disproportionately benefitted from creating new money. The shackles of the financial system were tightened in 1971 when gold was removed from the monetary system, and from there on, all fiat currencies have been backed by nothing aside from trust and confidence.

The rate of money printing accelerated post-1971 since there was no longer a constraint to the amount of new currency that could be created. The only limitation is the public's confidence in the currency, which can be lost if too much money is created in too short of a time. That is why we have been programmed to accept that "moderate inflation" is needed for a healthy and productive economy. It's nothing more than "A "Mostly Peaceful" Heist" over the past century.

The reality of "moderate inflation" is that it's a constant and steady transfer of wealth from laborers and savers to those who benefit from creating new money. After decades of "moderate inflation," the stakes of the heist have increased. We are now being blatantly robbed by inflation over the past few years.

The American Dream: Stolen By Fiat Currency

Admittedly, I can get frustrated and discouraged when I read articles like the WSJ one above. It's sad to read how much people are suffering due to the time theft perpetrated by the central banks and governments, and yet, how few people understand why their lives are getting worse. As the survey data shows, people are getting pushed to their limits, drowning in higher living costs.

For several generations now, our standard of living has increased. Typically the next generation has been better off than the last. Yet, the tide is shifting. Wages have been relatively stagnant for working and middle-class people. Meanwhile, the cost of living has rapidly increased. Not only that, but the avenues to building wealth that existed for previous generations are largely nonexistent.

The once achievable American dream - home ownership and starting a family - is now just a fantasy for a considerable amount of the population. The median cost of a home in the United States is approximately 7x the median income and it takes approximately 3x longer to save for a house than it did in 1970.

Home ownership is not the only thing that’s expensive. This chart below, which does not even capture the price inflation of the 2020s, highlights how expensive necessary services such as healthcare or education has become.

The central bank-driven time theft has also made starting a family unrealistic. When the topic comes up in my social circles, typically, one of the first comments out of people's mouths is about how expensive it is to have children.

The WSJ article captures the decline of the American Dream quite well:

"Her [Sylvia Vallejo, a 44-year old who lives in Adelanto, California] father left Mexico with a third-grade education, she said, and was able to support a wife and six children on his salary as a factory worker in Los Angeles. That scenario isn't possible today, she said."

A blue-collar salary supporting a wife and six children is completely unheard of in today’s world. In fact, the United States has become a nation of dual-income households, which still, in many cases, is not enough to enjoy the same standard of living as only a few generations ago.

The Fiat Cave: Prisoners of the Monetary System

If we do not free ourselves from time theft, the decline of the West will continue.

We the People need to unite to spread the truth. The fiat financial system is a system based on theft. This is not about Republicans vs. Democrats. The struggle we face is the peasants vs. the oligarchs. The corrupt politicians, bureaucrats, and central bankers want us to remain prisoners of the Fiat Cave, shackled with excessive taxation, egregious debts, and insidious inflation.

Our frustrations aimed at the other political party should instead be aimed at the broken monetary system. Without fixing the money, society will descend further into despair and hopelessness.

Bitcoin: An Economic and Moral Imperative

Previous generations built wealth through home values and financial assets such as stocks and bonds. These avenues do not exist any longer. While there is a benefit to owning these assets, they will not offer the same magnitude of wealth creation that they once did. To put this in perspective, take for example, the number of hours it takes to purchase one unit of the S&P 500.

Unlike the beleaguered fiat monetary system that's been forced on us, bitcoin is a digital hard money in the early stages of adoption. Unlike other store of value assets, such as real estate, equities, or gold, bitcoin's far from reaching its total addressable market. The store of value market, which is simply real or financial assets that can be used to protect savings against time theft, is estimated to be nearly $900 trillion (source). The current market capitalization of bitcoin is just north of $500 billion.

The bitcoin investment thesis is simple: do you or do you not believe that central banks and governments will continue to expand the money supply to enrich themselves and keep the financial system from imploding?

Not only is bitcoin the most probable way that younger generations can build wealth and have a shot at a better life than their parents or grandparents, but it's also a moral imperative to adopt bitcoin and spread bitcoin adoption.

If we can agree that the increasing despair in society is correlated with the expanding debasement of currency, then it's of utmost importance to adopt money that cannot be debased by central banks, governments, or anyone else. It's vital to help others understand the root cause of their worsening quality of life and show them a better alternative.

Should we not course correct, back to sound money, a path that our ancestors were on for thousands of years, society will eventually collapse due to broken money.

We have a unique opportunity to decide where we go from here. Do we continue to sit idle in the Fiat Cave, allowing those who control the money to destroy our livelihoods, or do we revolt peacefully by adopting digital hard money out their control?

If you have been enjoying my work, I’d greatly appreciate it if you share my newsletter with friends, family, and colleagues. I believe these messages are important for all to hear and hope that by writing, I can help inform, educate, and entertain. Thank you.