The Realities of Inflation & the Remedy of Bitcoin

Understand the root cause of inflation and bitcoin's role in preserving wealth

Most people I encounter in my everyday life all share a similar concern – the rising costs of goods and services with seemingly no explanation.

As I write this, we are less than a month away from the US Presidential Election, and the challenging financial times we are living through is a key issue on the debate stage and campaign trail.

Depending on who you listen to, you may hear a different reason as to why prices are so high today, but more likely than not, you haven’t heard the truth, or at least the root cause of the financial pressures you are experiencing.

What if I told you that the actual cause of these financial stressors and affordability crisis we’re living through can be explained quite simply and that there is even a way for you to combat it?

My goal with this article is to provide a clear and concise explanation for the financial pressures we are experiencing today and offer bitcoin as a potential remedy to this problem.

If you find this valuable, my only ask is that you share it with folks to help them better understand what we are up against and how they can improve their financial lives with bitcoin.

Today’s Challenge: Inflation

As we navigate our daily lives, we all share a common struggle. The prices of goods and services have significantly risen over the past five years, impacting our personal finances and threatening our livelihoods.

An insidious force drives the prices of every good and service higher, eating away at our monthly income, causing us to make sacrifices, and putting undue stress on millions of people.

This force is most commonly referred to as inflation but could also be described as debasement: the dilution or erosion of one’s purchasing power.

There is a lot of confusion about inflation, and intentionally so. There are many ways it is defined and measured; however, the best way to define inflation is the increase of the money supply, also referred to as monetary expansion or simply money printing.

More currency units, in my case, dollars, chasing the same amount of goods, which means the cost of those goods necessarily increases in dollar terms.

Why is this happening? It should be a simple question to answer, yet there’s so much confusion and conflicting opinions. Your favorite talking heads, whether they are mainstream media or even alternative media sources, all seem to have different answers. It’s easy to blame Biden and it’s easy to blame corporations.

However, stepping out of the fog of inflation, the root cause of this symptom plaguing our pockets becomes clearer. Inflation is not the fault of corporations, and it is not the fault of solely the Democrats or Republicans.

Inflation is a problem inherent to fiat currencies such as the Dollar. Fiat currencies are issued by governments and are “backed” by the “full faith and credit of the government.”

They are not backed by hard money such as gold. In fact, the US Dollar has not been backed by gold since 1971. This means that the US Government and Federal Reserve can create more dollars as they see fit.

But why do they create more dollars? One of the key dynamics at play is the relationship between increasing government debt and central bank money creation.

When the government issues debt and borrows excessively to cover its spending - the central bank creates more money to fund this debt. Rather than allowing firms or institutions that can’t meet their obligations to face short-term restructuring or bankruptcy, which could stabilize the economy in the long run, governments often 'paper over' these problems by creating more money. This is done to avoid short-term volatility, but it only delays the inevitable and leads to inflation as more currency floods the economy.

Consider what happens when you, as an individual, can’t pay your car loan or home loan—the bank seizes the asset. However, when the government cannot meet its financial obligations, the public, through mechanisms like money creation, ends up bearing the cost in the form of inflation. This is why everything becomes more expensive for everyone. Recent examples of this include the Great Financial Crisis in 2008 and the COVID response in 2020. The United States now has over $35 trillion in debt due to this dynamic, and more and more of this debt is being funded by central banks, creating more money from nothing.

As governments continue to increase their debts and central banks continue to increase the currency in circulation, prices inevitably rise. This increase in the money supply is the fundamental cause of the escalating cost of living and represents the mathematical inevitability of a debt-based monetary system.

Nothing stops this train of kicking the proverbial can down the road through more and more debt and money creation at a faster and faster rate.

I’ve written extensively about the origins of our monetary system and its implications for you. Check out the “Fiat Cave” series for more details.

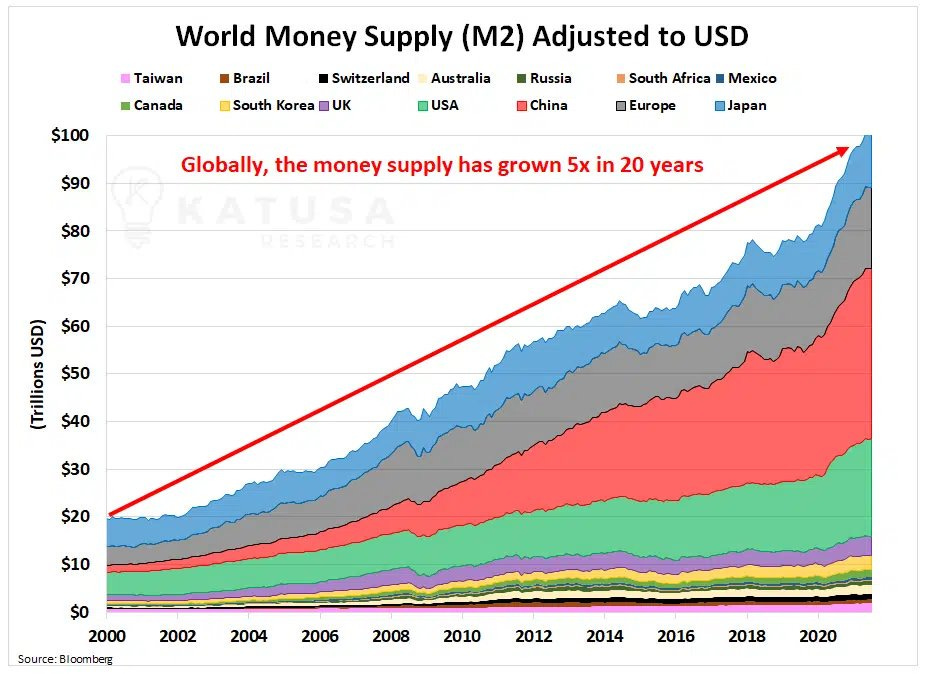

There is no absolute limit to how much fiat currency a government can print. The chart below shows the growth of the US money supply. Did you know that 40% of all dollars ever created were printed in 2020 and 2021? More on that shortly.

The only constraint is the public's faith in the currency. This means that if the government and central bank create too much currency in too little time, this can lead to hyperinflation and the collapse of a currency.

Some fiat currencies are better than others. The dollar is arguably the best fiat currency because it is the world reserve currency, which means there is a need for dollars not only in the US economy but also globally. This increased demand for the dollar helps mitigate runaway inflation to some degree but does not make it immune to a decline in value, as we've seen in the past four years.

But regardless of the fiat currency of choice, dollars, euros, or pounds can be created without constraint, which means over time, more currency is created chasing the same amount of goods, which means everything is getting more expensive.

This means that your income affords you less year over year, and your savings are worth less year over year. Effectively, your time is being stolen. You spend your time earning fiat currencies, which can be created by the powers that be, which in turn dilutes the amount of purchasing power you have.

So far this decade, we have lived through much higher inflation than we have seen in recent decades. That is because, in 2020-2021, we saw a massive surge of new money created worldwide.

In 18 months, nearly $7 trillion of new dollars were created, a 40% increase in the US money supply, and that does not account for the massive increase in other currencies around the world, such as the pound, euro, and yen.

It's not a coincidence that most goods and services we need have increased by 40%+ since 2020. Of course, other factors could impact the price of a good, such as a decreasing supply (supply chain disruptions in 2020), but the most significant factor by far is the creation of more dollars by the coordination of the US Government and Federal Reserve. This contributes directly to the rising cost of goods and assets such as housing.

During this period, the majority of people have not seen a 40%+ increase in their income. As a result, most people now find themselves with a reduced standard of living, as their costs have outpaced their income, as shown below.

The inflation of fiat currencies perpetrated by governments and central banks is the biggest risk to human flourishing. This insidious system impacts your ability to live a better life.

A Solution? Investable Assets?

For those with financial means, investable assets such as stocks or real estate have served as a monetary substitute.

In plain English, since dollars and other fiat currencies lose value over time, they are a suboptimal way to save for long periods. This is why people often turn to scarce or nominally productive assets like real estate and equities to store their wealth.

There is much I can say about this, but the short of it is that these investable assets either maintain your level of wealth or grow it marginally, as shown below.

From Q1 2020 to Q1 2024, home prices have increased in the US on average by 47.1%. Did a house become 47% better in that time, or did the money supply increase by 40%?

This means that if your wealth is tied up in your primary residence and perhaps other investment properties or vacation homes, you have likely maintained your purchasing power or grown it marginally.

Here’s a broader look at investable assets, comparing the return to the average growth of the money supply in the past two decades. Most investments have not even kept pace with the growth of the money supply, meaning if you choose the wrong investment, you are losing purchasing power.

Moral of the story? Traditional assets, at best, are maintaining or growing your purchasing power slowly, or at worst, losing your money slower than just saving in dollars.

The Solution: Better Savings Technology

If the problem we all collectively face is an inflating money supply, which is destroying our savings and stealing our time, then we need a form of money that does not inflate, respects our time, and protects it.

The good news is that there is a better way to save. There is a technology that preserves and grows purchasing power. There is money that protects you against the inflating fiat currencies that are compromising your livelihood.

Bitcoin is the remedy. Bitcoin is the safe haven. Bitcoin is simply a better form of money. Bitcoin’s monetary properties best resemble gold, but better.

You may inherently know that gold is valuable, but have you ever really considered why that is?

That is because gold is a scarce commodity and preserves wealth over time. Individuals and institutions have used it for thousands of years to protect their wealth. Gold’s scarcity is governed by the laws of nature, meaning there’s a certain amount of gold in the Earth’s crust, and it requires work to discover, extract, refine, and ship it.

Historically, the supply of gold has grown about 2% per year because of these constraints of the natural world, which is far lower than the growth of fiat money supplies that can be created at will. This means that gold has served as a better store of value - a better way to save.

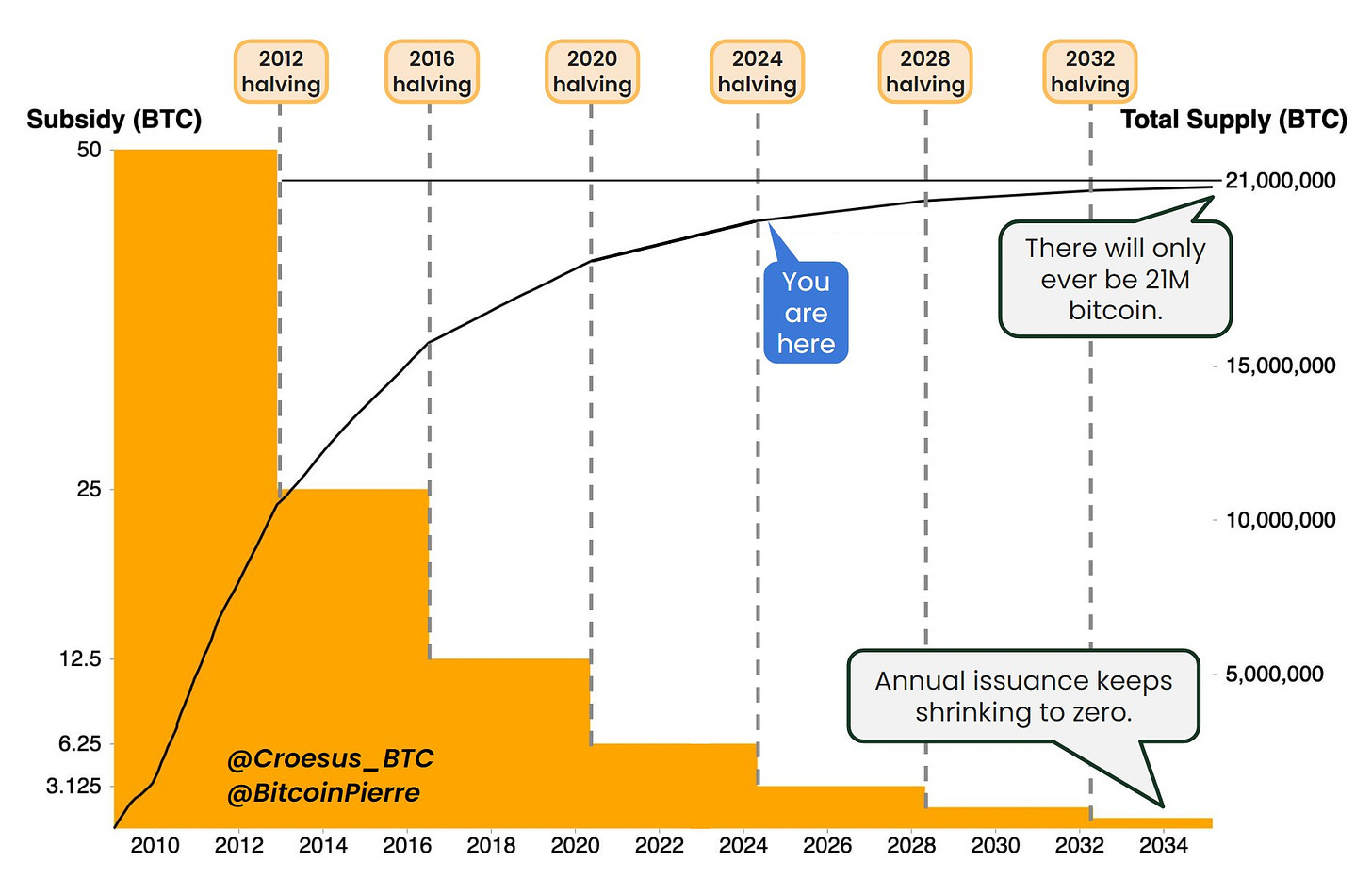

Similarly, bitcoin is scarce. Unlike gold’s scarcity, which is imbued by the laws of nature, bitcoin’s scarcity is derived from the code and math that governs the network. Its scarcity is encoded.

It’s a software protocol with a predetermined limit of 21 million bitcoin that will ever exist, and the issuance of bitcoin follows a predetermined path, as shown.

A common refrain is that “bitcoin is digital gold.” However, this doesn’t tell the full story. More accurately, “gold is analog bitcoin.” Gold was the best proxy for scarcity that humans could find for thousands of years, up until it was digitally engineered for perfection, as represented by bitcoin.

This is critical because no person or institution can increase the amount of bitcoin in their favor, which is the root problem with the dollar. The code that governs bitcoin was established when bitcoin went live in 2009 and has remained unchanged since.

Bitcoin is like the internet for money. It’s a way to store and send value globally, similar to how the internet is a way to store and send information globally. Bitcoin is a protocol for money, the same way the internet is a protocol for information.

Bitcoin’s Role in Preserving Wealth

Bitcoin is a solution to the brokenness of money. The fiat financial system is draining all of us financially. For some people, it is crippling, totally jeopardizing one's finances and making it nearly impossible to survive. For others, it is a pesky annoyance, and for a select few, those who create the money, it is the greatest gift of all time.

Bitcoin provides you with a long-term vehicle to safeguard your savings. While the US dollar and other fiat currencies continue to decrease in value increasingly rapidly, destroying your savings, bitcoin is a vehicle to protect and grow your wealth.

Bitcoin helps you achieve long-term financial goals. It is not something meant to be traded or "invested" in for short-term gains. It should be viewed as a long-term savings account because while it has short-term volatility, it continues to appreciate favorably relative to fiat currencies and other assets over the long term. In fact, no one who has held bitcoin for a period of four years or more has ever lost money, and in most time periods, depending on when measured, people have managed to grow their savings materially over those four years.

Your cost of living will continue to increase in dollar terms. The food you need to survive, the vehicle you need to commute to work, and the home you need to have shelter will all increase in dollar terms. But in bitcoin terms, these goods and services are decreasing in cost over time, becoming more and more affordable.

Housing becomes more affordable over time when denominated in bitcoin

Not only does bitcoin offer a secure way to store wealth over time, but it also offers you more financial freedom. In a world of increasing government oversight and control, bitcoin allows you to have a form of money that can be sent peer to peer without relying on private or public financial institutions. This means you have more control over your money and do not have to fear financial censorship of your transactions.

Now, one thing I know people think is they look at the price of bitcoin and think, "I've missed the boat."

It's important to remember that bitcoin is still in its early stages, much like the internet was in the 1990s. This means there's still plenty of opportunity for those interested in investing.

Bitcoin is a $1T asset that exists among the $900T of assets globally.

Over the coming years and decades, bitcoin ownership will continue to grow exponentially worldwide as people adopt this better form of money, and bitcoin will grow from a $1T market to $2T, $5T, $10T, and beyond.

In a world where inflation erodes the value of traditional currencies, bitcoin offers a compelling alternative.

At the end of the day, bitcoin helps you focus on the things you love in your life, whether it's your family, friends, business, free time, or hobbies; having money that protects and grows your wealth over time will help you escape the rate race.

You will spend less time stressing over finances and more time building the life that you want. You will spend less time figuring out how to manage an investment portfolio to protect your wealth against inflation. In a world of complex financial instruments that most don’t understand, bitcoin proposes an alternative. What if you could choose to save in a better form of money that increases in scarcity over time, thus increasing your purchasing power? Bitcoin makes savings simple.

Overall, bitcoin is a huge net positive for humanity. Because of this monetary innovation, people can easily store their wealth, however much or little they have, in a technology that will preserve and grow it over time.

Bitcoin is for everybody.

@macrojack, Thx for the data and clear messaging. You point about what the driver was for Housing prices rising 47% since 2020 is one EVERYONE should try to answer. I have, and its the same as yours. I suggest others read to understand why there is a growing interest in bitcoin.