The Biggest Ponzi Scheme in History

Bitcoin isn’t the scam. It’s the mirror.

Critics love to call Bitcoin a Ponzi scheme.

It’s one of the most common critiques: Bitcoin is backed by nothing, requires a “greater fool” to keep the price rising, and will eventually collapse under its own weight.

But ironically, this criticism of Bitcoin reveals more about the existing financial system than it does about Bitcoin itself.

What if Bitcoin only looks like a Ponzi because it reflects the world we already live in, a fiat system that is, in reality, a debt-driven Ponzi scheme?

What Is a Ponzi Scheme?

A Ponzi scheme is a fraudulent investment structure where early participants are paid using money from new participants rather than any actual profits or value creation. It only works as long as new money keeps coming in. When that stops, the entire system collapses.

Ponzi schemes typically have the following traits:

They promise guaranteed or outsized returns

They have no real underlying value or business model

They rely entirely on new participants to pay old ones

They are centrally controlled and lack transparency

So, Bitcoin is a Ponzi Scheme, Right?

Not so fast. If you actually step back and apply the definition, Bitcoin doesn’t fit the mold.

Bitcoin doesn’t promise returns, rely on deception, or have a central operator pulling the strings. There’s no secret payout. No marketing department. No insider enrichment.

In fact, Bitcoin is the opposite. When it was introduced as a whitepaper in 2008 to a group of cryptographers (internet nerds), the breakthrough was technological, a form of money that does not require any middlemen or trust to use.

There was no talk of an investment opportunity. The conversation focused on the underlying code.

The real breakthrough wasn’t profit-driven. It was the creation of money that no one controls, that no one can print more of, and that anyone can use without permission.

Bitcoin is transparent, not secretive. It’s open-source code; anyone can verify the code base (the rules). And the blockchain is public, meaning ownership and movement of Bitcoin is visible to all.

Bitcoin also doesn’t need to recruit new participants to survive. The network exists on its own. It has already reached escape velocity. Even if Bitcoin’s price never rose again, it would still function as a censorship-resistant payment network, no middlemen required.

To call Bitcoin a Ponzi scheme is to admit you haven’t done the work. Bitcoin only appears like a Ponzi to those who can’t see past the system they’re trapped in, one built on ever-expanding debt and money creation.

Yes, like any market, Bitcoin’s price is determined by supply and demand. Yes, holders often sell to new buyers. But that doesn’t make it a scam. That’s how markets work.

To call it a “greater fool’s game” is to misunderstand how value is assigned. All assets require a buyer. Value is subjective.

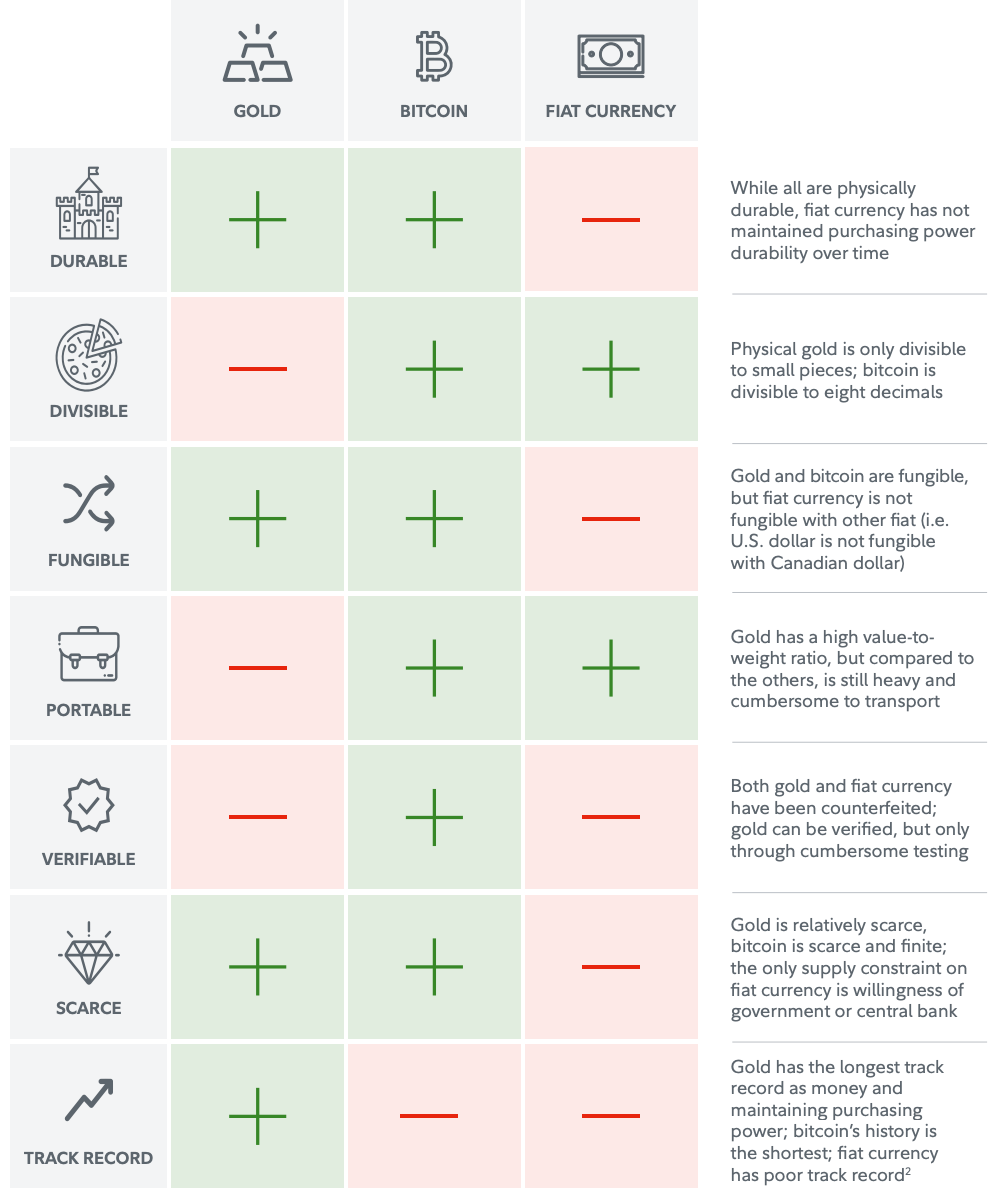

People assign value to Bitcoin because of its objective monetary properties, most importantly, its hard-coded scarcity.

What does that mean exactly?

It means that by design, there will only ever be 21 million Bitcoin. No government, central bank, or institution can change that. Ever.

That’s a first in human history. Digital scarcity. And it’s why more and more people are choosing to store their dollars, euros, yen, whatever they earn, in Bitcoin.

If anything, Bitcoin exposes what a real Ponzi looks like, because the more you understand Bitcoin, the more you start to question the foundation of the fiat system itself.

So let’s ask the harder question: if Bitcoin isn’t the Ponzi… what is?

The Real Ponzi: Fiat Currency

Ironically, the real Ponzi scheme is being run by the U.S. government.

Maybe that’s why there’s so much antagonism toward Bitcoin.

Sounds like a radical thing to say, right? But ask yourself, what actually backs the U.S. dollar? Not gold. That link was severed decades ago.

Today, the only thing backing your dollars is U.S. Treasury debt.

And the debt doesn’t look good.

The government’s revenue comes from your hard-earned money, your tax dollars. Yet they continue to spend far more than they collect.

If the federal government were a business, it would have folded long ago. Revenues consistently fall short of obligations. The difference is that the government can print the shortfall.

The system survives only by issuing more debt, a growing portion of which is bought by the Federal Reserve using money it creates out of thin air.

Let that sink in:

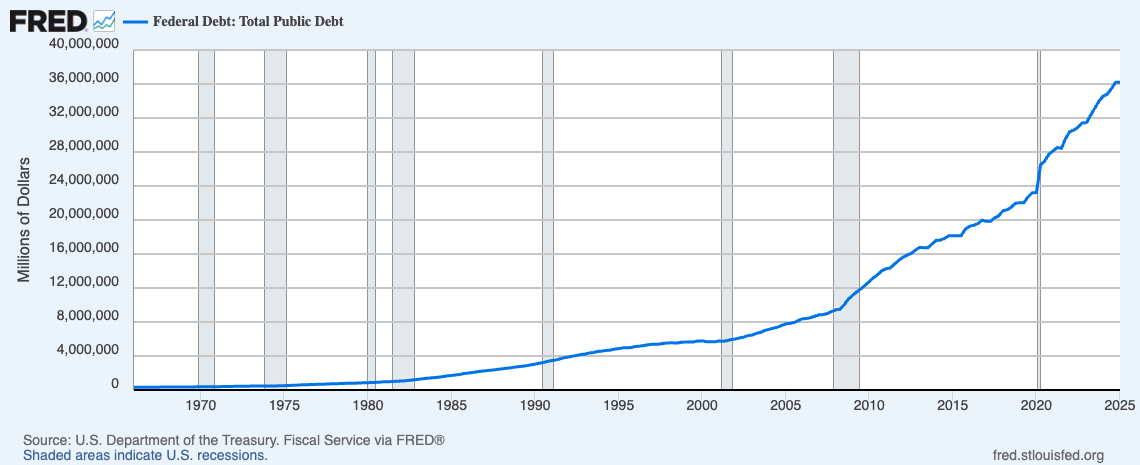

The U.S. has raised the debt ceiling 79 times since 1960.

The government has run deficits in 45 of the last 50 years.

Federal debt now exceeds 37 trillion dollars.

And by the way, this isn’t a Democrat or Republican issue. It’s a structural issue with fiat money.

It’s the Fiat Cave, and like fish in water, most people never ask, What is water? Or in this case: What is money?

The problem is hiding in plain sight. Media pundits point fingers and debate symptoms, but never the root cause, a system that requires perpetual money printing or collapse.

That is the definition of a Ponzi.

Bitcoin Is the Mirror

Bitcoin’s exponential price increase isn’t just the result of hype or speculation. It’s a reflection of growing awareness.

More and more people are realizing the financial system they’re living in is the real Ponzi scheme. And they’re opting out in real time by converting their fiat currencies into Bitcoin.

Bitcoin doesn’t promise riches. It promises something more important: monetary integrity.

Its supply is fixed. Its issuance schedule is known. And no one, not presidents, not central bankers, not unelected bureaucrats, can alter the rules.

Now compare that to a system with no integrity at all. Politicians are spending like drunken sailors, pointing fingers, dividing the public, and padding their own pockets, while your dollars lose purchasing power every year.

Bitcoin’s price goes up because the debt and the money supply continue to increase. It’s not a bubble, it’s a mirror.

Its rise reflects the rise in debt and dilution. And for many, that reflection is too uncomfortable. It challenges everything they’ve been taught to believe.

And once you question the money, it’s hard not to question everything else.

Who’s Really Getting Scammed?

Every year, your dollars buy less.

Housing, healthcare, education, food, utilities, it all gets more expensive. Not because these things are inherently more valuable, but because the money is inherently broken.

You’re not being scammed by Bitcoin.

You’re being scammed by the system Bitcoin exposes.

Bitcoin isn’t a Ponzi. It gives you the chance to step outside of one.

Agree or disagree? Leave a comment below.

If you’re interested in any of the following, subscribe for more:

Bitcoin investment research

Bitcoin personal finance

Building a bitcoin business

Practical ways to invest in bitcoin

Practical ways to secure bitcoin

Excellent Article!

Clear, concise, and strong!