The "Polk Moment" for Bitcoin: The Modern-Day Gold Rush Begins

Trump’s Bitcoin Executive Order Just Changed Everything—Here’s Why It Matters

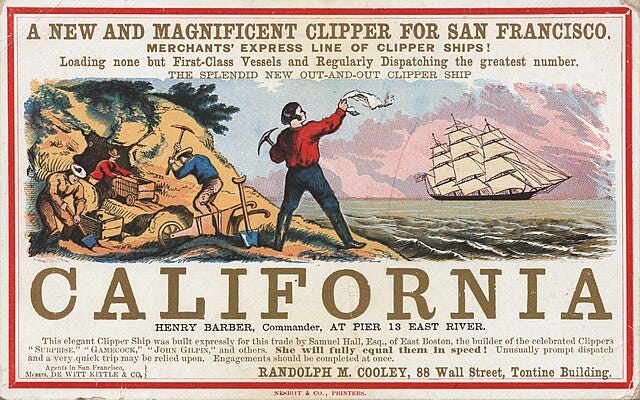

In 1848, gold was discovered in California. Despite the discovery, skepticism reigned. Was there really gold in the hills? Could it be extracted at scale? For months, news trickled out in fragmented reports, but the world remained unconvinced.

Then, in December 1848, President James K. Polk addressed the nation in his State of the Union, confirming that gold had, in fact, been found in abundance.

That singular moment sent a shockwave through the United States and beyond. The California Gold Rush was officially underway. Hundreds of thousands of people—prospectors, merchants, and opportunists—flooded the West in search of fortune. Capital flowed, infrastructure was built, and a new economic era was born.

Fast forward to 2025, and history rhymes again.

Thursday night (March 6th), President Donald J. Trump signed an executive order establishing the Strategic Bitcoin Reserve of the United States. This move signals that the U.S. government is not only recognizing Bitcoin’s strategic importance but actively positioning itself as a leader in the new digital monetary era.

For years, Bitcoin has been dismissed, misunderstood, and attacked. But much like gold in the early days of the California discovery, its true value was evident to those paying close attention. The market signaled its significance through relentless adoption, and now, the highest levels of government are acknowledging it as a reserve asset.

Why This is the “Polk Moment” for Bitcoin

Polk’s confirmation of gold’s discovery turned a regional curiosity into a global event. Trump’s executive order does the same for Bitcoin.

It’s not about whether the asset is valuable—the free market has long settled that debate—but rather about how governments will position themselves in the arms race to accumulate “digital gold.”

National Reserves & Sovereign Accumulation – Trump’s order establishes a Bitcoin reserve backed by 200,000 BTC already in U.S. government possession, instantly making the United States one of the largest Bitcoin holders in the world. The Executive Order also allows for the nation to explore “budget neutral” ways to accumulate more of the asset.

Digital Fort Knox – As David Sacks put it, the U.S. has now created a ‘Digital Fort Knox’ for Bitcoin. The executive order explicitly acknowledges Bitcoin as digital gold, recognizes its 21M supply cap, and states that Bitcoin has never been hacked.

Monetary Transition – Gold’s monetization in the 19th century led to new financial infrastructure—banks, minting facilities, and standardized reserves. Bitcoin’s integration into national reserves signals that we are entering a new phase of monetary transition.

Geopolitical Competition – In the 19th century, global superpowers fought to accumulate gold reserves to back their currencies. Today, sovereign accumulation of Bitcoin is emerging as the next competitive race. The executive order even authorizes a budget-neutral strategy for acquiring additional Bitcoin over time, ensuring that the U.S. does not fall behind.

What Comes Next?

After Polk’s announcement, migration to California exploded. Capital surged, railroads were built, and San Francisco transformed from a small outpost into a booming financial center. The same thing will happen with Bitcoin. With government validation now on the table, we can expect:

Institutional FOMO: Pension funds, sovereign wealth funds, and corporations will accelerate their Bitcoin strategies.

Regulatory Shifts: The policy landscape will adjust to ensure Bitcoin’s integration within national and international frameworks.

A Global Arms Race for Bitcoin: If the U.S. is declaring Bitcoin a strategic asset, other nations will follow. The game theory has now kicked into high gear.

Final Thoughts

For years, Bitcoin has been compared to digital gold. Now, it has its President Polk moment. Just as gold reshaped the global financial order in the 19th century, Bitcoin is positioned to do the same in the 21st.

If the California Gold Rush was the greatest financial migration of its time, Bitcoin adoption may become the largest wealth transfer in modern history. And like those who left for California in 1849, those who position themselves early will be the biggest beneficiaries of this new monetary era.

The Bitcoin Gold Rush has officially begun.

If you’re interested in any of the following, subscribe for more:

Bitcoin investment research

Bitcoin personal finance

Building a bitcoin business

Practical ways to invest in bitcoin

Practical ways to secure bitcoin