A Brief History on the California Gold Rush

The California Gold Rush began on January 24, 1848, when gold was discovered at Sutter's Mill in Coloma, CA. The news of the discovery spread rapidly, and people worldwide migrated to CA in search of the shiny yellow metal.

It may seem obvious, but why did the Gold Rush occur? Scarcity.

By the mid-1800s, precious silver and gold metals had been used as money in several civilizations for thousands of years. The monetary properties of gold, most importantly, scarcity led to its adoption as money - a medium of exchange, store of value, and unit of account. Gold's properties, particularly its store of value function due to scarcity, were well understood in North America 200 years ago, as gold was used to back the dollar. Gold's scarcity allowed people to save for the long term in an asset that preserved purchasing power over time.

So, of course, when stories of gold deposits in California began making their rounds, there was excitement but also much skepticism - it's a rare metal. The first to hear of the newfound deposits resided in California. It's said that when the news broke in San Francisco, many didn't believe it at first. It took American settler, businessman, and journalist Samuel Brannan walking through town with a vial of gold to convince the people of the discovery - not long after, stores were empty as people flocked to the mines in search of the shiny metal.

The news then made its way to places most accessible from California, such as Mexico, South America, and the Pacific Northwest. It wasn't until summer, 6 months later, that news would break on the East Coast of the United States. Again, there was a high degree of skepticism, and it wasn't until President Polk shared Colonel Richard B. Mason's report of the gold discoveries at his State of the Union address in December 1848 that widespread belief occurred in America.

In 1849, no more time was wasted, and the non-native population in California boomed to 100,000, a 10x increase from a few years prior. Few things were more compelling than the idea of potentially creating newfound generational wealth from the mines.

The California Gold Rush lasted for several years; however, the early settlers from 1848-1852 stood to gain the most from the more easily identifiable and extractable gold deposits. As time progressed and more prospectors entered the market, it became more challenging to find deposits, and speculators moved to other regions of the US, such as the Rockies.

It's hard to find consistent data, but in a few years, billions of dollars were pulled out of the ground in today's dollar terms - a truly rare opportunity for generational wealth creation that cemented a prosperous future for California and the United States.

And I believe an even more compelling opportunity is on the horizon.

Understanding the Case for Digital Gold

It’s not often that these circumstances present themselves - a chance for life-changing wealth to be created over the coming years, yet bitcoin presents that exact opportunity for all of us.

What is bitcoin? It’s a question that could be answered in many ways. Often people don’t approach the topic of bitcoin because it’s perceived to be too foreign. But we can simplify our understanding of bitcoin as digital gold to make it more accessible.

Using the digital gold lens to assess bitcoin is effective, as we all innately understand the value of gold derived from its scarcity. Thousands of years of history give us confidence in the value of gold and its ability to store wealth for the long term despite economic turmoil, currency devaluation, war, and social upheaval.

If we apply that same framework to bitcoin, we can make a strong case for it as a savings technology or an allocation in a broader investment portfolio.

So what makes bitcoin “digital gold?”

First and foremost, similar to gold, bitcoin’s value is derived from its scarcity. You’ve likely heard that there’s a hard-capped supply of bitcoin of 21 million. To achieve the 21 million bitcoin, bitcoin is mined (issued) at a predetermined rate. At the time of this writing, 19.4 million bitcoin have been mined.

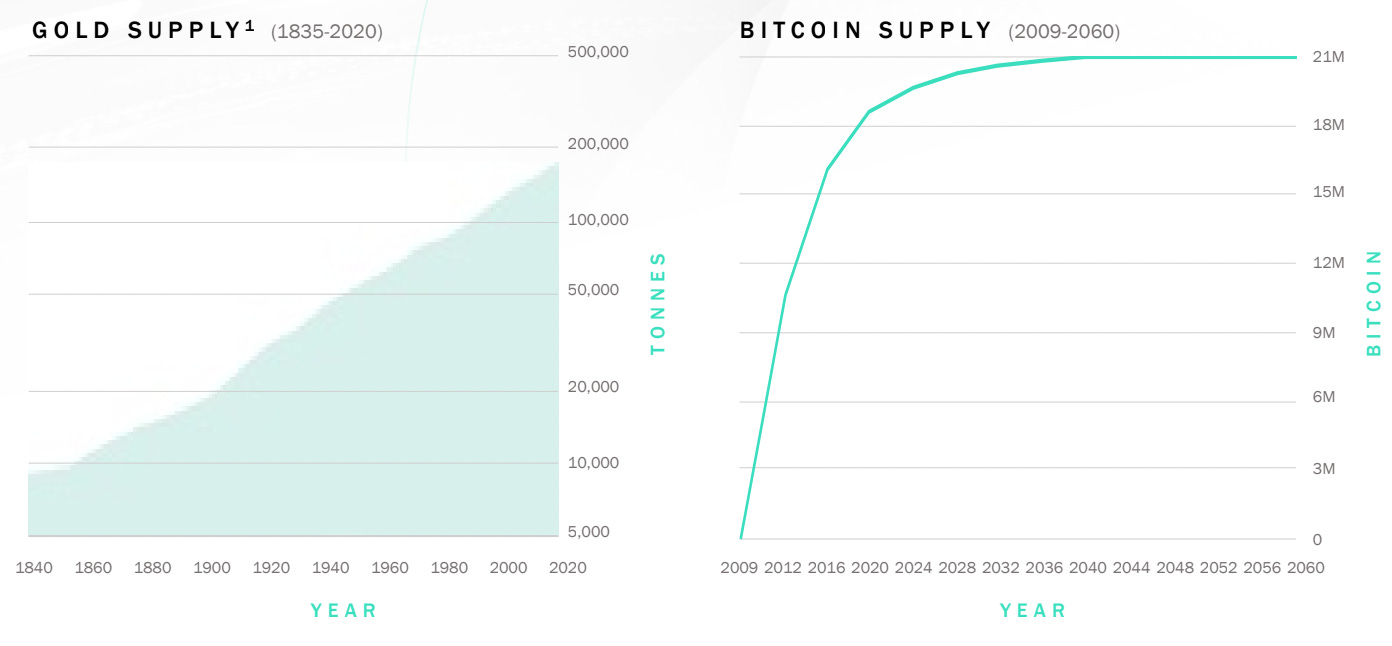

Bitcoin improves on the scarcity of gold by introducing a finite amount that can ever exist. While gold is a relatively scarce good compared to other metals, investable assets, and consumer/durable goods, the supply increases by ~ 1.5-2% each year. Compared to the increase in the money supply of fiat currencies or other metals such as silver, that’s a considerably lower growth rate in supply.

Due to gold’s relative scarcity, it’s been a great asset to own for decades and even generations to preserve purchasing power against devaluing paper currencies.

Gold’s relative scarcity should be compared to bitcoin’s absolute scarcity, achieved by the finite supply.

Not only is there a fixed number of bitcoin that will ever exist due to the protocol rules, which are enforced by tens of thousands of nodes (computers) running the bitcoin software, but the issuance of bitcoin rate is decreasing.

As depicted in the chart above, gold’s above-ground supply has increased steadily for about 200 years at a rate of 1.5-2% annually. Understanding that gold’s scarcity towered over other monetary metals and paper currencies for thousands of years is critical. Yet, the supply continues to grow, and there’s no certainty of how much gold exists in the earth, lost in the ocean, or even in space.

Over the last two centuries, gold’s supply has increased by 20x.

Bitcoin stands in stark contrast to the steadily increasing supply of gold. Bitcoin not only exhibits absolute scarcity but also increasing scarcity. If you want an excellent primer on “increasing scarcity” I recommend this piece by

.To summarize, increasing scarcity is driven by the “halving” event that happens every four years to the bitcoin supply - when the amount of bitcoin issued in each block decreases by half. Since bitcoin’s inception, there have been three “halving” events that have occurred: 2012, 2016, and 2020.

Thus, bitcoin becomes increasingly scarce every four years as the amount of new supply decreases until 2140 when the last bitcoin of the bitcoin supply is mined.

Just as gold’s scarcity has determined its value for thousands of years, bitcoin’s absolute scarcity and increasing scarcity established in 2009 are the key drivers of long-term value for those purchasing the asset.

While there's no denying that volatility exists in bitcoin's price relative to the dollar, these two factors have contributed to extremely compelling long-term returns for adopters.

The International Digital Gold Rush Begins

Now that we understand what constitutes bitcoin as digital gold, what might a “digital gold rush” look like? Digital in nature, it wouldn’t represent a mass migration of picks and shovels, but there would still be many parallels, including the opportunity to create generational wealth.

A few days ago, Larry Fink, CEO of the world’s largest asset manager, BlackRock, appeared on Fox Business. He shared his current thinking on bitcoin, given BlackRock’s recent filing for the “iShares Bitcoin Trust.”

During a segment that went viral, Fink makes the following comments (emphasis added):

I do believe the role of crypto is digitizing gold. Instead of investing in gold as a hedge against inflation, a hedge against the onerous problems of any one country, or the devaluation of your currency in whatever country you are in [you can invest in bitcoin]. Let’s be clear, bitcoin is an international asset.

While I am no fan of Mr. Fink for many reasons I’ve outlined in this newsletter, that doesn’t matter; bitcoin is for everyone. His recent comments on the asset are a seismic shift in his view [Wall Street’s view] of the nascent investment.

Similar to the initial skepticism of the gold deposits found in California 200 years ago, Wall Street and Mr. Fink have long been skeptics and even denouncers of bitcoin.

It was only in 2017 that Fink said the following:

Bitcoin just shows you how much demand for money laundering there is in the world.

After years of naysaying and attempts to discredit bitcoin with no success, it’s becoming clear to the old world of Wall Street that bitcoin adoption is happening with or without them.

Admittedly, I wish we could leave Fink behind in the coming international digital gold rush; however, it’s clear that he and many others are realizing the potential of bitcoin as a savings technology and investable asset in a broader portfolio, given his comments about digitizing gold.

At a minimum, the Finks of the world see it as an opportunity to make fees on the increasing client demand they see at their firms.

His words come a few weeks after the aforementioned BlackRock Bitcoin Trust filing, which was recently rejected by the SEC. The regulators claimed the “spot bitcoin ETF filings are inadequate,” stating they are not clear and comprehensive.

While that may seem like negative news for the approval of these Wall Street bitcoin products, the quick engagement from the SEC is actually more optimistic than one may initially think. Eric Balchunas, Senior ETF Analyst at Bloomberg, notes below:

While the SEC did reject the initial filing, ultimately, they’ve provided guidance on how to amend the filing to meet their standards. This is a positive development as the regulators have been radio silent on bitcoin spot filings in the past.

It’s worth noting as well that BlackRock’s record for ETF approvals is 575-1, which is why shortly after they filed for a spot bitcoin product, many Wall Street behemoths followed suit.

When BlackRock files for a new product, they have confidence in its approval.

In June 2023, Wall Street firms representing $24 trillion+ of AUM have filed for bitcoin and crypto products and changed their tune publicly on the asset.

Wall Street, led by BlackRock, has signaled that bitcoin is a legitimate asset. Not that bitcoin needed their approval, but it certainly accelerates the next wave of adoption.

These are all signs that the international digital gold rush is on the horizon.

A Comparison: The CA Gold Rush & The International Digital Gold Rush

To tie this all together, let's consider the similarities and differences between the California Gold Rush and the International Digital Gold Rush.

Asset history

At the time of the gold rush, gold had a proven track record as a reliable store of value, spanning thousands due to its scarcity.

The international digital gold rush is coming. It's only fourteen years since bitcoin's inception. To some, that may seem like a short track record, but the reality is the digital world progresses much faster than the analog world. Bitcoin has undergone several cycles of extreme appreciation and subsequent crashes. Yet, it continues to make higher highs and higher lows, highlighting its ability to store value (especially for 4+ year hold periods due to the halving).

Supply elasticity

As discussed earlier, gold's supply grows at 1.5-2% annually. The Gold Rush led to an uptick in supply growth as deposits were found and gold was brought to market. The supply growth of gold ebbs and flows with demand and discoveries of deposits.

Demand for bitcoin is growing exponentially - bitcoin adoption is happening at a rate faster than internet adoption. Despite the current demand and how much it may accelerate from Wall Street's entry into the digital gold rush, bitcoin's supply will continue on its preetermined issuance scheduling - halving every 4 years. In this sense, bitcoin's supply is perfectly inelastic, not reacting to shrinking or growing demand at any given time.

Scarcity

Gold exhibits relative scarcity when compared to other assets. Its supply growth of ~ 2% is much less than other assets/goods and currencies. That has made it a reliable store of value for thousands of years.

Bitcoin exhibits absolute scarcity and increasing scarcity. With the next halving coming in 2024, bitcoin's issuance rate will be reduced, making it 2x more scarce than the present time. Unlike gold, there will be no future discoveries of more "bitcoin deposits." All bitcoin that will ever exist is known, and we are on a predetermined path to 21 million.

Ease of participation in the gold rush

Participating in the Gold Rush was no walk in the park. People traveled hundreds or even thousands of miles, uprooting their lives in hopes of partaking in the massive opportunity in California. A challenging endeavor, especially as the initial deposits were depleted, and it became harder to find gold. The labor was intense and arduous, and many people suffered injuries or even died in search of gold.

Bitcoin is easily accessible to nearly everyone in the world. There's no need to uproot one's life and undertake a journey across the world to participate in the digital gold rush. The barriers to entry are substantially lower. Bitcoin can be purchased from exchanges and bitcoin ATMs globally and earned by delivering a good/service and being paid in bitcoin by anyone in the world. Ease of participation is set to increase with the coming Wall Street products.

Social Proof

There was a high degree of skepticism when the public was first made aware of gold deposits in California. It took President Polk's State of the Union address, where he cited a verified report of the gold findings, for the American public to believe the news.

Similarly, while many individuals and even some institutions have been adopting bitcoin for fourteen years now, most people need the validation and acceptance of bitcoin by "trusted" institutions to consider participating in the opportunity.

In either case, an authoritative figure needs to make a public statement of endorsement for many people to cement their conviction.

Generational wealth opportunity

At the time in the United States history when the Gold Rush happened, most wealth was either earned through labor or entrepreneurship. While there were opportunities to create generational wealth through these avenues, evidenced by the success of the Rockefellers and others, they were few and far between.

Similarly, it's a challenging environment to create generational wealth today. People are battling the debasement of currencies by global central banks and governments, making it difficult to allocate capital and preserve wealth for the long term. For most, wages have been relatively stagnant for decades while prices of all goods and services have increased dramatically.

Both the Gold Rush and the Digital Gold Rush present an opportunity for generational wealth creation. While there have been many millionaires and even some billionaires minted by bitcoin already, it remains a mere $600 billion asset in a $900 trillion global asset landscape. It's still early.

Get the picks and shovels. The International Digital Gold rush is coming.

Thank you for reading! I hope that you found this analysis helpful. If so, you can help spread the word by sharing this piece with friends, families, colleagues, and social media audiences. I would greatly appreciate that.

If you are new here, I write bitcoin-focused macro research, taking a long-term view on the current state of markets and economies and making the case for bitcoin as an asset everyone should explore and consider. Unlike traditional finance outlets, I don’t care about quarters or years, and I don’t think you should either. Real wealth is created over decades and generations - let’s focus on the signal, not the noise.

Beyond investment-related research, I also pontificate on the societal ills of fiat money and the current state of the clown world. I hope to provide my readers with information and entertainment to navigate the increasingly perilous, ridiculous, and tumultuous times we are living through. Thanks for being here!

For those reading without a bitcoin allocation, I urge you to “get off zero.” The only wrong allocation to bitcoin is 0%. Are you really going to let Fink get in before you do?

Finally, if you’ve been here for a while or are new to the page, the greatest way to reciprocate the value I hope to deliver to you is by pledging a paid subscription. Time is scarce, and it takes a lot of it to write these pieces. A $11/month subscription goes a long way to ensure I stay motivated and can eat grass-fed beef. Thank you.