The Health of the State and Its Constituents (Part 1)

The deterioration of the United States' fiscal health and the dire consequences.

"We know we have this incurable debt disease, and we're going to draw it out for as long as we can." -

during a recent appearance on the "What is Money? Show" hosted by .If you have been reading "The Fiat Cave" or other bitcoin and macro-focused publications, you are likely aware that the US Government, and all governments globally for that matter, are not in the best fiscal health.

This article will shed light on the horrid fiscal health of the state and the abysmal physical health of its constituents and how the two are intrinsically linked.

Binging on Debt

Since 1971 there's been no constraint on Government spending beyond the public's faith in the US Dollar and US Treasuries. Well, actually, there has been one constraint in theory, the "Debt Ceiling" or the "Debt Limit."

The US Department of the Treasury’s website defines the Debt Limit as:

The debt limit is the total amount of money that the United States government is authorized to borrow to meet its existing legal obligations, including Social Security and Medicare benefits, military salaries, interest on the national debt, tax refunds, and other payments.

Notice "existing legal obligations" in the text above. That's important. The Treasury's website goes on to state:

The debt limit does not authorize new spending commitments. It simply allows the government to finance existing legal obligations that Congresses and presidents of both parties have made in the past.

So let's get this straight, the way politics works in a fiat monetary system is the current administration will make promises, usually monetary ones, to get elected. At one point, the government's budget was fairly balanced, meaning their campaign promises and other expenses could be met by revenues provided to the government; in other words, taxes.

However, since there's no gold backing and no real constraint to the government's borrowing besides the public's faith, what has happened is more debt has been issued to meet their campaign promises, often above the taxes that are brought in. That means that the government is running a deficit.

So bills get passed to spend more (issue debt), and eventually, when the next person is in office, and there's not enough money to pay back the debts of promises past, then they need to raise the debt ceiling for those "existing obligations." Since 1971, the federal debt of the US Government has trended only one way: up.

Should Congress not raise the debt ceiling to meet those obligations, then the US Government would, to put it bluntly, default. As the US Treasury states:

Failing to increase the debt limit would have catastrophic economic consequences. It would cause the government to default on its legal obligations – an unprecedented event in American history. That would precipitate another financial crisis and threaten the jobs and savings of everyday Americans – putting the United States right back in a deep economic hole, just as the country is recovering from the recent recession.

Because the entire financial system is based on the issuance of more and more debt, if debt were to stop being issued then the whole house of cards would collapse. So, as a result, the debt ceiling has been increased by Congress 78 times. From the Treasury’s website:

Since 1960, Congress has acted 78 separate times to permanently raise, temporarily extend, or revise the definition of the debt limit – 49 times under Republican presidents and 29 times under Democratic presidents. Congressional leaders in both parties have recognized that this is necessary.

To put this all into perspective, the chart below shows the annual Federal Surplus or Deficit since 1971, when the Fiat Standard came into existence. Since the US Government abandoned the gold standard, you can see that they've gotten into a bad habit of issuing more debt (spending) far in excess of their tax collection. This trend accelerated after the turn of the century, especially during and after the Great Financial Crisis.

Again, this is possible because there's no backing to the dollar. The financial system is built on a foundation of debt, US Treasuries. More and more of these obligations are issued to meet the promises of politicians, and when the time rolls around to pay the debt's principal, more debt has to be issued to fill the shortfall from taxes. So despite the name of the "debt ceiling" or "debt limit," in reality, there's no limit to the amount of debt issued, aside from the loss of trust.

The US Government, and all governments globally for that matter, have binged on debt for the last 50+ years, and there's no political will to stop. To stop issuing debt would mean the worst economic hangover (depression) in recorded history.

Looking Forward: Accelerated Decay of the State’s Health

The Congressional Budget Office, a federal agency that provides budget and economic information to Congress, does not anticipate the health of the US Government to improve. In fact, their projections are for it to get worse.

Why is the health of the US Balance Sheet worsening?

There are two main reasons:

The first, as described above, is that the entire financial system is a house of cards that requires the issuance of more debt to pay off previous debts, and part of fiat politics is making promises to get elected, most of which require more spending (debt issuance).

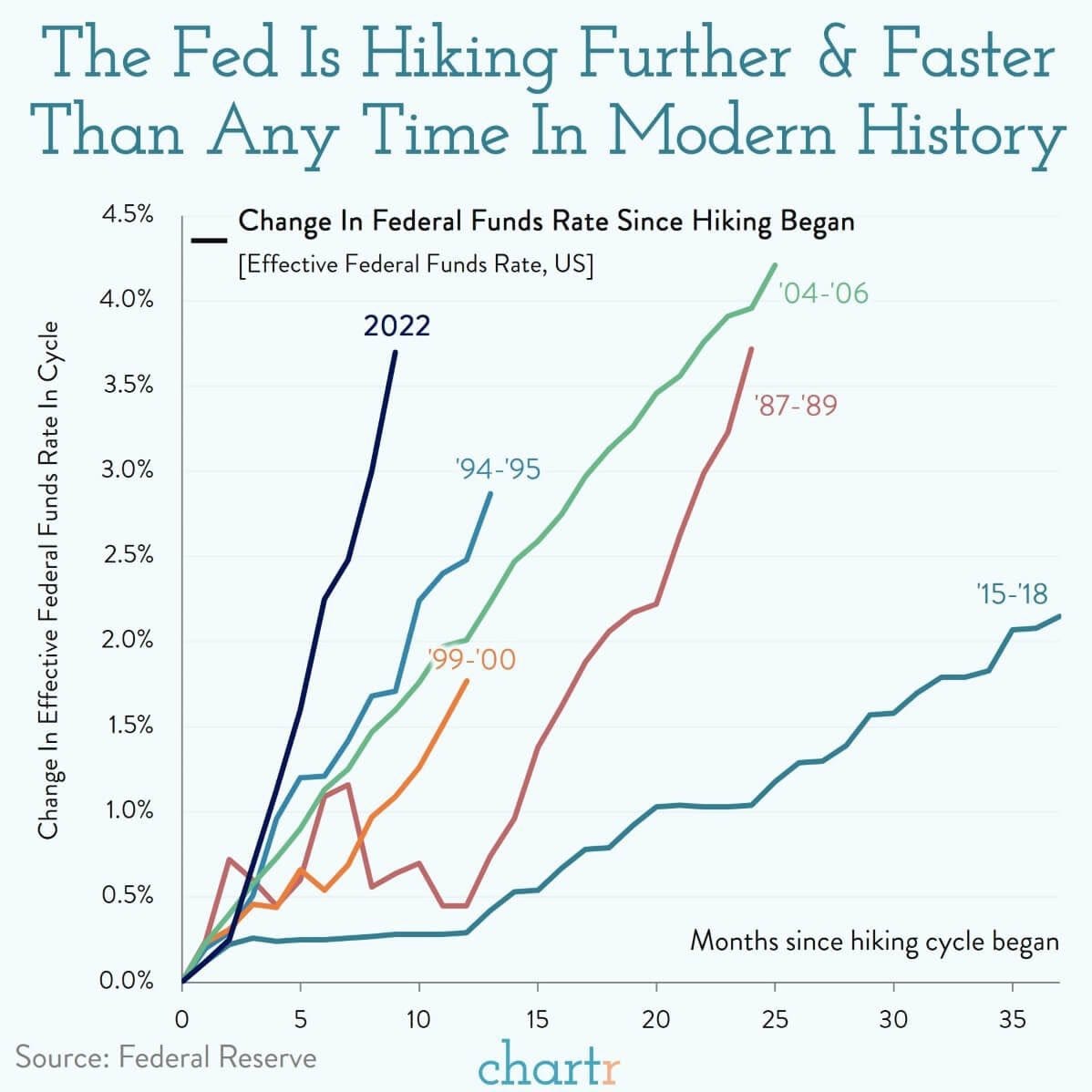

Second, the US Government and Federal Reserve jointly decided to lower interest rates and issue more debt to combat the deflationary forces of economic crises over the past few decades. Most recently, as the economy and financial markets were on the brink of calamity in 2020, the decision was made to lower rates to 0% and create $6.4 TRILLION of new money supply in less than two years. The result is the inflation that we are all living through today. To fix the problem they've created, the Federal Reserve embarked on the fastest rate hiking cycle in recent history in 2022.

The last time there was high inflation in the US, in the 1970s and 1980s, and the Federal Reserve raised interest rates, US Federal Debt to GDP was roughly 35%. Today it is 120%, as shown below.

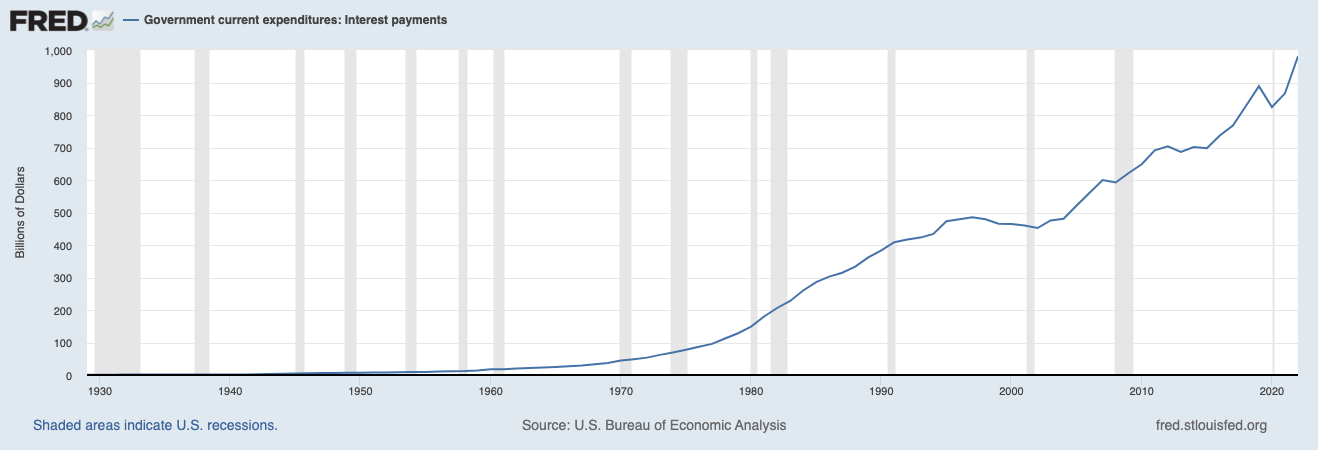

Because of the egregious amount of debt in the financial system, increasing rates from 0% to 5% results in a much larger interest expense bill.

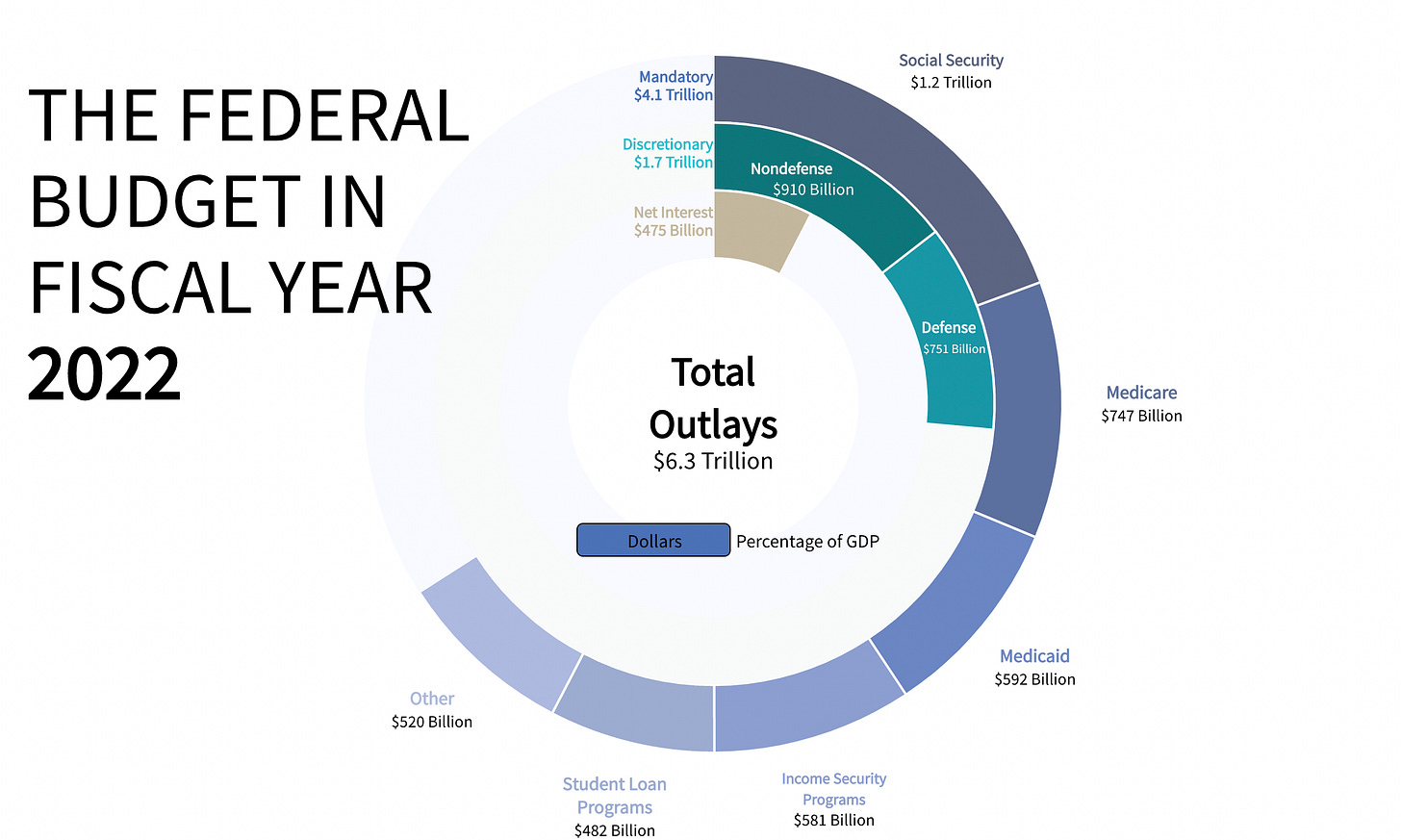

Effectively, by raising rates to fight inflation, the Fed is causing the deterioration of the fiscal health of the US Treasury even further. In Fiscal Year 2022 alone, based on the CBO's data, the federal deficit was $1.4 trillion, equal to 5.5% of GDP and almost 2% greater than the average over the past 50 years. You can see below that the "mandatory" expenses are $4.1 trillion, nearly equal to the total tax revenue in 2022 of $4.8 trillion.

Accounting for "discretionary" expenses such as non-defense and defense spending is another $1.7 trillion. And who are we kidding? These are essentially mandatory spends. Will we cut the defense budget while geopolitical tensions rise and escalation in Ukraine continues?

And finally, net interest for 2022. That came in at a cool half a trillion. That number is projected to be $640 billion in 2023 due to the higher interest rate environment.

Now looking forward, let's turn our attention to the CBO's "Budget and Economic Outlook: 2023 to 2033" report published in February 2023.

For context, "the CBO regularly publishes reports presenting its baseline projections of what the federal budget and the economy would look like in the current year and over the next 10 years if current laws governing taxes and spending generally remained unchanged. This report is the latest in that series."

I won't bore you with all the details of the report (nor will I bore myself by reading it all), but to use the Treasury's own words, the US Government is on "An Unsustainable Fiscal Path."

The CBO's projections include a $1.4 trillion deficit in 2023, which uses quite rosy assumptions, and projects an annual deficit average of $2.0 trillion over the 2024-2033 period. In total, from 2024-2033, that's a $20 trillion deficit.

I agree with the Treasury. This is an unsustainable path. To put it politely, the debt situation in the US and globally is a disaster. There's no way out of this mess.

The CBO's projections highlight perpetual deficits, which means that the Treasury will continue to issue debts, Congress will continue to increase the debt ceiling, and the Federal Reserve will continue to print money to fund the Treasury's spending. Illustrated by the CBO's chart, here's the projected Federal Debt-to-GDP ratio.

Meanwhile, as the US will need to issue more debt, there's an active push from the BRICS+ (Brazil, Russia, Iran, China, South Africa & more) to de-dollarize, which means selling US Treasuries and dollars and exploring alternatives for global trade. So, we have an increasing supply of US Treasuries, as highlighted above, alongside a decreasing demand for them globally. This means that the Federal Reserve will have to print even more to make up the difference.

As the Treasury hinted in the quote earlier, there's only one choice: to print the money to fund the deficits. There's no political will for the other option, default.

We are in a Debt Spiral. Governments are drowning in debt. Rather than taking responsibility for fiscal health decades ago, the US and all nations have chosen to indulge in creating a massive amount of debt and ignoring the long-term ramifications.

As we will explore in Part II, it's no coincidence that the decline of the fiscal health of the US Government has coincided with a massive decay of its constituents' health.

If you have been enjoying my work, I’d greatly appreciate it if you share my newsletter with friends, family, and colleagues. I believe these messages are important for all to hear and hope that by writing, I can help inform, educate, and entertain. Thank you.

Any pledges for future paid subscriptions will increase my financial sovereignty and reduce my reliance on my employer. As a paid subscriber, you will receive additional benefits.