The Hard Truth About Bitcoin Adoption

Why scalable custody is the key to real ownership and long-term adoption

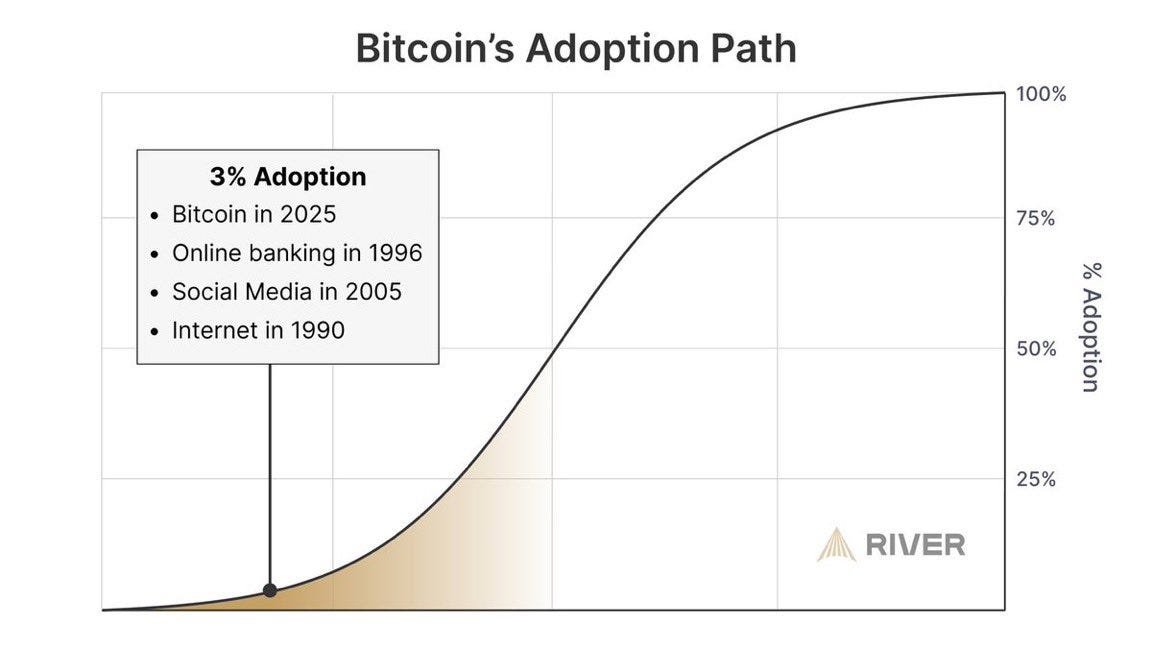

Depending on which data you reference, Bitcoin adoption today ranges from 1% to 3%. That means the overwhelming majority of people have not adopted Bitcoin in any meaningful way.

Some may have downloaded Coinbase, bought a small amount of Bitcoin (along with some shitcoins), or hold a sliver of a Bitcoin ETF in a brokerage account. But most have no allocation, or close to it.

This shouldn’t surprise us. We’re still early. Very early.

If Bitcoin adoption today is around 3%, it’s roughly equivalent to where online banking was in 1996 or where social media stood in 2005.

If you’re old enough to remember, people were skeptical of doing their banking online. It felt risky, unnecessary.

Social media? An odd niche. Perhaps fun, but certainly not something most people imagined would become a foundational part of human interaction.

Bitcoin is tracking a similar path, but with a significantly higher barrier to entry, because it represents a radical proposition as a new form of money.

There are several reasons why adoption hasn’t yet scaled.

The media coverage has been abysmal:

It’s boiling the oceans.

It’s for criminals.

It has no intrinsic value.

Even when people are curious, the public image is often dominated by stories of collapse: FTX, Celsius, Mt. Gox.

Most stop at these headlines and assume the collapse of FTX was the collapse of Bitcoin itself.

Bitcoin also challenges most traditional finance mental models.

A form of money? Then who backs it?

An investment? But there’s no cash flow.

A store of value? But it’s volatile.

You get the point. There’s still a lot of work to do on the education front.

But let’s set all that aside.

Let’s assume someone gets it and they understand Bitcoin is sound money.

They want to own it. Then, naturally, these questions arise:

How do I buy it?

How do I secure it?

How do I ensure I don’t lose it?

How do I ensure it’s not hacked?

This is where most people get tripped up and where many ultimately give up.

The Self-Custody Dilemma

Many within the Bitcoin industry promote self-custody, where users are fully responsible for managing their Bitcoin. I’m a strong advocate for self-custody, but we have to acknowledge that it doesn’t meet most people where they are.

Telling someone they must become fully responsible for technical security just to participate isn’t a scalable adoption strategy.

This image from a presentation by Francis Pouliot at Bitcoin Prague makes the point perfectly:

Self-custody can be a cascade of catastrophic outcomes:

Lose your backup? You’re screwed.

Store your passphrase in the wrong spot? Screwed.

Use a weak passphrase? Screwed.

Die without passing on your setup properly? Your heirs are screwed.

And this isn’t FUD, it’s the reality of self-custody for most people.

Self-custody has long been (and will be) a pillar of Bitcoin culture, and for good reason.

Exchanges have been hacked, mismanaged, or outright collapsed. The phrase “not your keys, not your coins” emerged from real pain.

But here’s the problem:

The models of custody we still rely on were designed when Bitcoin was just hundreds or thousands of dollars. Yet, people were still using those same setups at $10,000, $50,000, and now $100,000 and above.

And now we expect the mainstream to step in and secure meaningful wealth in that same framework?

That’s not realistic. It’s not scalable.

And if we’re honest, it’s one of the key reasons mass adoption hasn’t arrived.

When most people hear “self-custody,” they opt out.

They bought GBTC. Now they buy an ETF or the latest Bitcoin Treasury Company.

They gain price exposure, but not ownership.

If we want mass adoption, we need mass-adoptable infrastructure.

Mass adoption won’t happen without infrastructure that people can actually use.

That’s why multi-institution custody matters: it removes single points of failure by distributing security across institutions, while keeping control in the hands of the user.

It provides the benefits of self-custody, namely, control over your Bitcoin, without placing the full operational burden on the individual or relying solely on a single institution that can be compromised.

It is purpose-built to protect against rising threat vectors, both physical and digital. And it’s a model people can onramp into in minutes, without needing to become technical and operational security experts.

This is how Bitcoin scales.

Multi-institution custody isn’t just another custody implementation.

It’s an adoption unlock.

Multi-Institution Custody = Bitcoin Adoption

Multi-institution custody bridges the gap between two models: self-custody, which places the full burden on the user, and centralized custody, which relies on blind trust in a single institution.

Multi-institution custody doesn’t require every person and every business to become technical experts in managing private keys.

At the same time, it doesn’t ask them to trust a single counterparty who could lose their assets, freeze withdrawals, or fail altogether.

It’s built on a foundation of distributed trust, where multiple independent institutions secure Bitcoin on behalf of the client, but no single one of them can move or lose it. This model:

Removes single points of failure

Retains client ownership and control

Enables account recovery without technical burden

Unlocks inheritance planning and seamless transitions

Provides a foundation for services like loans, insurance, and more

In other words, it creates the conditions that enable individuals, families, and institutions to hold Bitcoin in the long term.

Without Bitcoin financial services infrastructure that people can use confidently, securely, and with minimal friction, real adoption doesn’t happen.

People will default to wrapped products, ETFs, or intermediaries that obscure Bitcoin's underlying nature.

If we want people to truly own Bitcoin across time and generations, we must meet them where they are, without compromising the asset’s principles.

That’s what multi-institution custody makes possible.

It enables real ownership at every level, from the individual buying their first bitcoin to the family managing significant Bitcoin wealth to the institution securing tens of thousands of BTC.

Bitcoin doesn’t need Wall Street to create adoption; it needs infrastructure that actually enables ownership.

It needs infrastructure that respects its principles while meeting people where they are.

Some will say, “Bitcoin will eat the world” as a parallel to Marc Andreessen’s 2011 WSJ article "Why Software Is Eating the World.”

That’s still true. However, without usable custody solutions, Bitcoin wrappers will eat Bitcoin.

ETF shares, equity proxies, and other abstractions will dominate, not because they’re better, but because they’re easier.

And in the process, people won’t actually own Bitcoin.

They’ll just rent exposure to it.

If we truly care about real adoption, we need to address this issue.

Multi-institution custody is Bitcoin adoption.

It’s the bridge between today’s fragmented landscape and a future where people truly own their wealth, without being screwed.

Agree or disagree? Leave a comment below.

If you’re interested in any of the following, subscribe for more:

Bitcoin investment research

Bitcoin personal finance

Building a bitcoin business

Practical ways to invest in bitcoin

Practical ways to secure bitcoin

This was a great read! I actually just wrote a 101 piece for non-bitcoiners, but didn’t include anything on the ‘how’ to buy and store. Your idea here is compelling if it can take hold. I have non-technical friends and family who, until now, can’t be bothered to own bitcoin on their own keys. Most of them also see it as a convenience to own the ETF because of tax reporting. Increasingly, this will be tough to get around, as the infrastructure for owning a security is so much better established. I even have one very capable friend who sold all his bitcoin from cold storage to buy IBIT. He didn’t care about the self-sovereign argument; did it for tax purposes, and because he wanted to get a yield from lending his ETF shares.

The thesis is very sound Jack. I would like to understand how the ideas here manifest into actual infrastructure solutions and I think you are on to something here.