The Fiat Cave: An Allegory of Monetary Deception (Part 3)

If you missed Part 2, you can find it here. We introduced the idea of the Fiat Cave, covered a brief history of money, and explored the monetary corruption of the Roman Empire.

This piece will examine the creation of the modern financial system, the consequences of fiat money, and the illusion of the political system. As we will cover, despite humans advancing toward harder monies over millennia, today we have fiat money. Fiat comes from the Latin "let it be done." Fiat money is government-decreed currency not backed by a commodity such as gold.

While there are 76 central banks globally today, and the first central bank was the Bank of Amsterdam, created in 1609, we will focus on the Federal Reserve. The Fed is the center of the current monetary system and will thus be the focal point.

The Construction of the Fiat Cave

Before the fiat monetary system, a Gold Standard existed. Both gold coins and gold bullion were used as money, as the shiny yellow metal was selected as money, as discussed in Part 2.

As trade expanded, both domestically and internationally, gold's portability (i.e. how easy it is to carry or transport) was insufficient despite having the best monetary properties. Thus, in the United States, for example, banks would issue paper currencies (receipts) backed by gold. Individuals and businesses could deposit their gold and receive a paper receipt that would be redeemable for gold. These receipts could be easily transported and traded among people.

Some banks decided to breach the trust established with their customers and began issuing more receipts than gold secured in the vault, what we would call "fractional reserve banking." Fractional reserve banking, as opposed to full reserve banking, simply means that the bank issued more money than it had in reserves. This action was counterfeiting, an expansion of the supply of money (inflation), in this case, paper receipts.

Fractional reserve banking was not only counterfeiting, but it also caused issues when people went to redeem their money. "Bank runs" are common when there is economic uncertainty, and people want to redeem their gold rather than have paper receipts. When depositors all went to a bank at the same time, and the bank did not have enough gold for all the receipts, some people would not get their money back because the banks created too much paper money.

The fluctuation in the money supply due to fractional reserve banking created booms and busts in the economy. Many people would not recover the gold that they had deposited. At that point, the counterfeiting of money should have been outlawed, but the bankers had a different plan.

In 1910, a secret meeting was held at Jekyll Island, Georgia. The attendees were established Wall Street bankers and European financiers. As covered in detail in the book "The Creature from Jekyll Island," the purpose of the meeting was to devise a plan to control the money supply of the United States. The bankers realized that they would have to partner with politicians to create a banking cartel, a central bank.

Per the author, G. Edward Griffin, the creation of the Federal Reserve was held in secret, because "had it been known that rival factions of the banking community had joined together, the public would have been alerted to the possibility that the bankers were plotting an agreement in restraint of trade - which, of course, is exactly what they were doing."

While this may sound conspiratorial, it is openly acknowledged in "Federal Reserve History," "The meeting and its purpose were closely guarded secrets, and participants did not admit that the meeting occurred until the 1930s. But the plan written on Jekyll Island laid a foundation for what would eventually be the Federal Reserve System."

G. Edward Griffin explains the five objectives of the creation of the Federal Reserve:

Stop the growing competition from the nation's newer banks;

Obtain a franchise to create money out of nothing for the purpose of lending;

Get control of the reserves of all banks so that the more reckless ones would not be exposed to currency drains and bank runs;

Get the taxpayer to pick up the cartel's inevitable losses;

Convince Congress that the purpose was to protect the public.

Three years following the meeting, the Federal Reserve Act was passed on December 23, 1913. Interesting… right around Christmas when people are away on vacation - almost as sneaky as the Jekyll Island congregation. The Federal Reserve Act "provided for the establishment of Federal Reserve Banks, to furnish an elastic currency, to afford means of rediscounting commercial paper, to establish a more effective supervision of banking in the United States, and for other purposes." The birth of the Federal Reserve created a financial system of fractional reserve banking.

The creation of the Federal Reserve did not equate to the creation of the fiat money system we have today. While the central bank had successfully been established, the Act required that the Federal Reserve hold gold equal to 40% of the value of the dollars it issued. Individuals and businesses still had the ability to convert dollars into gold at the fixed price of $20.67. However, its formation was monumental in the Ruling Class of bankers and politicians controlling the monetary system. The Federal Reserve now had a monopoly on the issuance of money.

The money printer, the apparatus fortifying the Fiat Cave, was born.

The establishment of the Federal Reserve gave the Ruling Class a monopoly on the creation, allowing them to inflate the supply to their benefit. Through the creation of the Fed, inflation became embedded in the monetary system, a constant fluctuation in the supply of money in the short term, but an increase in the long term. As the money supply expanded over time, the savings of common people would be destroyed, as their piece of the "money pie" became smaller and enriched those who could direct the issuance of new money for their benefit. An increase in the amount of money with a commensurate increase in the output of goods and services results in higher prices. Fortunately, at the time, individuals and businesses could preserve their wealth in gold to hedge against the expanding number of dollars, but that would soon change.

As noted earlier in the piece, during times of economic upheaval, bank runs tended to occur. Rushing to the bank with their paper money, people would want to redeem their gold. The Great Depression was not different; gold was flowing out of the banking system.

In response to the gold leaving the banks, on April 5, 1933, President Franklin D. Roosevelt issued Executive Order 6102.

"All persons are required to deliver on or before May 1, 1933 all gold coin, gold bullion, and gold certificates now owned by them to a Federal Reserve Bank, branch or agency, or to any member bank of the Federal Reserve." Should anyone be found with gold in their custody, the penalty was a $10,000 fine or ten years' imprisonment or both."

Executive Order 6102 eliminated people's rights to own real money, gold. To avoid imprisonment, people had to turn their gold in to the government at the official rate of $20.67/oz. There was no longer a way for individuals to protect themselves against the devaluation of the currency due to fractional reserve banking.

The following year the US passed the Gold Reserve Act of 1934, which devalued the dollar by increasing the price of gold from $20.67/oz to $35/oz.

To be ultra clear here, the government took people's rights to save hard money away by force and then devalued their paper savings the next year.

By revaluing gold, the government was then able to create more dollars, further inflating the money supply. This act by the US government was no different than the Roman Emperors creating more money for themselves by issuing coins of gold and silver mixed with base metals such as copper.

Following the Second World War, leaders of developed nations met in Bretton Woods, New Hampshire in 1944 to create a new international financial system. The Bretton Woods system was structured with the US Dollar at the center. Before and during the Second World War, many countries sent their gold to the US to protect it from the conflict in Europe. Since the US had the gold, the US Dollar was directly pegged to gold at $35/oz, and all other fiat currencies were pegged to the dollar.

The Bretton Woods system worked for a while until European nations wanted to repatriate their gold. France specifically was concerned about the US spending during the 1960s, mainly the Vietnam War and Great Society Plan. The US debt had skyrocketed, and there were doubts that the US had sufficient gold reserves to back the spending.

After the US bluff was called, on August 15, 1971, President Nixon decided to "close the gold window," meaning that countries that had deposited gold with the US as part of the Bretton Woods Monetary system had their gold stolen. President Nixon blamed "international currency speculators" for his decision to "suspend temporarily the convertibility of the dollar into gold." However, it was clear to those paying attention that this was a default on the US obligations under the Bretton Woods system. Due to the massive spending plans that the US embarked on, there were far more dollars created than gold held in reserves.

Prisoners of the Monetary System

The Nixon Administration's decision to "temporarily" sever the dollar's ties to gold ushered in the fiat monetary system that we have globally today.

Each progressive step since the creation of the Federal Reserve has caused us to regress as a civilization. Despite our ancestors' efforts to store wealth in the hardest money possible, through a partnership between corrupt politicians and bankers, we have been forced to use fiat money under the threat of violence by the government.

Fiat money has been a boon to the Ruling Class. The state's monopoly on money has given them free rein to manipulate the supply of money to enrich themselves at our expense.

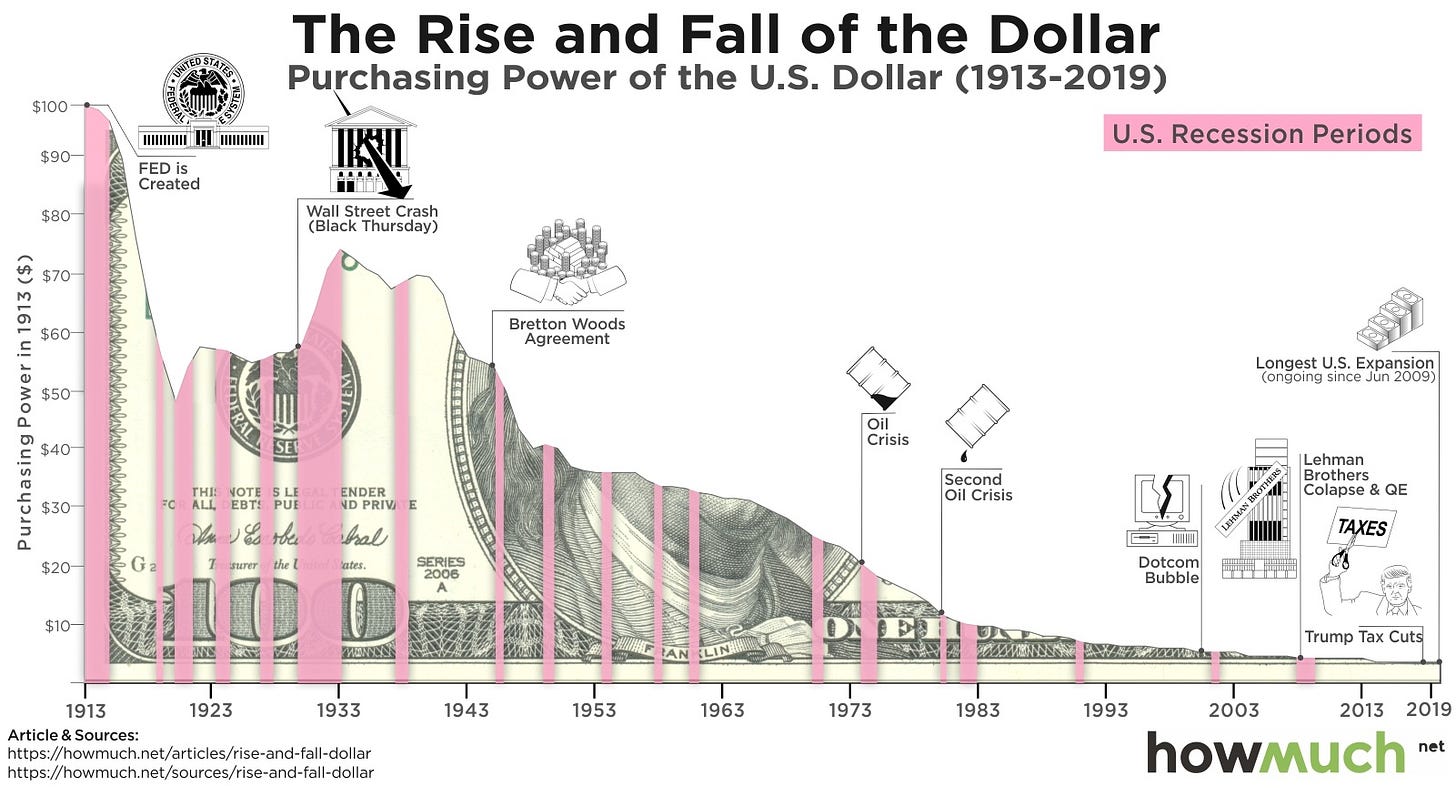

Through the process of devaluing fiat currencies, the Fiat Jailers keep us prisoners of the Fiat Cave. Fiat money fails to function as an effective store of value, one of the key functions of money, due to the printing of ever more money. As displayed in the chart below, since the creation of the Federal Reserve, the purchasing power of the dollar has fallen 99%.

The Ruling Class continues to siphon the wealth of savers, financially debilitating us and creating societal despair and hopelessness. Failing to understand that we are prisoners to the monetary system, we become outraged by the political shadows on the wall.

Those fortunate enough to grow their earnings faster than the rate of inflation can build savings; however, those savings must be invested in risky assets such as stocks, bonds, or real estate in the hopes of preserving wealth. There are, of course, risks with these investments, and there are financial crises that are occurring more frequently and more violently.

When these financial crises emerge, many people panic and sell their assets at a discount, losing wealth. In addition, these crises end up being beneficial to the Ruling Class, as more money is always printed and thrown at the crisis. Between taxation and money printing, the common man comes out of the crises with less, and the Ruling Class amasses more.

Through the constant devaluation of money and wealth transfers, over time, the Fiat Jailers continue to grow their power, and the prisoners become even more financially shackled.

Financial Crisis: A Transfer of Wealth to the Fiat Jailers

Let's take a look at the Great Financial Crisis of 2008 as an example.

In response to the Dot Com bubble in 2001, the Federal Reserve lowered the Fed Funds rate from 6% in 2001 to 1% by 2003. Due to the artificially low rates set by the Fed, demand for homes grew rapidly as everyone wanted to borrow at these historically low rates. The cheap credit and lax lending standards led to record demand for homes, especially for "subprime" lending. The subprime mortgages were packaged into risky Wall Street products. As interest rates started to rise, home prices began to go down, and many people had variable interest rates. So prices were falling while payments were rising. Eventually, one subprime lender went bankrupt, and many collapsed after that.

When the bubble finally popped, Wall Street was bailed out by you, the taxpayer. But it was not only taxes that bailed them out. In addition to the spending, the Federal Reserve instituted Quantitative Easing, a fancy phrase for money printing. Through QE, the Fed (or any central bank) creates money from thin air and purchases US Government Debt from Primary Dealer Banks such as JP Morgan to keep interest rates artificially low, in this case, 0%.

A deep dive into monetary policy such as QE is outside the scope of this article; however, it's important to understand that the Federal Reserve, by artificially lowering interest rates, created a bubble in assets following the Great Financial Crisis. Simply because assets are valued off of interest rates, also called the discount rate, and artificially lowering that discount rate will artificially raise asset values. Thus, asset prices grew at a faster rate following the 2008 Financial Crisis, which increased the wealth of those who owned assets disproportionately to the real economy, which was fairly stagnant.

Ultimately, the bank bailouts of 2008 and the ongoing QE following the Great Financial Crisis were a wealth transfer from the taxpayers and the broader middle and lower classes, who do not own many assets, to the bankers, politicians, and asset owners. These policies devalued the dollar and grew the wealth gap.

Again in 2020 with the emergence from COVID-19, the US Government and Federal Reserve printed over $6 trillion, a 40% increase in the money supply. According to Forbes, "The number of billionaires on Forbes' 35th annual list of the world's wealthiest exploded to an unprecedented 2,755—660 more than a year ago. Altogether they are worth $13.1 trillion, up from $8 trillion on the 2020 list."

While every reader has a varying proficiency in financial markets, the bottom line is that the monetary system as it exists today favors those who control it.

Shadows on the Wall: The Two-Party System

Many people were frustrated by the Wall Street bailouts in 2008, especially the "left-leaning" Occupy Wall Street, and rightly so. However, most of us are deceived into thinking that the issues we face, such as a financial crisis, are due to a specific political party. Despite the action taken in the ballots over the years, the Jailers continue to grow their wealth. According to CNBC, "the top 1% owned a record 32.3% of the nation's wealth as of the end of 2021."

To use our analogy from earlier, the two-party political system in many ways is simply an illusion, shadows on the cave of the wall.

The truth is that the monetary system is corrupt. The Fiat Jailers continue to loot our savings through inflation and taxation while telling us it's the prisoners next to us fault. The system benefits those who control the money and those closest to the creation of new money. The immoral fiat monetary system, which is based on the devaluation of currency, is a bipartisan issue. Against the nature of man, Fiat Jailers have forced money on us that is not scarce, and far from it.

While some change can be made through the political system, it's mostly a facade. The Fiat Jailers want us to be distracted by the political system. As long as they control the money, they will control us.

You may be surprised to know that Central Banks, such as the Federal Reserve, are communist entities. In The Communist Manifesto, Karl Marx and Friedrich Engels state as the "5th plank" of communism, "centralization of credit in the hands of the state, by means of a national bank with State capital and an exclusive monopoly."

At the center of what is supposed to be a "capitalistic country" is a communist institution, the Central Bank. There is no way to overcome the deception and corruption of the Fiat Cave without fixing the monetary system.

Even Founding Father Thomas Jefferson forewarned us of the monetary deception in our system today:

"If the American people ever allow private banks to control the issue of their currency, first by inflation, then by deflation, the banks and corporations that will grow up around them will deprive the people of all property until their children wake up homeless on the continent their Fathers conquered.... I believe that banking institutions are more dangerous to our liberties than standing armies.... The issuing power should be taken from the banks and restored to the people, to whom it properly belongs."

To conclude, the corruption of money has paid for the corruption of all else. The Fiat Jailers keep us shackled through inflation and keep us fixated on the shadows on the wall.

However, a bright light shines in the distance. Do you see the exit of the cave?