Thanks for being here! If you missed Part I, you can read it here.

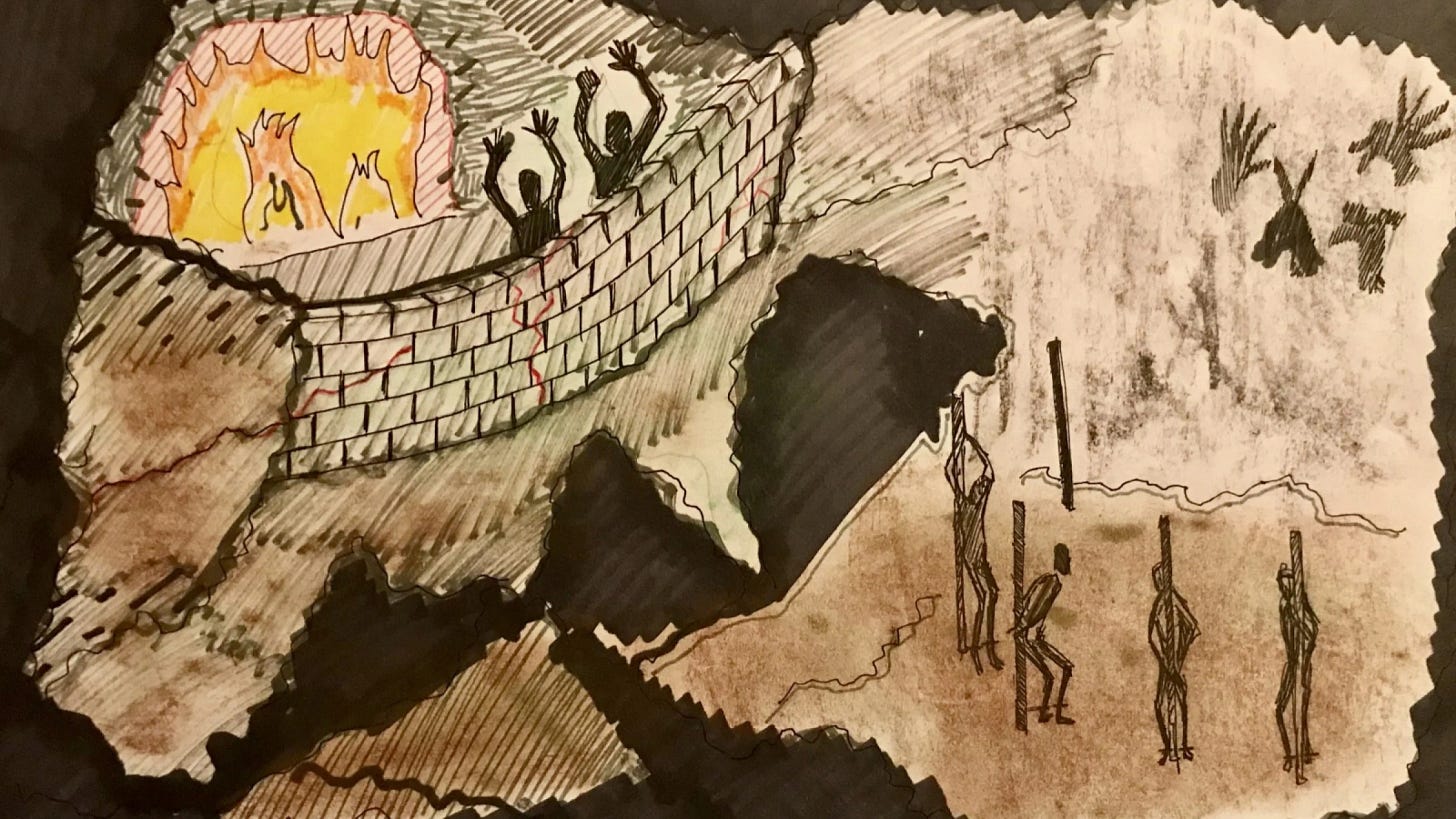

The Allegory of the Cave has described illusions of all kinds, and our monetary system is no different. As we cover in detail in this piece, an exploration of the history of money is required to understand the core issues we collectively face today.

Through the control of money, governments and central banks keep us prisoners. The Fiat Cave is an existence of distraction and manipulation. The Ruling Class enriches themselves by manipulating money, siphoning the wealth of productive members of society like you and me.

Focused on news headlines of "the current thing," a broken political system, and mindless distractions, we fail to realize the root cause of societal ills, fiat money.

So, what exactly is The Fiat Cave?

Just as the prisoners Plato describes, we are born as prisoners in the Fiat Cave. From a young age, our "reality" is influenced by schools, media, corporations, and governments. These institutions are incentivized by the corrupted money issued through central banks, fiat money.

As children, we are taught the importance of money, that we need it to survive, and that it's good to earn as much as possible. Despite the prevalence of money in modern society, we are never taught what money is, why money is necessary, and how money works today.

Although we all chase money, we never take the time to understand it.

As we grow up, our lives become busier with an expanding list of responsibilities, and we become more distracted by the shadows on the wall, such as politics or consumerism.

We live in a reality created for us, not by us. Because of inflation, which we will explore more later, life becomes a tireless existence on the hamster wheel, draining the soul as we age. Life becomes more expensive, and many people's earnings do not keep up with their expenses.

The manipulation of money unknowingly divides us, thinking our quality of life is worsening due to the other political party. We sense something is wrong with the system we have inherited and become disenfranchised over time.

We are drawn to politics to express our frustrations. We hope that voting for new representatives will effect the change we want to see in the world.

If only we could vote out these people ruining my life and our country! We decide that we need to effect change in the voting booths and the political system. We need to vote these people out, we think. We need term limits. We need to get greedy politicians out of office. That will fix it.

However, the two-party system is a crucial part of the Fiat Cave. The jailers of the Fiat Cave move the Donkey and Elephant in front of the fire.

Our identities become tied to our political leaning. While some changes can be made through the voting booth, it does not address the root cause of corruption, fiat money. Politics are shadows cast on the wall distracting us from the truth.

Despite our efforts in the ballots, countries continue to deteriorate. We become frustrated with the lack of change and outcomes we want to see in our country.

Becoming more divided and convinced that it's the people of the other political party's fault that we are miserable, frustrated, and exhausted.

This is the desired outcome for the jailers of the Fiat Cave. The political system is a false dichotomy, failing to address the corruption of the monetary system that is to blame for the money problems of the world today. The jailers want you to be focused on the two-party system. They want you to hate the prisoner chained next to you.

If we could become unshackled from the wall and emerge from the Fiat Cave, we would realize this false reality. The political system and the world we know are merely shadows on the wall.

Some, by chance, others by intention, realize the deception and manipulation in the Fiat Cave. Beginning to question the existence they have lived and the world around them.

The Fiat Cave is simply an illusion created by corrupted money, which steals our wealth through inflation while distracting us with other issues and rampant consumerism.

Should you ask yourself, "what is money?" reality will start revealing itself to you.

Through that lens, we can better understand this false reality, the Fiat Cave.

A Brief History on the Corruption of Money

A deep dive into the history of money is outside the scope of this article, although we'll cover a summary. Should you be inclined to learn more, I highly recommend "The Bullish Case for Bitcoin" and "The Bitcoin Standard."

The history of money can be summarized as man trying to store, exchange, and measure the fruits of his labor most effectively.

Before money, barter was used to exchange goods among people (e.g. a farmer would give his vegetables in exchange for meat from a rancher). However, as civilization expanded and the lack of coincidence between wants emerged, it became impractical to barter. The person who raised eggs wanted clothes, but the person making clothes didn't want eggs.

A barter system had other disadvantages as a store of value, as many of these goods were perishable. People could only store vegetables for so many days. Cows could be stolen or die of disease. Clothes could tarnish.

Thus, money emerged as an intermediary good to move value across space and time. Allowing individuals to trade without desiring each other's goods. It also allowed people to preserve their money and accumulate and build wealth over time.

Many goods have been used as money throughout history, including, but not limited to, cattle, salt, seashells, Rai stones, glass beads, and of course, gold and silver. It's important to note that money was chosen by the free market rather than being decreed by a government. The market selection of money continued to narrow in on more scarce goods to better store value (preserve purchasing power) over time.

Through a free market selection process, humans settled on precious metals as the most desirable form of money, which became widely accepted and used in many civilizations due to best embodying the six critical properties of money: scarcity, divisibility, durability, portability, verifiability, and fungibility.

Scarcity: hard to produce and obtain.

Divisibility: can be easily divided into smaller units and grouped into larger units.

Durability: not perishable or easily destroyed.

Portability: easy to transport.

Verifiability: easy to verify that it is real.

Fungibility: all the same, interchangeable.

Of the traits listed above, the most important is scarcity. Money must be scarce to store value over time, which allows us to amass wealth and plan long-term. This is beneficial not only for ourselves and our families but for civilization as a whole. If money is not scarce and the supply can be easily increased, someone will always find a way to increase the supply to his benefit, as we will explore more later.

Our ancestors understood the importance of scarcity well, hence their selection of precious metals as money.

Precious metals were used for thousands of years and worked well. Gold was the hardest form of money, hard meaning most difficult to inflate the supply. Historically, gold's supply has increased roughly 2% a year, as significant time and capital are required to identify, extract, and refine it. The 2% annual inflation rate was roughly in line with economic growth throughout history, and thus prices were stable.

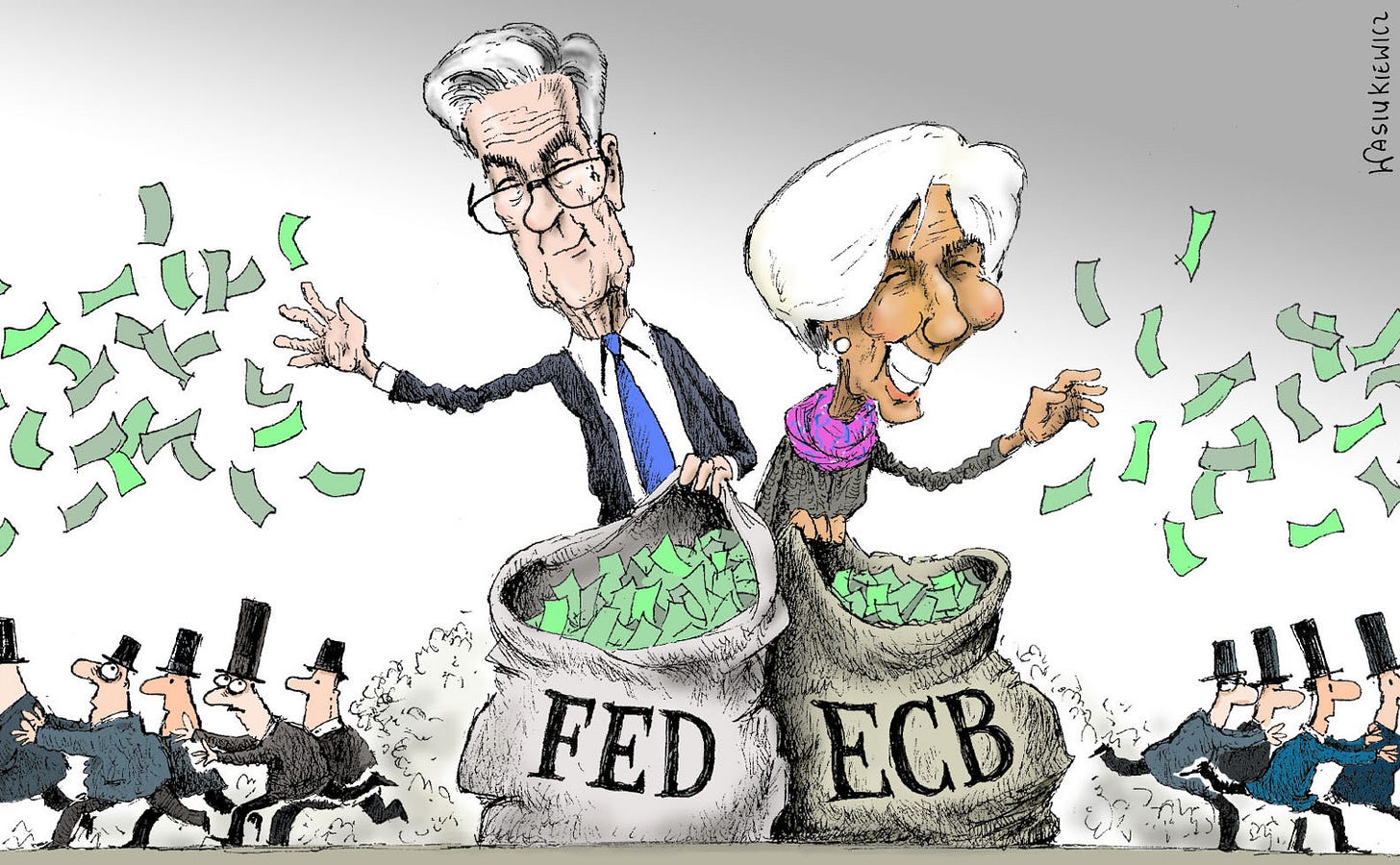

Interesting, right? Prices were stable. Today, we all know that prices have increased materially in the past two years due to the increase in the money supply by governments and central banks. In the US, the Federal Reserve and US Government increased the money supply by $6.4 trillion, a 42% increase, between March 2020 and the end of 2021. No wonder everything is more expensive now.

Going back to history, eventually, precious metals were forged into coins. The first coin was minted in Lydia, modern-day Turkey, in 700 BC. Coinage was an upgrade in monetary technology, as each coin was equal to the next, removing the need for weighing and testing the metals for authenticity. At that point, fungibility, the quality of being interchangeable, was established.

Moving forward to the Roman Empire, coinage became the standard. One of the coins in circulation was the Denarius, a silver coin used for day-to-day transactions.

During the Empire's existence, Emperors would mint coins with their faces on them, the official mint, which all people transacting in that currency knew was legitimate. However, things took a dangerous turn as the state established a monopoly on money, i.e. only the government could mint coins.

Emperors debasing their currencies was a common practice in the Roman Empire to enrich themselves and pay for expenditures without explicitly raising taxes. "Debasement" here is defined as the action or process of reducing the quality or value of something, which they did by mixing precious metals with lower-value base metals such as copper or nickel to create the same coins but with lower gold or silver content.

Over 200 years, the Denarius' silver content went from over 90% to less than 5%. Through this process of debasement, more coins with less precious metal content were issued, which increased prices in the Empire. Thus, an inflating money supply is a hidden form of theft from those holding the currency (those in power). More money is printed (or minted) to benefit a small group, devaluing the savings of others. Sound familiar?

Historians often cite the debasement of currency to be a significant contributor to the collapse of the Roman Empire. The increasing prices due to debasement (inflation) interfered with economic signals, making it more challenging to coordinate economic activity. The ongoing manipulation of money eventually led to societal collapse as many people saw their savings destroyed and took to the streets.

As we will explore in the next piece, the corruption in the financial system that exists today closely resembles the corruption of the Roman Empire.

We are too distracted by the shadows on the wall of the Fiat Cave to realize we are on a similar path to financial destruction.

Fantástico! 👏👏👏

Great article