The Fed’s Big Decision: Destroy the Middle Class or Destroy the Middle Class (Part 2)

Part 2 of 2

In Part 1, we examined the theft-based fiat monetary system and how it disproportionately disadvantages the middle class, growing the wealth gap. We discussed how the COVID response destroyed the middle class via inflation and business closures. Now we face 40-year high inflation, primarily due to money printing, and the battle between central planners and the inflation they created is underway. How will it end?

As a refresher, for decades now, each recession has been met with lower interest rates and more debt issuance. Lower interest rates served to inflate asset prices and created larger bubbles each business cycle. A technology bubble became a housing bubble which became an everything bubble.

Eventually, when the financial crisis came in 2008, which was a result of speculation driven by the low-interest rates set by the Federal Reserve, they lowered rates to 0%. That was not enough, so they began Quantitative Easing. Simply adding liquidity into the financial system (money printing), inflating asset prices. These easy money policies stayed in place much longer than most expected. The financial markets and economy became addicted to this stimulus. While these policies were meant to be emergency measures to prevent the collapse of the economy, they have become standard operating procedures.

When COVID hit in 2020, lowering interest rates to 0% again was not enough. And this time, the Federal Reserve and central banks globally embarked on a QE program of colossal scale. This time, there was a coordination of fiscal and monetary policy. The US Treasury would issue bonds purchased by the Federal Reserve, and the proceeds were sent into the real economy rather than remaining in the financial markets. Who would have thought printing money and blasting it into the economy would cause inflation? The highest inflation in forty years in the US.

Despite one of the Federal Reserve's mandates being "stable prices," their actions have unleashed inflation far beyond their "mostly peaceful" heist target of 2%. Now the Federal Reserve and global central banks are attempting to reduce inflation in their respective economies through interest rate hikes and Quantitative Tightening (QT).

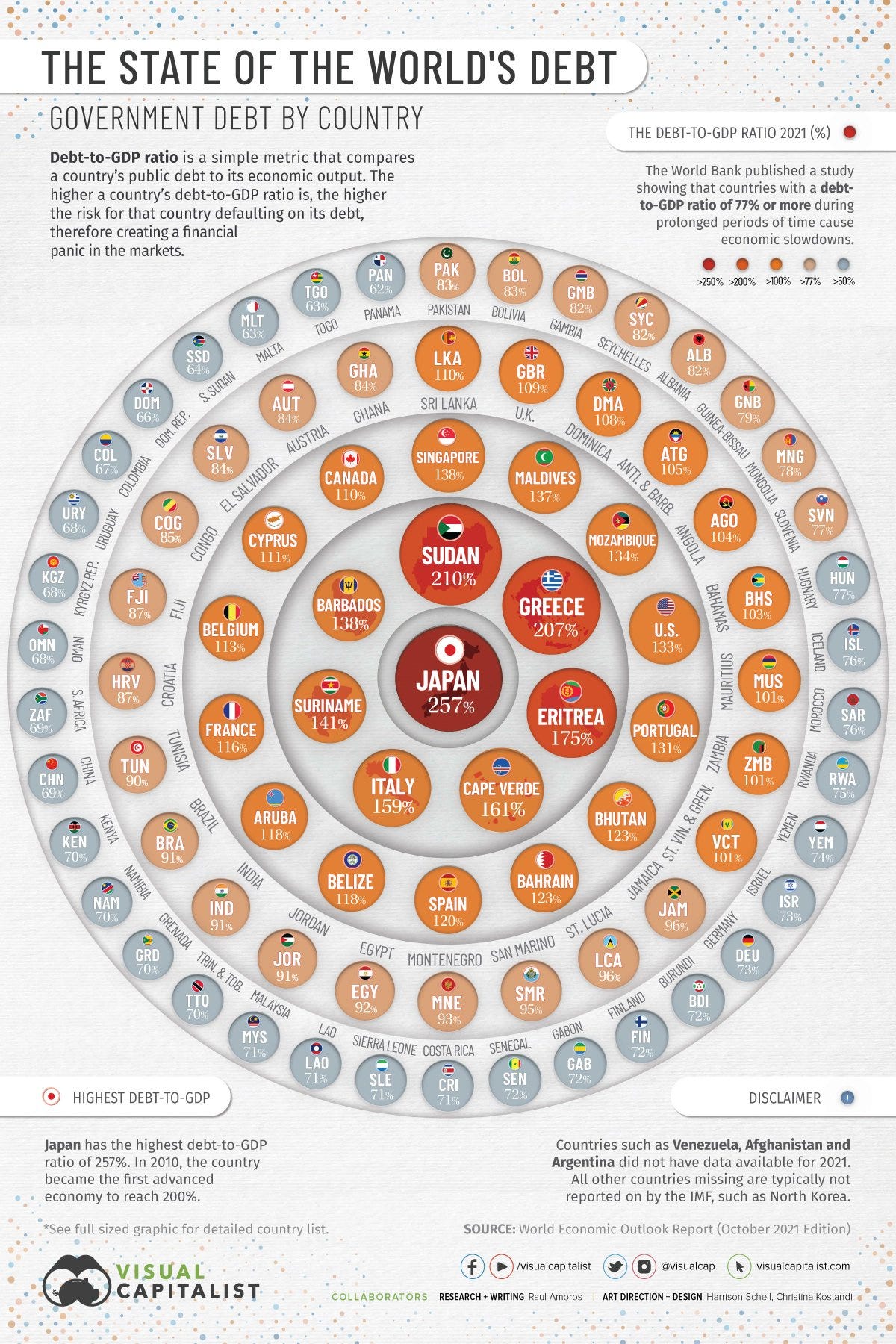

However, as mentioned above, their playbook for the last forty years has been lower and lower interest rates and adding more debt to keep the system afloat. And now, nation-states worldwide find themselves in a precarious fiscal situation. The egregious debt burdens they have accrued stand in the way of their plans to fight inflation.

The United States has $31 trillion of federal debt, not including state and local government debts. At the time of this writing, the Debt-to-GDP ratio at a national level is over 120%, and the total Debt-to-GDP is 135%. This is unsustainably high, yet other countries make it look like nothing.

Per Hirschmann Capital's Q2 2020 Investor Letter, "Since 1800, 51 out of 52 countries with gross government debt greater than 130% have defaulted, either through restructuring, devaluation, high inflation or outright default."

That does not sound promising, does it?

The challenge these nations face is fighting inflation without the absolute demolition of their economies. The last time high inflation in the US was in the 1970/80s. Consumer Price Inflation (CPI) peaked at 14.8% in March 1980. Federal Reserve Chairman Paul Volcker raised the Federal Funds Rate to 20% in 1981 (for comparison, today it's 4.50%). Volcker's fight against inflation was successful, but not without its costs. Inflation fell below 3% by 1983, but unemployment rose to over 10%.

The core difference between the situation during Volcker's time and today is the leverage in the financial system. At the time of Volcker's fight against inflation, Debt-to-GDP was approximately 35% compared to 135.5% today. The excessive debts in the system will serve as a hindrance to the Federal Reserve in their attempt to reduce inflation, which, remember, they created.

Based on history, the United States and many other countries will default this decade; however, we must consider whether it will be an explicit or implicit default (inflation)?

The Ruling Class will either destroy the middle class with a recession or inflation.

Option #1: Destroy the Middle Class with Recession

Currently, this is the option that Central Banks are pursuing. Led by the Federal Reserve, global central banks are tightening financial conditions, hiking interest rates at the fastest pace in history.

The Fed's benchmark rate was at 0% to start the year, as Central Bankers claimed inflation was "transitory." As inflation unsurprisingly persisted, they are attempting to decrease it because it has become the number one issue for voters. Suddenly inflation was in everyone's dictionary, despite being blindly robbed for decades.

Thus, in March 2022, the Federal Reserve began to hike interest rates, and at the time of writing, following the December FOMC meeting, their target rate is currently 4.25% to 4.50%. The Fed remains steadfast in hiking rates and maintaining tight financial conditions to reduce inflation much closer to their 2% target. However, their most recent hike was 0.50% rather than 0.75% for the previous four. Although the Fed remains hawkish, focused on reducing inflation and returning to "stable prices," the pace of their hikes has decelerated.

History has proven that recessions have been an effective way to reduce inflation, and the baseline expectation at this point is that a recession is underway, which will become more severe as financial conditions remain tight. The economy and markets have grown accustomed to the low-interest rate environment following the Great Financial Crisis. The higher rates will soon shock the economy, as they have already done to asset prices.

Currently, the middle class, in particular, is suffering from inflation, and the situation does not look better on the horizon. Although the Federal Reserve and US Government are the culprits for the high prices, the middle class will suffer the most from the solution.

Although there are other contributing factors to the inflation we are experiencing, such as the Russia-Ukraine War and China's Zero COVID Policy, it is primarily a result of the money printing that took place in 2020 and 2021. Because there is nothing central banks can do to fix those real-world issues, their only way to fight inflation is by destroying demand. Although the Fed's mandate is typically "maximum employment," now it is "maximum unemployment." They will have to destroy the economy and people's livelihoods to try to reduce demand for goods and services.

For now, unemployment remains low. But as financial conditions continue to tighten, the labor market will weaken. Layoffs will accelerate.

So once again, the real victims of these booms and busts created by the central planners are the middle class, who have had their savings stolen from them, their quality of life worsened, and soon their jobs destroyed. Many of these people were small business owners, already crushed by the government policy during COVID.

Debt Spiral: A Challenger to the Fed's Fight

But it's more complicated. Remember the debt burden we discussed earlier? That challenges the Fed's ability to fight inflation via demand destruction from higher interest rates and QT.

Recall that the last time inflation was this high domestically, Debt-to-GDP was 35% compared to 135% today. In the 1980s, the Federal Funds Rate needed to surpass CPI materially to decrease inflation. That would mean that the rate would need to surpass 7%. However, is this feasible, given the amount of debt outstanding?

Leaning on the work of

, we believe that high-interest rates pose a systemic threat to the financial system. James writes about a "Debt Spiral" to describe the fiscal situation of the United States and many other nation-states. I recommend checking out James' newsletter covering this in more detail; however, we will do our best to summarize.So what is the "Debt Spiral?"

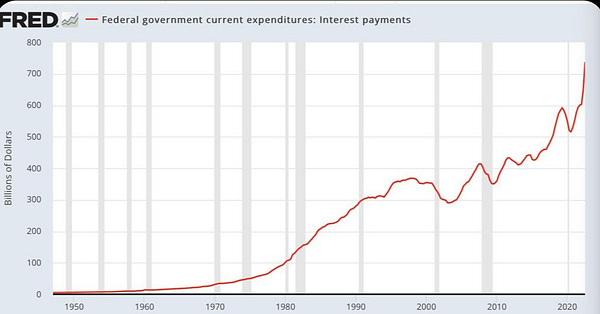

Higher interest rates mean higher interest expense for the US Government. Not only is interest expense increasing due to higher rates, but also entitlement spending is increasing due to cost of living adjustments (COLA) to match inflation. Thus, the expenses of the US Government are growing at a time when their revenues are decreasing.

Taxes are the government's revenue, and the bloodbath in the market this year means that capital gains taxes will be subdued, especially compared to the past two years. Additionally, with a recession underway, a loss of income to tax and lower corporate earnings will result in less revenue for the government.

James writes that we are already running a $1 trillion deficit, using an optimistic budget from the Congressional Budget Office (CBO). There is $31 trillion of debt outstanding, roughly ⅓ of which must be refinanced in the next 18 months at higher interest rates. Revenues are falling while expenses are rising, there will have to be more debt issued, and without sufficient buyers, the Federal Reserve would have to step in to purchase (Quantitative Easing).

As interest rates remain elevated, the fiscal situation of the US Government weakens. Higher expenses and lower taxes for a country that already has a habit of running large deficits raises questions about the solvency of the nation. The US Government is insolvent if we treat it as a business; however, unlike a company, the government can issue its own currency to pay its debts. This ultimately becomes a confidence game. Countries with high debts may lose the confidence of bond investors, think of foreign central banks, which means yields must rise, which means a weaker fiscal position, which means higher interest rates, and so on. A spiral.

The Reality of the Fed's Fight Against Inflation

Ultimately, because of the government's fiscal situation, we believe that Fed's interest rate hikes and QT program will not be fruitful. There will be damage done to the economy, evidenced by much higher unemployment. And equally, there will be damage done to the financial markets, evidenced by perhaps Treasury market dysfunction. But with that said, it seems mathematically impossible for the Fed to defeat inflation, especially after considering this stat from Research Affiliates.

Reverting to 3% inflation, which we view as the upper bound for benign sustained inflation, is easy from 4%, hard from 6%, and very hard from 8% or more. Above 8%, reverting to 3% usually takes 6 to 20 years, with a median of over 10 years.

As fiscal realities set in, whenever that may be, but likely in 2023, it will be apparent that the plans to destroy the middle class (and inflation) with a recession will not be seen to completion.

A "Powell Pivot" will happen, which means once again, the interest rates will be lowered, and the money printers will be turned on again.

Option #2: Destroy the Middle Class with Inflation

Woah, not so fast. Even though the original plan, economic destruction via recession, will not work as planned, another equally destructive option is still available. You thought the middle class was going to catch a break? No way.

Rather than destroying jobs, incomes, and livelihoods, the more likely option is destroying people's (rather limited) savings, quality of life, and hopes for the future, with inflation, which will persist much longer than people anticipate.

Back to the regularly scheduled programming.

As we wrote in detail throughout "A "Mostly Peaceful" Heist," the fiat financial system relies on the debasement of the currency. Despite a temporary reprieve from low-interest rates and money printing, that is still the most likely outcome going forward. As mentioned, the first choice, recession, would likely create a debt spiral, which could ultimately lead to an explicit default of the US Government. Based on historical precedent, it is unlikely that a government that issues its own currency would default on its obligations rather than printing the money to meet said obligations.

Our base case for 2023 is a return to low-interest rates and money printing. Inflation will still be elevated above the Fed's official 2% target; however, their fight against inflation will end with the reality of their crumbling fiscal position.

To have a chance at ever normalizing their policy again, meaning being able to manipulate interest rates, debt to GDP will have to be much lower than it is today. To achieve that goal of a lower debt burden, the government and central bank will pursue a strategy of financial repression.

Russell Napier, a financial market strategist, researcher, and author, describes financial repression as "the art of stealing money from old people slowly."

Sounds like a heist.

To ensure we are on the same page, financial repression creates an environment of negative real yields. Savers get paid less interest than the rate of inflation, which means they are losing purchasing power over time. A wealth transfer from the savers to the government.

A similar playbook was run after the Second World War when the US Debt-to-GDP ratio was over 120%. Per Lyn Alden, Founder of Lyn Alden Investment Strategy, from 1945 to 1980, real interest rates were negative half the time. A massive heist of savings as money is printed to suppress interest rates to pay off debt. Ten years of yield curve control reduced the Debt-to-GDP ratio from over 120% to 60% in roughly a decade.

Similar to QE, but slightly different, Yield Curve Control is a monetary policy that targets a specific yield in a government's bond. Rather than a particular dollar amount of liquidity injected into the financial system, which back in 2021 was $80 billion a month, the central bank targets an exact yield. To maintain that peg, for example, 2.5% on the 10-Year, the Fed would purchase all debt issuance, whether it's $10 billion or $500 billion. Enough money is printed to make sure the peg holds. This is a currency devaluation.

Thus, we will find ourselves in an environment where bond yields are below the inflation rate, which will certainly not be at their 2% target. That means that people's savings will lose value in real terms. Not only will savings evaporate over time, but those who cannot grow their wages as fast as the level of money printing will struggle to survive. Those who store their savings in assets will be protected depending on their chosen investment.

Unlike Paul Volcker, who is remembered for his win in the ring against inflation, Jerome Powell's Federal Reserve will not accomplish its mission. This could have potentially serious consequences.

The Fed forced to abandon its campaign against inflation due to the weak financial position of the government. Meanwhile, inflation is still much higher than "moderate." That will not look good for their credibility.

Thus, another crisis may emerge to justify future money printing. "Wartime finance" may be on the horizon. Not necessarily a kinetic war, although who knows what will happen with Russia/Ukraine, but another war. Like the war on COVID. We would not be surprised that around the same time the Fed and global central banks begin to lower rates again and print money, there is a crisis to justify it. To preserve whatever credibility they have in the eyes of the public. Definitely not in our eyes!

It may even be possible that the Federal Reserve will find a way to change its inflation target from 2% to 3%/4% to make its fight look like less of a failure.

Overall, to summarize our sentiment, the rate hikes and QT of this year will be reversed because of the fiscal position of the United States and nation-states globally. Back to the long-term trend of money printing and the destruction of the middle class through inflation.

Protect Yourself Against the Coming Destruction

A storm is brewing. As we have laid out in this piece, the options are either destruction through a recession or inflation.

Given the government's debts, it seems mathematically impossible for interest rate hikes to continue or for interest rates to remain at the current level. Based on historical precedent, interest rates are likely lowered next year, and money printing will begin again.

We expect that inflation will remain higher than the 2% target, and interest rates will not adequately compensate savers. A decade (minimum) of financial repression is underway.

The best assets to own in this environment are those that cannot be diluted. Real assets should outperform financial assets. Real assets include real estate, land, precious metals, commodities, and bitcoin. These assets are far more scarce than fiat money, which will continue to be diluted. Financial assets such as stocks and bonds will fare less well in a sustained inflationary period. Some equities will manage better than others, but those unable to grow their earnings faster than their cost increases will suffer. Companies that can pass their inflation on to customers will do better. Bonds should be avoided as much as possible unless you would like to make a charitable donation to the government.

Looking back to the last time there was high inflation in the United States, the 1970s, gold was the best-performing asset. A large part of its performance was driven by the US abandoning the gold standard in 1971. A scarce commodity, able to be held outside the banking system, appealed to savers and investors in a high inflation and low economic growth environment. Financial assets, such as stocks and bonds, had negative real returns, meaning a loss of purchasing power.

As there seems to be no choice but to lower interest rates and begin money printing again, bitcoin is primed for success. Fiat currencies will continue their long-term trend toward worthlessness, and all assets that are more scarce will perform well, especially bitcoin, which is absolutely scarce. Bitcoin’s perform this decade could very well resemble the chart of gold in the 1970s.

The heist is bound to continue, and unless you can store your savings in a digital vault outside the reach of the thieves, your wealth is at risk for devaluation or confiscation. Not only does bitcoin possess absolute scarcity through its hard-capped supply of 21 million, but it's also being adopted at an exponential rate while the supply decreases every four years. The monetary policy of the protocol is designed to increase the purchasing power of the asset over time, unlike fiat money which will continue to lose purchasing power.

Destruction is inevitable. Time will tell if that destruction comes from recession or inflation. Based on the fiscal situation of nation-states and the macroeconomic environment, we believe that inflation will be the path chosen. But, unfortunately, in either case, tough times are ahead, especially for those in the middle class, unable to protect themselves with traditional assets.

The good news, however, is that bitcoin is an escape hatch available to all.

Thank you for taking the time to read this post. If you enjoyed it, please let me know and hit the like button. If you have any comments or questions, I would love to hear from you!

This is a brilliant piece bro! 🤝🤝 The impending debt spiral is very little understood and you tackled this so well here

"The US Government is insolvent if we treat it as a business" this is what really stood out for me in this piece.

An the mentioning of Paul Volcker, I really enjoy the interview he did with ray dalio, helps understand his rationale into his decision making during his time.