Stocks, Bonds, Bitcoin: The Evolution of Custody

In the past, investing in stocks and bonds meant taking on the responsibility of storing physical certificates. Investors would keep stock certificates and bonds at home, often locked away in safes or deposit boxes. These physical documents represented ownership, and losing them meant headaches. Although there were ways to recover lost certificates, the process was cumbersome and time-consuming.

But as technology evolved, so did our approach to managing assets. The introduction of electronic stock registries and centralized depositories drastically reduced the risks associated with physical storage. This shift made stock trading more efficient and secure, allowing investors to trade shares almost instantaneously while eliminating the need for physical documentation. Centralized entities like the Depository Trust Company (DTC) revolutionized the landscape by offering electronic systems to safeguard shares, reducing the likelihood of losses and administrative hassles.

Not only did it increase security, but it also opened up a new world of financial services like margin lending, instant trading, and portfolio management—all made possible by centralized institutions that provided easy access to shares.

Early Days: The Parallels Between Custody of Stocks, Bonds, BTC

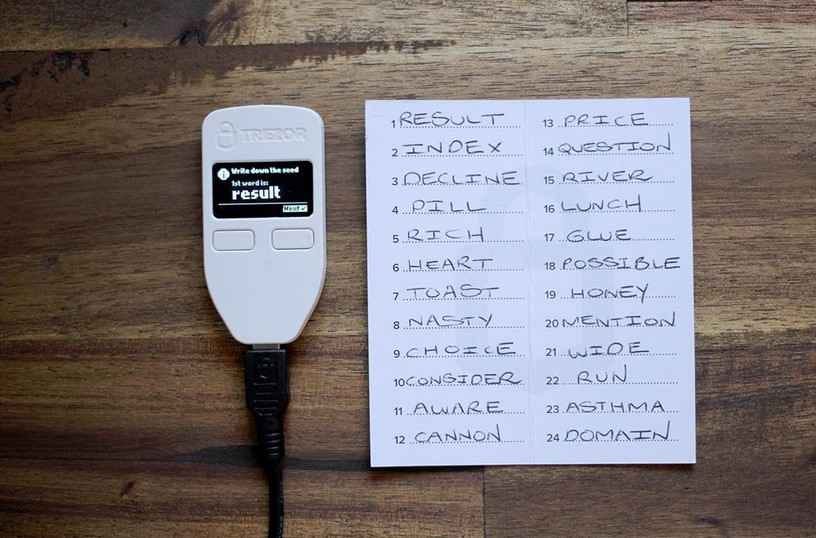

How people initially stored stocks mirrors how many bitcoin holders manage their assets today. Early bitcoin adopters often use self-custody, storing their private keys on hardware wallets and writing down their seed phrases. Self-custody allows for full control of one’s bitcoin but also introduces significant risks, even more so than the physical storage of stock certificates.

The crucial difference is that with physical stock certificates, investors had the chance to recover ownership through a surety bond process or by contacting the issuing company. With bitcoin, however, taking self-custody is an unforgiving proposition. Lose your private keys (seed phrase), and your bitcoin is gone forever with no way to retrieve it.

This irreversible loss makes self-custody particularly daunting for less tech-savvy or risk-averse individuals, as there is no central authority to restore access if private keys are lost, stolen, or compromised.

Similar to how physical storage of stock certificates limited interaction with financial services, so too does self custody. In a world where everyone secures their bitcoin at home, it makes it difficult to integrate bitcoin into broader financial markets and hinders bitcoin’s ability to scale and be widely adopted.

However, this lack of access to financial services is not necessarily a problem at the moment, as most people simply want to save their bitcoin for the long term. Self custody can provide a useful means of doing so, protecting your bitcoin from the pitfalls of exchange failures, hacks, and frauds, but it does introduce significant responsibility and risk of permanent loss of capital.

Evolving Bitcoin Custody Solutions

Just as investors eventually recognized the risks of holding physical stock certificates, many bitcoin holders today are seeing the downsides of only using self-custody, especially as bitcoin prices increase significantly each cycle. The rise of sophisticated social engineering attacks and physical threats of violence are prompting bitcoin holders to rethink the notion of holding material wealth on plastic devices stored in their homes. As a result, we're witnessing a shift toward more forgiving and less technical solutions—similar to the shift in the stock market decades ago.

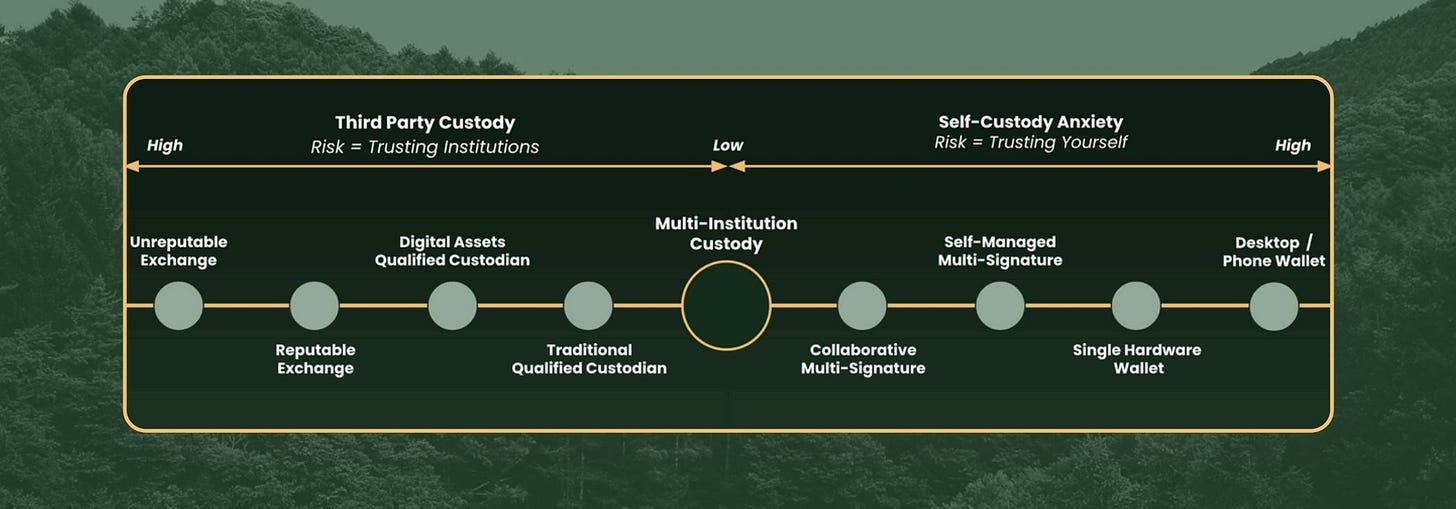

Namely, multi-institution custody (MIC) is emerging as a third-party custody solution that is secure, fault-tolerant, and eliminates single points of failure in typical single-third-party setups.

MIC is a custody arrangement where distinct independent entities each hold one key in a quorum of multiple keys needed to access the bitcoin wallet. For example, a multi-institution, multi-signature arrangement would consist of 3 keys, each held by a different entity, and would need 2 of those keys in order to access or move funds.

In this setup, no single entity can move or lose client funds. It requires the coordination of multiple independent institutions which can only act at the explicit direction of the end client.

By distributing custodianship among reputable institutions, bitcoin holders can maintain security in a trust-minimized fashion while avoiding the risks of storing their private keys at home for material amounts of bitcoin. This system offers a similar level of convenience and a greater level of protection to the electronic stock registries that revolutionized stock ownership.

The KEY Difference: Multi-sig

While traditional third-party custody has existed in bitcoin for over a decade now, it has resulted in hundreds of billions of dollars of losses to investors. While these entities typically use multi-sig to secure assets, the single-entity risk remains in that one custodian holds all the keys in the multi-sig quorum.

Again, this is not a problem in traditional assets because losing a record does not result in a loss of the asset. In traditional finance, a central entity could hold stocks or bonds, and because these are typically claims on physical or corporate assets, ownership records could be restored if lost. However, bitcoin is fundamentally different—it’s digital and fully decentralized, and there's no central body to restore lost assets. If all access is held by one custodian (like Coinbase or any single entity), that setup introduces a significant risk of failure.

With centralized bitcoin custody (NOT multi-institution), a hack, bankruptcy, or mismanagement at a custodian could result in catastrophic losses. Multi-sig custody, specifically multi-institution multi-sig, mitigates this risk by decentralizing control—no one entity holds all the keys, and even if one custodian is compromised, the funds remain safe. It aligns more closely with bitcoin’s ethos of decentralization while providing institutional-grade security.

Final Thoughts

As bitcoin adoption grows, it's likely that these institutional custody solutions will become even more robust, just as the stock market saw the rise of electronic depositories. Multi-institution custody addresses some of the biggest concerns in the space for those who self-custody: what happens if I lose my keys or something happens to me? By leveraging distributed trust and professional custodianship, these systems can offer a layer of safety while still adhering to bitcoin’s decentralized ethos.

In five to ten years, we might look back on the era of hardware wallets and self-custody as a stepping stone—similar to how we now view the days when stock certificates were stored in lockboxes at home. As technology evolves, so too will the ways we secure our bitcoin, making the process simpler and safer for both seasoned investors and newcomers alike.

If you want to learn more about multi-institution custody or talk BTC custody, feel free to book some time to chat with me or check out Onramp’s website.