Gold Is Surging, Bitcoin Is Lagging — Here’s the Real Reason Why

Everyone sees the divergence. Few understand the forces behind it and why it won’t last.

Every week, new perspectives on health and wealth.

If you’re new here, welcome to Sound Life — subscribe below and share this with someone who’d get value from it.

Gold and Bitcoin address the same issue: the weakening of the global monetary order and the destruction of fiat currencies.

Both assets are scarce, both sit outside the traditional financial system, and both are widely understood as ways to preserve purchasing power in an environment defined by rising debt and declining currency strength.

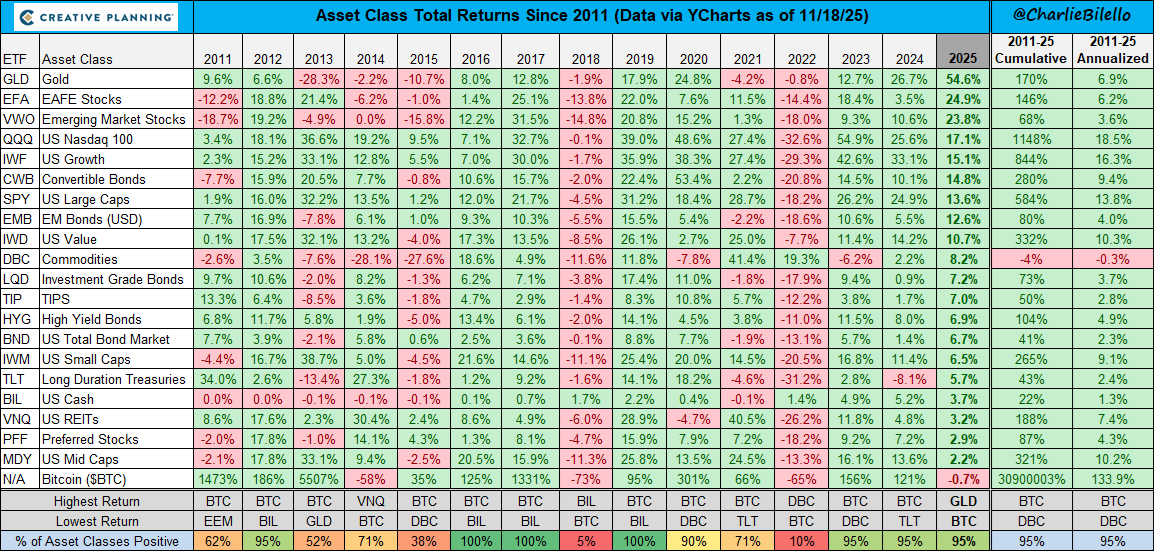

Because of this, many investors rightly expect the two assets to move together. Earlier this year, that was true; gold was the top-performing major asset, and Bitcoin was close behind it in second place. But as the year progressed, gold maintained its leadership position while Bitcoin slipped to become the weakest performer among major assets.

The divergence may raise questions, but the explanation is clear once you understand the sequence of macro forces over the past several years and the different catalysts each asset responds to.

The Start of Gold’s Historical Move

Gold’s breakout is not simply the result of a slightly weaker dollar or short-term investor enthusiasm. It reflects deeper, structural forces that have been building since 2022 and have now intersected with a highly supportive macro landscape.

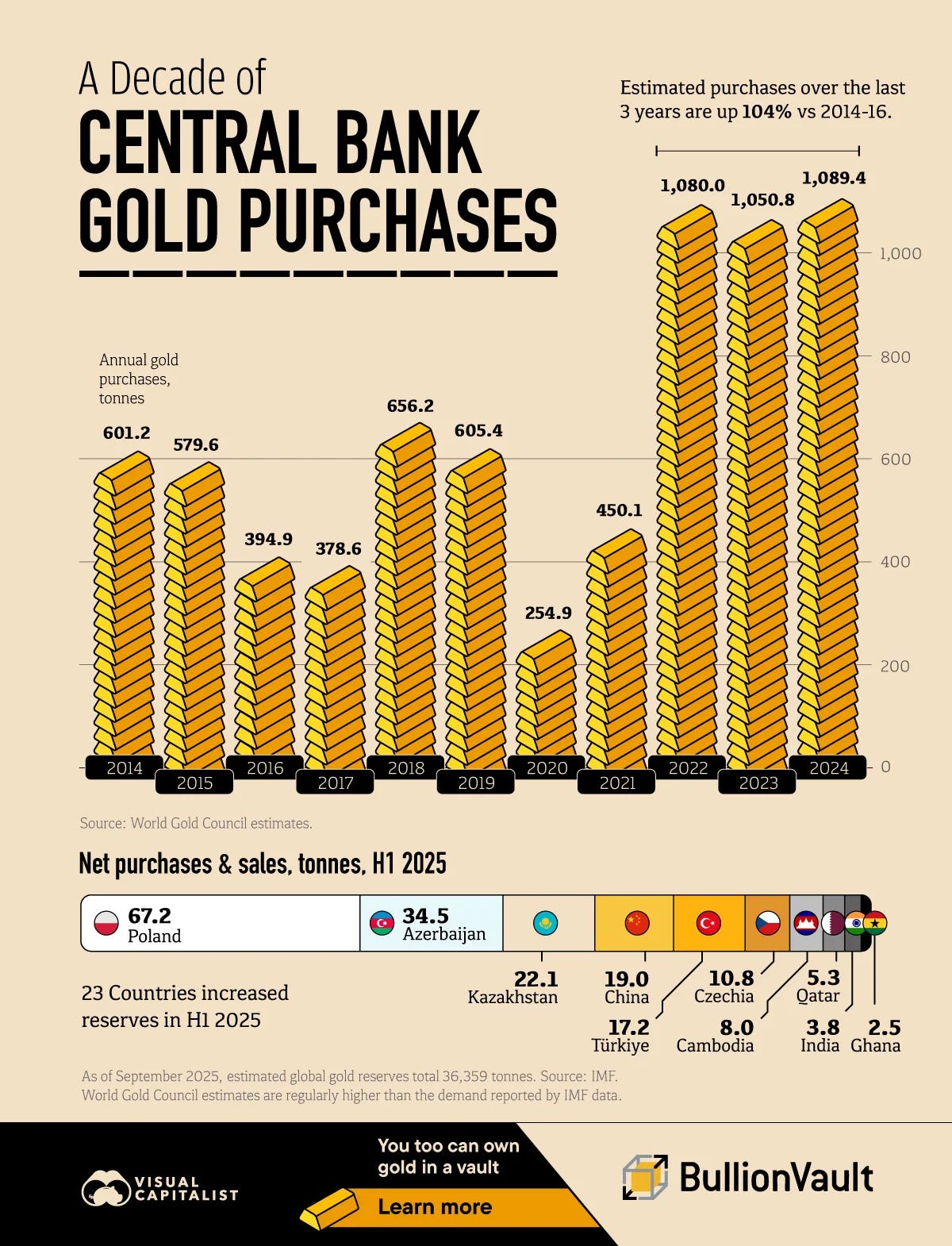

One of the major turning points was the seizure of Russia’s foreign reserves following the invasion of Ukraine in 2022. That event fundamentally changed how nations, largely outside the Western world, think about custodial risk in a dollar-centric system.

Central banks realized that their reserves were not truly theirs in the ultimate sense; they were liabilities of the U.S. government and could be frozen, restricted, or used as political leverage.

This recognition triggered a multi-year trend toward diversifying reserves, with gold becoming the primary beneficiary.

In 2022, central banks purchased roughly 1,100 tonnes of gold, the highest level on record. In 2023, purchases were again over 1,000 tonnes, despite higher real yields. And once again in 2024.

Sovereign demand has been persistent and meaningful, but up until this year, the macro environment has limited the full expression of gold demand, particularly from retail and institutional investors.

Throughout 2023 and 2024, real yields were significantly higher, which has historically acted as a headwind for gold in investment portfolios.

The Federal Reserve was still publicly committed to restrictive policy, the dollar was strong, and global growth had not yet slowed enough to prompt policymakers to ease policy. These factors constrained gold’s upside even as central banks continued to accumulate at record levels, as outside the sovereign bid, limited interest existed.

The Macro Environment & Investor Demand Flipped in 2025

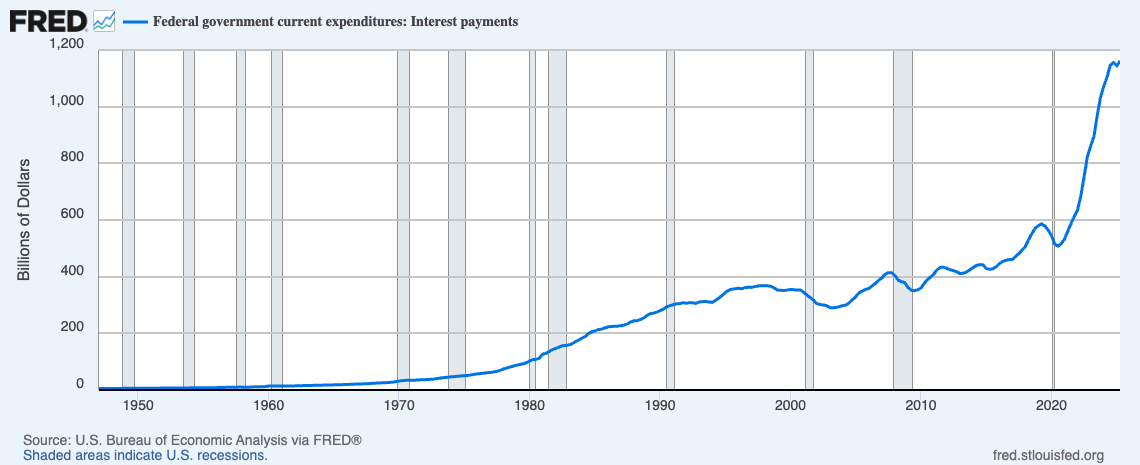

Heading into 2025, those constraints finally began to reverse. Interest rates began to be cut as labor markets weakened, fiscal deficits widened, DOGE failed, and the debt ceiling debate resurfaced once again with little attempt to address long-term sustainability.

U.S. interest expense is now running at an annualized rate of $1.2 trillion, up from roughly $600 billion just a few years ago. Real yields fell as the market began pricing in additional cuts, geopolitical tensions intensified across multiple regions, and investor confidence in fiscal management further deteriorated.

Crucially, this was also the year when investor demand returned, after being absent throughout 2022, 2023, and 2024.

After nearly four years of persistent outflows, global gold ETFs saw a decisive resurgence of interest in 2025.

According to recent disclosures, institutions such as Harvard Management Company (HMC), which oversees the university’s endowment, significantly increased their exposure to gold through vehicles like GLD ETF, with positions totaling approximately $235 million as of September 30, 2025.

With both sovereign accumulation and investor flows moving in the same direction for the first time since 2020, the market finally repriced gold in a meaningful way.

Why Bitcoin’s 2025 Has Looked Very Different

Bitcoin entered 2025 with a very different backdrop. The launch of spot ETFs in 2024 brought historic inflows, regulatory clarity improved, and institutional on-ramps expanded. Bitcoin reached new all-time highs, and that momentum carried into the election, where investors anticipated a more favorable political environment and a potential shift in U.S. digital asset policy.

Expectations also grew around the Strategic Bitcoin Reserve, with early signals suggesting the government might pursue some form of budget-neutral accumulation. Taken together, these developments created the sense that Bitcoin was on the cusp of a major policy tailwind heading into the new year.

But much of this narrative never materialized. The “reserve” turned out to consist of previously confiscated coins rather than a newly acquired sovereign position. Rumored quantities in the hundreds of thousands of Bitcoin proved to be far smaller, and no meaningful sovereign accumulation occurred. As the gap between expectations and reality became clear, the market was forced to reset those assumptions quickly.

Quick favor — if you’re enjoying this, hit the like button. It helps more people find the work.

A Tightening Impulse, Not a Bitcoin Tailwind

Instead of a broadly pro-Bitcoin easing of conditions, the administration’s first major moves centered on tariffs and trade pressure, introducing new uncertainty into global markets and sending Bitcoin sharply lower at the start of Q2.

Even with only a few weeks remaining in the year, we are only now beginning to see early signs of monetary support. Quantitative Tightening is ending in December, and the Federal Reserve has cut rates, with more cuts likely ahead.

But for most of 2025, liquidity remained constrained, and Bitcoin’s performance reflected that reality.

Bitcoin Is a Liquidity Asset, Not a Geopolitical Hedge

This distinction is essential. Bitcoin tends to perform well when liquidity expands, real yields fall, and the dollar weakens. It struggles in environments defined by tightening conditions, elevated real rates, and broader market uncertainty. Those dynamics have dominated most of 2025.

While Bitcoin is an apolitical asset with long-term geopolitical relevance, it is not yet treated as a traditional flight-to-safety instrument in the way gold is. Gold has a track record of thousands of years as a reserve asset, and central banks routinely turn to it during periods of stress.

Bitcoin, by contrast, still trades primarily as a liquidity-sensitive asset. It may benefit in the years following geopolitical events, but it does not see immediate safe-haven inflows when tensions rise. Its performance hinges far more on whether policymakers are easing or tightening financial conditions.

Gold thrives during the recognition phase of a crisis, when the world acknowledges that instability is growing. Bitcoin thrives during the response phase, when policymakers attempt to counteract that instability through monetary expansion.

In 2025, we experienced the former, not the latter. Gold has responded to the acknowledgment that the system is weakening. Bitcoin is waiting for the moment when policymakers attempt to stabilize that weakness with renewed liquidity.

Structural Selling and Market Maturation

Bitcoin’s market structure has also played a significant role this year. For the first time, the asset has developed enough liquidity for early holders, many with large positions acquired over a decade ago, to sell without causing disorderly price action.

Spot ETFs, expanded Wall Street access, and corporate treasury participation have all deepened the order book. This was not possible in prior cycles. As a result, we have seen a natural distribution process take place, which is consistent with the maturation of any asset class. But in the short term, this additional supply has weighed on price at a time when expectations were already being reset.

The Divergence Is Temporary

None of these developments implies that Bitcoin’s long-term investment case is weakened. They simply reflect the fact that Bitcoin responds most strongly to liquidity-driven catalysts that have not yet begun.

Throughout its history, Bitcoin has accelerated when monetary policy shifts from tightening to easing, when liquidity expands, and when fiscal stress drives policymakers toward more accommodative measures. Those catalysts are just beginning to appear now, but they were largely absent in 2025.

The divergence between gold and Bitcoin is temporary and reflects two different stages of the same macro cycle. In a world of political instability, currency depreciation, and rising geopolitical tension, both assets become more important.

Gold responds first, during the recognition phase. Bitcoin responds later, during the response phase, when policymakers turn to monetary expansion to manage the consequences of a fragile financial system.

What Comes Next

When that response arrives, and history suggests it is only a matter of timing, the environment will shift meaningfully in Bitcoin’s favor.

Liquidity will improve, real yields will fall, the dollar will weaken, and risk appetite will return.

Bitcoin, which has spent much of the year under pressure from unmet expectations, tightening macro conditions, and large-holder distribution, will have the catalysts it needs to reflect its longer-term fundamentals once again.

Gold is telling the story of a system under strain. Bitcoin is waiting for the chapter in which policymakers attempt to relieve that strain through renewed liquidity. Both assets ultimately reflect the same structural thesis. They simply react at different points in the cycle.

I’d love to hear from you. What would you like to see me dig into next? Drop your ideas in the comments.