Generational Wealth & Generational Health

A low-time preference to holistic wealth & health management.

The Fiat Cave is free today. But if you have enjoyed my work, please help me increase my financial sovereignty by pledging a future paid subscription. You will not be charged until I enable payments. Thank you for your support - Jackson

"A healthy man wants a thousand things, a sick man only wants one." - Confucius.

Time preference is the extent to which an individual favors the present over the future. Because of future uncertainty, the morality of man, and the fact that some degree of present consumption is needed to survive, we naturally prefer the present.

Dr. Saifedean Ammous, Author of The Bitcoin Standard, explains in more detail:

Humans always prefer present over future goods, but the magnitude varies from person to person and for each person across their life. A high-time preference implies heavy discounting of the future in favor of the present. While a low-time preference implies a lower discounting of the future and more future orientation.

In layman's terms, low-time preference can be considered delayed gratification, while high-time preference means catering to present needs with less emphasis or thought for the future. Financial security influences one's time preference substantially.

Money, or any property, that can store your value well into the future will provide more certainty than money that loses its value rapidly.

Fiat currencies, decreed by governments and backed by nothing, can be created on a whim. Central bankers and politicians collude to expand the money supply, resulting in a decrease in purchasing power of savers. The volume of money printing determines the rate at which savers lose purchasing power, which reduces their ability to plan for the future. Thus, fiat currencies incentivize high-time preference thinking - emphasizing the present over the future.

Fortunately, in the United States, we have the cleanest shirt in the pile of dirty laundry, the US Dollar. It's the world reserve currency, the strongest of all the fiat currencies. Yet, that does not make it a good store of value. Between 2020 and 2021, the US money supply was increased by over $6 TRILLION, a 40% increase, which explains the higher prices we are currently experiencing.

Since the creation of the Federal Reserve in 1913, the US dollar has lost 99% of its purchasing power. Despite being the strongest fiat currency, the US Dollar is inadequate for preserving generational wealth.

And this is the best-case scenario. Other countries have had it much worse when it comes to their currencies. Dr. Ammous writes in his newest book, The Fiat Standard, "More than 60 episodes of hyperinflation have taken place in countries using fiat monetary systems in the past century."

During a hyperinflationary event, survival is all that matters. The idea of planning for the long term is not the slightest consideration. This shows that a currency's inability to store value long-term directly determines an individual's and a civilization's time preference. One's ability to produce more than their consumption and save hard money is the foundation of civilizational progress.

Prior to governments imposing their monopoly money on their citizens, people would save in actual money, gold and silver. Humans settled on precious metals, specifically gold, because its monetary properties were superior to other forms of money that came before it. Gold best embodied six critical properties of money: scarcity, divisibility, durability, portability, verifiability, and fungibility.

Scarcity: hard to produce and obtain.

Divisibility: can be easily divided into smaller units and grouped into larger units.

Durability: not perishable or easily destroyed.

Portability: easy to transport.

Verifiability: easy to verify that it is real.

Fungibility: all the same, interchangeable.

Of the traits listed above, the most important is scarcity. Money must be scarce to store value over time, which allows us to amass wealth and plan long-term.

Bitcoin: Generational Wealth on the Horizon?

Bitcoin is sound money for the digital age. It is a digital savings technology that has improved the monetary properties of gold. Thus far, bitcoin has proven to be a highly effective tool to preserve and grow purchasing power, especially over 4+ year periods.

Bitcoin has garnered the attention of people from all walks of life globally as they realize its potential to become the premier store of value globally.

writes in his recent post, "Bitcoin's Full Potential Valuation":Bitcoin's principal innovation was the invention of "digital scarcity" – a digital system where nobody could create more of something.

This breakthrough enabled Bitcoin to simultaneously implement two additional firsts in the global asset landscape: "increasing scarcity" and "absolute scarcity." The core design of Bitcoin is that there is a finite supply that can ever exist and that can never be changed (absolute scarcity), and this supply is released into circulation at a rate that decreases exponentially over time (increasing scarcity).

Concurrently, bitcoin's scarcity and global adoption are increasing. It's estimated that the adoption of bitcoin is less than 5%, and its total addressable market could be as large as $900 TRILLION.

So what does this mean for us? There is potential for significant wealth generation for those early adopters of bitcoin. It's not hard to imagine that in a world of central banks and governments completely out of control, racing to debase their currencies, bitcoin will achieve parity with gold's market capitalization of $12 TRILLION.

However, bitcoin is a superior form of money in the digital age. Gold's ability to be transported, divided, and verified for its authenticity is limited. At a $12T market cap, one bitcoin would be ~ $500,000 in today's dollars.

As more people understand bitcoin while the supply decreases, it will become a self-fulfilling prophecy, a positive feedback loop of higher and higher prices as measured by the dollar and other fiat currencies.

Bitcoin is the hardest form of money that humanity has ever discovered. Unlike fiat currency, which raised society's time preference, bitcoin lowers time preference. After understanding bitcoin's full potential, one is incentivized to reduce present consumption and accumulate more.

Bitcoin reorients time preference. In stark contrast to fiat currency, which incentivizes present consumption and short-term pleasure, bitcoin rewards those who are patient and are willing to defer consumption.

Bitcoin fundamentally changes how people think about money. Even compared to the traditional financial services industry, specifically the investment management business. Asset managers are typically focused on beating a benchmark for a quarter or a given year. The thought of purchasing "magic internet money" and holding it for decades, experiencing multiple 50%+ drawdowns, is a foreign concept.

But that's the beauty of adopting a low-time preference mindset and holding bitcoin.

Of course, you must remain solvent and have fiat to meet your expenditures to avoid selling your bitcoin, but otherwise, you can continue to purchase bitcoin and secure it for your future self and future generations.

If bitcoin becomes a global store of value, it's hard to imagine the amount of wealth we may amass, and hopefully, we will be around to enjoy it.

"A healthy man wants a thousand things, a sick man only wants one."

In my experience, the fiat mindset of wealth is focused almost solely on accumulating assets and material possessions. There's a significant blindspot in this thinking because it completely neglects our most important property, our physical and mental health.

You may have beautiful vacation homes, sports cars, and a healthy stash of bitcoin, but what does it matter without good health?

There's nothing wrong with working hard and accumulating assets, but the issue is viewing that in isolation. Gauging one's success solely by looking at numbers on a screen representing your bank or brokerage account is insufficient and one of the many areas where fiat man falls short in his thinking.

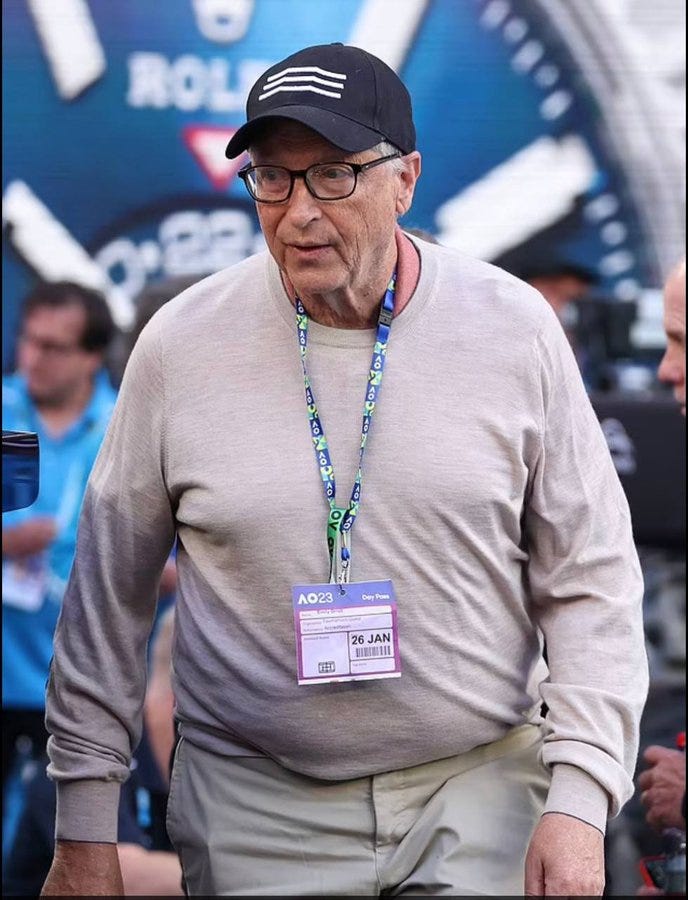

In the fiat world, extremely wealthy people like Bill Gates are pretty unhealthy.

What's even more concerning is that he's viewed as an authority and someone we should be listening to regarding our health decisions. Classic fiat mindset, decreeing dietary changes onto people despite not having achieved mastery in their own health. But I digress. Would you trade places with Bill Gates? Probably not, despite the enormous amount of money and assets he possesses.

The Key to Unlocking Generational Wealth: Generational Health

Good health is the most critical asset that we have. To enjoy the generational wealth of bitcoin, we must strive for generational health. That means making nutritional, exercise, and lifestyle decisions to maximize our chances of a healthy and long life. My desire to focus on generational health is a new phenomenon as I have become more passionate about bitcoin.

Generational health does not mean suffering through restrictive diets and not enjoying a glass of wine or beer with family or friends. But it does mean largely ignoring the government's advice on health, such as their nutritional guidelines. It does mean not eating highly processed foods in the grocery store's inner aisles. It does mean not eating lab-grown meat and industrial sludge that Bill Gates and the broader Davos class are pushing onto us.

Some guiding principles that I have adopted in my own life:

Avoid processed foods

Avoid seed oils (canola, soybean oil, sunflower oil, etc.)

Get lots of sunshine

10,000+ steps a day

Eat whole foods (one ingredient, for example eggs)

Eat a high protein and fat diet

Strength training and/or cardio

Sleep optimization (circadian rhythm)

Sourcing food locally - high-quality ingredients

Enjoy time with people you love

Generational health is not one size fits all. Find a way to stay active, eat real foods, and enjoy the company of family and friends. I am not a health expert by any means. As mentioned, this is a newer mindset that I've adopted in the past couple of years as I have become more passionate about bitcoin and realized the benefits of low-time preference decision-making.

Bitcoin does not guarantee generational wealth; however, there's certainly a possibility of early adopters (we are still early) realizing massive financial gains in the coming decades. Should we be correct about the future of bitcoin, it's in our best interest to seek generational health to accompany our generational wealth.

Ultimately bitcoin and health are intrinsically linked, as they are two of the few remaining things in our modern society that require proof of work and low-time preference. A healthy body and mind require discipline, training, and hard work, and bitcoin uses proof of work to validate transactions and secure the network.

Health is wealth.

Thank you for reading. If you enjoyed this article, please consider helping me out in one (or all) of the following ways. Thank you for your support and generosity.

Share The Fiat Cave with a friend, a family member, or a colleague.

Share this post with a friend, a family member, or a colleague.

Like this post and comment any thoughts/questions.

While I enjoy writing the newsletter, creating high-quality posts is a serious time commitment, and I hope that readers who find value in my work can compensate me for my most scarce asset: time.

Part of my goal with the newsletter is to increase my financial sovereignty, not solely rely on my employer. While I don’t expect to make a living from this, each subscription helps me become more financially resilient.

Thank you for your support!

Excellent stuff Jack. The alignment of these two topics are fun exploration

great analysis Jack, and thanks for the shout!