Fort Knox Is Empty? Bitcoin Is the Reserve

Could an Empty Fort Knox Pave the Way for Bitcoin as America’s New Reserve?

For decades, the question of whether the gold inside Fort Knox actually exists in its reported quantities has been a topic of speculation and conspiracy.

But recently, this discussion has shifted from fringe theory to mainstream conversation, with figures like Elon Musk and Donald Trump raising the idea of a full audit.

The last official audit of Fort Knox’s gold reserves was conducted in 1953, and since then, transparency has been virtually nonexistent. In an era where leaders and policymakers push for more ‘financial transparency,’ why does one of the United States' most critical reserves remain shrouded in mystery?

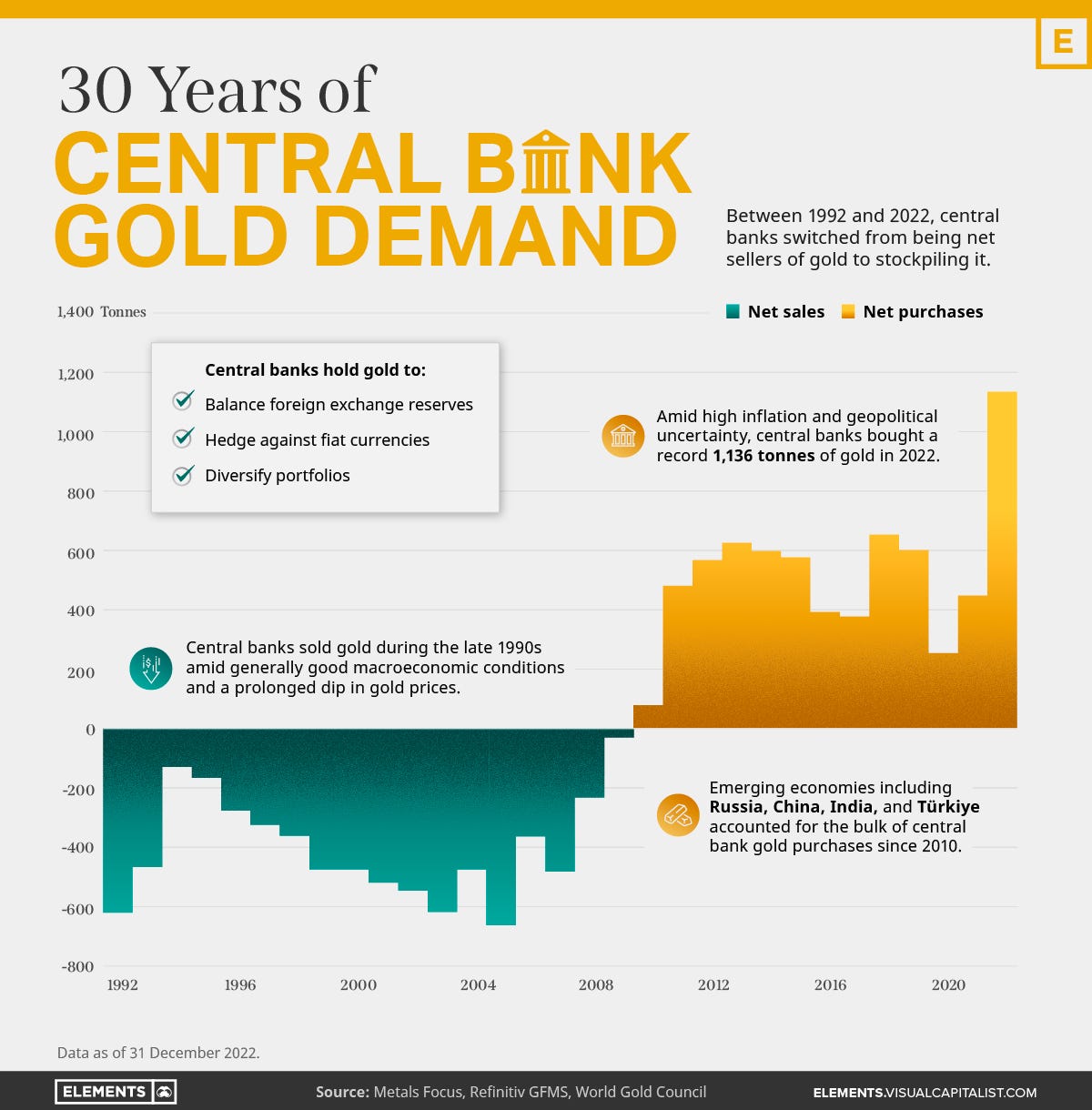

The timing of this discussion is particularly interesting given global geopolitical trends. While the U.S. has been relatively stagnant in its gold reserves, adversarial nations such as China and Russia have been aggressively accumulating physical gold, particularly in the past decade, and even more so in the past two years.

While the U.S. has relied on its dollar dominance, adversarial nations have methodically accumulated gold, preparing for a post-dollar world.

It’s worth noting that if the reported U.S. gold reserves are accurate, then the U.S. has far more gold in reserve than any other country.

But if an audit were to reveal that Fort Knox holds significantly less gold than expected, it could shake confidence in the U.S. financial system but also present an opportunity to accelerate a shift toward Bitcoin as a strategic reserve asset.

The Global Gold Accumulation and U.S. Positioning

Central banks worldwide have been ramping up gold purchases over the past decade, particularly in nations that are reducing their reliance on the U.S. dollar.

China has openly reported increased gold reserves, while Russia has made de-dollarization a key part of its financial strategy. These nations want to store their savings in an asset that cannot be confiscated or devalued by inflation.

Beyond China and Russia, BRICS nations and other emerging economies are stockpiling gold to insulate themselves from Western monetary policies. This signals a broader shift away from fiat dependence and toward harder assets. If these nations continue accumulating gold while the U.S. lags, the perceived strength of U.S. reserves could be called into question.

The U.S. dollar’s role as the global reserve currency has long been backed by the perception of economic and financial stability rather than direct gold backing. However, should an audit reveal that Fort Knox’s gold reserves are overstated or missing, it would call into question the credibility of U.S. financial reserves, potentially triggering a larger shift in global reserve strategies.

The Bitcoin Reserve

Rather than playing defense against a potential gold shortfall, the U.S. could go on the offensive—leveraging Bitcoin to reinforce financial dominance in the digital age.

Bitcoin provides several advantages over gold:

Transparency – Unlike Fort Knox, Bitcoin reserves can be publicly audited at any time through the blockchain.

Portability – Gold is difficult to move and secure, while Bitcoin can be transferred globally in minutes.

Fixed Supply – While gold reserves can still be mined and expanded, Bitcoin’s supply is permanently capped at 21 million.

At present, the U.S. already holds a significant amount of Bitcoin from various government seizures. Converting part of its strategic reserves to Bitcoin could reestablish U.S. financial dominance in the digital age while countering the rising influence of gold-backed strategies in adversarial nations.

A Fort Knox audit—if it indeed reveals that reserves are lower than expected—could initially cause a financial confidence shock. However, instead of viewing this as a crisis, the U.S. could use it as an opportunity to lead the next evolution of financial reserves. As nations shift toward harder assets in response to inflation and currency devaluation, Bitcoin stands as a uniquely positioned alternative to gold.

The most ironic and potentially beneficial outcome? A Fort Knox livestream confirming a gold shortage, followed by a U.S. announcement that Bitcoin will become a formal part of the national reserve strategy. What might first appear as a financial weakness could, in reality, become the catalyst that propels the U.S. into the next era of monetary leadership.

Whether the audit happens or not, the fact that this conversation has entered mainstream discourse signals that the world is waking up to the importance of real, verifiable reserves.

And in the digital age, there’s no asset more transparent, secure, and resilient than Bitcoin.

If you’re interested in any of the following, subscribe for more:

Bitcoin investment research

Bitcoin personal finance

Building a bitcoin business

Practical ways to invest in bitcoin

Practical ways to secure bitcoin