The Fiat Cave is free today. But if you have enjoyed my work, please help me increase my financial sovereignty by pledging a future paid subscription. You will not be charged until I enable payments. Thank you for your support - Jackson

I've written about financial repression in other "The Fiat Cave" issues, but I have not dedicated an entire article to the topic. It's crucial to understand the concept as it's underway and will become more pernicious over the next decade.

Failure to understand financial repression will result in your savings being stolen.

The Debilitating Debt Burden

Financial repression describes policies enacted by governments that result in savers earning returns (interest) below the rate of inflation. Creating an artificially low-interest rate environment during a time of higher inflation is an effective strategy to reduce Debt-to-GDP, which is at a dangerous level for the US and nations globally.

For decades now, central bankers and politicians have met each financial crisis with more debt issuance at lower interest rates to stimulate the economy. The result is countries saddled with debts that cannot be repaid. However, that does not mean those governments will all default on their obligations.

Using the US as an example, the country's Debt-to-GDP has ballooned since fiat money took hold in 1971, and debt accumulation accelerated following the 2008 Financial Crisis. The total Debt-to-GDP of the US Government is 133.96%.

As I have cited many times before, Hirschmann Capital has noted that "since 1800, 51 out of 52 countries with gross government debt greater than 130% have defaulted, either through restructuring, devaluation, high inflation or outright default."

That's where financial repression comes in. In 2015 the International Monetary Fund published a detailed report titled "The Liquidation of Government Debt" by Carmen M. Reinhart and M. Belen Sbrancia.

The Liquidation of Government Debt

The research goes deep into financial repression, but the authors first start by highlighting five options to deleverage (reduce debt) a sovereign balance sheet:

Economic growth

Austerity

Explicit default or restructuring of debt

Surprise burst in inflation

Steady dosage of financial repression accompanied by an equally steady dosage of inflation

Let's review each option quickly to learn how we end up at #5: financial repression.

While growing out of the debt would be an ideal scenario, it's unrealistic. High levels of public debt have been associated with lower growth historically. At high debt levels, economic growth is restricted by interest expense. Revenues are spent paying back interest expense on outstanding obligations.

The second option, austerity, would stagnant GDP, leading to a fairly stable Debt-to-GDP ratio. In this scenario, debt issuance stops/slows, as does GDP. And what politician could possibly win on an austerity platform? Both parties are responsible for the debilitating debt we are saddled with today.

An explicit default or restructuring is more common in emerging markets. The reason being is that these countries often have dollar-denominated debts, meaning debt issued in USD; however, these countries cannot print more dollars to repay the debt, which means if their financial situation goes south, it usually leads to a default or restructuring - think Argentina.

Hyperinflation could work to wipe out debts, but it's chaotic and would wreak havoc on an economy for some time. This works in practice because debts are repaid with worthless currencies, but most people are wrecked financially.

Financial repression policies to suppress interest rates lower than the rate of inflation is the most favorable outcome politically but is only possible for countries with domestic currency debts. The US has dollar-denominated debts.

Although some of you may not have heard of this concept, or have heard of it more recently, it's nothing new. It's a time-tested strategy for the reduction, or as the authors call it, liquidation, of government debts.

It apparently has been collectively forgotten that the widespread system of financial repression that prevailed worldwide from 1945 to the early 1980s played an instrumental role in reducing or liquidating the massive stocks of debt accumulated during World War II in many of the advanced countries, United States inclusive.

As the authors remind us, the United States used a similar strategy for nearly four decades following World War II. Real interest rates were negative for over half the years during that period, which meant savers lost significant purchasing power.

Meanwhile, the US Government had the favorable outcome they were seeking to achieve. Over that period, US Federal Debt-to-GDP declined from over 120% to 30%.

These results were achieved with financial repression, described in more detail by the authors here:

When controlled nominal interest rates coupled with inflation produce negative real interest rates, it liquidates (reduces) the stock of outstanding debt; we refer to this as the liquidation effect. However, even in years when real interest rates are positive, to the extent that these are kept lower than they otherwise would be via interest rate ceilings, large scale official intervention, or other regulations and policies, there is a saving in interest expense to the government. These savings are sometimes referred to as the financial repression tax.

Financial repression is most effective at liquidating government debt, when interest rates are surpressed below the rate of inflation, as they have been for two years now. A low nominal interest rate reduces debt servicing costs, and negative real interest rates erode government debt's value.

During the last period of financial repression, the authors note that real interest rates were far lower during 1945-1980 than in the "freer capital markets before the depression and World War II and after financial liberalization in the 1980s."

For the advanced economies, real ex-post interest rates were negative in about half of the years of the financial repression era compared to less than 10 percent of the time since the early 1980s.

How exactly did the US Government keep interest rates low? They tell their "independent" Federal Reserve to purchase their bill and bond issuance at a volume to maintain a specific interest rate. Similar to Quantitative Easing (QE) we have been familiar with for over the past decade, this is QE Infinity, meaning there is not a nominal amount of debt the Federal Reserve purchases each month. They purchase whatever it takes to keep rates at their predetermined level - printing money to maintain low rates.

During World War II there was an agreement between the Federal Reserve and the Treasury to support the price of government securities in the market. The Treasury had set a structure of returns for securities of different maturities: 3/8 Percent on 90-day T-Bills, 7/8 Percent on 12-month certificates, and higher rates on longterm issues up to a maximum of 2.5 Percent on the longest term taxable bond. The Fed announced that it would buy and sell securities in the market in order to maintain the prices of bonds at par. As a result, long term securities were liquid and investors were protected from capital losses.

While capping interest rates below the inflation rate is integral to liquidating the government's debt and the individual's savings, other financial repression strategies have been used and will be used in the future. The exact measures taken will differ by country; however, there are some common pillars:

Explicit or indirect caps or ceilings on interest rates

Creation and maintenance of captive domestic audience

Government securities price support

Interest rate ceilings

Margin requirements

Gold restrictions-capital controls

Moral suasion

Let's simplify the financial jargon above. Financial repression is a strategy to steal the savings of individuals and institutions by creating a captive financial system rife with regulations and restrictions. Not only does the government pay savers a rate below the rate of inflation, but they implement regulations and restrictions to ensure that it's challenging, if not impossible, to escape the theft.

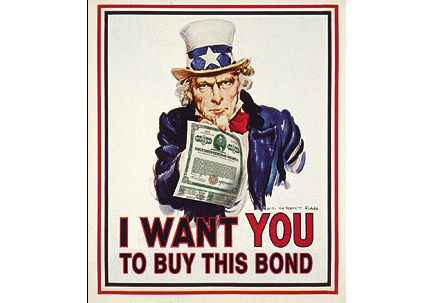

Governments are broke. They must steal from savers by creating a negative interest rate environment and forcing institutions (and their customers) to purchase their worthless debt securities.

Russell Napier, a financial market strategist, researcher, and author, describes financial repression as "the art of stealing money from old people slowly."

It's a transfer of wealth from the savers to the government. A heist.

You, the saver, are on the hook for the reckless behavior of your government over the past several decades. Anyone with savings held in financial instruments or savings accounts will be forced to bail out insolvent governments.

Even though you may not have supported fiscal spending programs, it does not matter. This is where we are today. And not to mention, none of us has a say in monetary policy, which has continued to lower rates to enable the government to issue debt at cheaper and cheaper rates.

You spend decades working hard to earn money and then working hard to safeguard your savings from inflation, just for the government to find another way down the road to steal more subtly from you. It's subtle because financial repression does not require high levels of inflation. In fact, the report details the opposite:

We suggest that financial repression was relatively more important than unanticipated inflation for the sample as a whole, although the latter played a more prominent role in the later stages of FR in the 1970s. Since FR ensures that interest rates have a substantial regulated or predetermined component, inflation need not take market participants entirely by surprise, and, in effect, it need not be very high (by historic standards).

The authors' research shows that high bursts of inflation were less crucial than consistently negative interest rates in liquidating government debt. Over time, suppressed interest rates below the level of inflation lead to a reduction of government debt while also growing nominal GDP, which in turn lowers Debt-to-GDP.

Financial repression is theft. It's the next iteration of the "mostly peaceful heist."

Tightening of the Financial Shackles

Real interest rates have been negative for the past two years. Those who have held cash or government bonds have had their pockets picked by Uncle Sam. But that was only the first two years of many, as we have yet to see the more stringent measures to restrict capital movement be implemented by governments.

The most captive audience for financial repression is regulated financial institutions and their clients, including commercial banks, pension funds, and brokerages - all of these institutions custody trillions of dollars in various account types such as savings accounts, retirement accounts, or brokerage accounts.

As the government continues to steal savings via negative interest rates, more people will realize their strategy and seek to move savings out of the reach of these thieves.

However, the government is aware that people will react this way, which is why financial repression strategies include regulations to impede the movement of capital and mandate that institutions hold a certain amount of US treasuries or not pay interest to their depositors. Because if the government did not impose restrictive measures, there would be a mass selling of its bonds, spiking yields higher, and challenging the solvency of governments.

The government will create reasons for why prohibitive measures must be instituted:

Not only purchasing bonds would be mandated, but even after the Great Depression, interest payments on time and saving deposits were prohibited, rationalized by the fact that excessive competition for deposits generated instability in the financial system.

Governments will make it as hard as possible to escape the grips of financial repression. Once restrictions are in place, your capital is captive to their heist.

You may think if the government does carry through with restrictions, you can move your savings elsewhere at that time, but not so fast:

Finding high-yield alternatives (to government debt) to save vehicles in the era of financial repression was no easy task. Capital controls kept many potential high-yield investment possibilities off limits while available domestic alternatives offered even more unattractive yields than government debt.

Financial repression tightens the shackles of a monetary system - a system that has kept us prisoners via inflation, taxation, and indebtedness. As we proceed further into this decade, we can expect that negative real interest rates will persist, and before you know it, if you have not escaped already, it will be too late.

Those who keep their savings stored in banks or government bonds will see their purchasing power diminish to nothing over decades.

Outside Money

To protect your savings against financial repression, it's necessary to have some wealth stored in money outside the banking system. Money stored within the financial system will be subjected to negative real interest rates and capital controls.

We are shifting toward a paradigm that will become abundantly clear that, if you do not have custody of your own wealth, it's not really yours. "Outside money" such as bitcoin or physical precious metals are the best ways to truly own your wealth, in assets that can protect you from the heist currently underway.

A broke government aiming to liquidate its debt is a dangerous counterparty. Fortunately, bitcoin and precious metals are effective ways to reduce your counterparty risk and save in hard money. Based on its monetary properties and digital nature, our opinion is that bitcoin is the best way to preserve and grow wealth during this period of financial repression.

Financial repression is the art of stealing money from people slowly. Don't be a victim of the heist. Protect your savings and hedge your counterparty risk. The debasement of fiat currency is a certainty. Governments prefer to print money than default.

Most market analysis these days, especially in the mainstream, focuses on quarters or the year. I aim to provide investment research to help you preserve your hard-earned wealth and navigate the shifting financial landscape.

If you find the work valuable, pledging a paid subscription is the best way to reciprocate that value. It's only $11/month, which is practically a dozen eggs, and I eat a lot of eggs.

A goal of writing this newsletter is to increase my financial sovereignty and not solely rely on my employer - thank you for your support.

Other ways you can support my work:

Share The Fiat Cave with a friend, a family member, or a colleague.

Share this post with a friend, a family member, or a colleague.

Like this post and comment any thoughts/questions.