Fiat Money: A Currency of Confidence

In the wake of SVB's collapse, do you have confidence in the fiat financial system?

If you find my work valuable, please consider helping me increase my financial sovereignty by pledging a paid subscription.

While I enjoy writing the newsletter, creating high-quality posts is a serious time commitment, and I hope that readers who find value in my work can compensate me for my most scarce asset: time.

You will not be charged until I enable payments next month. Thank you for your support - Jackson

Silicon Valley Bank. Ever heard of 'em?

The 18th largest bank in the U.S. imploded last week, making it the 2nd largest banking collapse in U.S. History.

SVB was the preferred bank in the Venture Capital and start-up world. This ecosystem has benefitted massively from the zero interest rate policy (ZIRP) enacted by the Federal Reserve post-2008 Financial Crisis.

VCs were particularly fortunate following the outbreak of the Wuhan Flu, as the central banks and governments globally came in with truly unprecedented levels of liquidity, AKA money printing.

In the United States alone, the money supply was increased by over 40% or $6 TRILLION. Wall Street, of course, tremendously benefitted from that, while Main Street dealt with government-imposed lockdowns destroying their businesses.

SVB saw a considerable increase in its deposits during this period, as shown below.

Bank deposits are liquid and can be withdrawn at any time…. right?

Not so fast. Today's fractional reserve banking system takes deposits and lends a large majority of them out or even purchases securities. Banks have materially less cash available than deposits. Essentially your bank balance is an IOU.

With a deluge of deposits in 2020 and 2021, SVB purchased large quantities of long-dated securities. At that time, due to the ZIRP of the Fed, Treasury Bills (short duration) were yielding close to 0%. Banks such as SVB sought longer-duration Treasury Bonds to earn a (minimal) yield on customer deposits.

Although the Fed was confident that inflation was transitory, they eventually admitted they were wrong. Still trying to figure out how the people who created $6 TRILLION of new money supply got that one wrong...

At any rate, as inflation the Fed created tore the fabric of society and formed a cost of living crisis, they had to act. So the Fed embarked on one of the fastest tightening cycles in history, raising their benchmark interest rate from 0% to 4.50% from March to December 2022.

As rates climbed higher, interest-rate-sensitive long-duration Treasuries and Mortgage Backed Securities (MBS) plummeted.

SVB, among the entire banking sector, found themselves with monumental unrealized losses in their securities portfolio due to the higher interest rate environment engineered by the Fed. Remember, interest rates and bonds have an inverse relationship – rates up, bonds down.

The

highlights last week's events, which ultimately caused SVB to fail.On Tuesday, the bank announced a sizeable $1.8 billion loss from the sale of U.S. Treasuries and MBS securities, both of which are highly rate-sensitive and were the victims of 2022's aggressive rate hikes. That same day, the bank's holding company announced a capital raise; in response to the news of the loss and subsequent raise, investors started walking towards the exits, eventually snowballing into a mad dash for safety. Despite being in sound financial condition the day before, SVB faced a bank run. The fear among depositors reached a fever pitch, with a total deposit call on Wednesday of $42 billion—about a quarter of its $173 billion deposit base.

To recap, the bank run started when it was revealed that SVB had a significant portion of its deposits tied up in long-dated government bonds. They were not liquid. That started the panic, and as depositors rushed for the door in fear of a liquidity crunch; it became a spiral of loss of trust in the bank.

The collapse of SVB was a collapse of confidence.

Fiat: A System Backed By Trust and Confidence

The stability of the fiat financial system is all about confidence. The entire global economy is based on funny money, created with nothing by central banks, backed by the public's confidence.

If you saw Biden's Statement on Monday, what was one of the first words out of his mouth?

Americans can have confidence that the banking system is safe. Your deposits will be there when you need them.

If the public loses confidence at scale, a series of bank runs could collapse the financial system. To restore confidence in the wake of SVB, the U.S. Government, Federal Reserve, and the Federal Deposit Insurance Corporation (FDIC) bailed out SVB depositors beyond the FDIC's $250k threshold per depositor. In fact, approximately 97% of SVB deposits were not FDIC insured. That money would have been lost if there was not a bailout.

When the money is backed by nothing and the financial system is an interconnected web of debt and complex financial securities, many resources must be allocated to maintain the public's confidence.

Interestingly enough, the FDIC is in the business of confidence. Directly from their website (emphasis added):

An independent agency created by the Congress to maintain stability and public confidence in the nation's financial system. The FDIC insures deposits; examines and supervises financial institutions for safety, soundness, and consumer protection; makes large and complex financial institutions resolvable; and manages receiverships.

To keep the confidence and prevent more bank runs from occurring, we all have the pleasure of bailing out SVB. In a joint statement issued by Treasury Secretary Janet Yellen, Federal Reserve Chairman Jerome Powell, and FDIC Chairman Martin Gruenberg, it was announced Sunday that all deposits at SVB would be protected by FDIC insurance and on Monday depositors would have access to their funds.

But in typical political doublespeak, the government assures us, the taxpayers, that we will not bear the brunt of the bailout. How is this possible, though? The money must come from somewhere.

Money printing, of course. The precedent has been set that uninsured deposits above the $250,000 FDIC limit will be met by creating more currency units.

explains:While government officials stated that taxpayers will bear no burden, the reality is that the direct costs of the bailout will be borne by the entire banking system and, by extension, the overall economy. There is no magic wand that allows depositors at Silicon Valley Bank and Signature Bank to be made whole without socializing losses.

The FDIC will provide unlimited deposit insurance for Silicon Valley Bank and Signature Bank and the Fed will accept depreciated securities at par value from banks seeking emergency funding.

While the intervention acts as a short-term solution for SVB depositors, paid for by everyone else, the cascading effects of SVB's collapse remain to be fully seen. The saga could be far from over as investors are scrutinizing other banking and financial institutions.

It's unlikely that a systemic collapse of the banking system is on the horizon near term. Still, it's worth understanding the entire fiat financial system is continually one scenario away from more money printing to avoid its inevitable expiration.

An excellent Tweet from Gabor Gurabacs, Founder at PointsVille, summarizes the fiat house of cards.

Between the FDIC's Deposit Insurance Fund and the line of credit with the Treasury, the FDIC has about $225bln to cover 4,706 FDIC-insured institutions with over $9T of assets at the top four banks alone.

It's problematic enough that fiat currency is backed by public confidence, but even more so, the FDIC, the backstop against bank runs, has a mere 1% of assets to fully cover deposits.

If a widespread bank run were to occur, the FDIC would need a government bailout printed by the Fed. This is why SVB was saved because had they not, the financial system could've collapsed, and the dollar would've been printed into oblivion.

Although a complete financial calamity may be avoided for now, make no mistake, we are in a bear market in confidence in the financial system, which has accelerated from 2008 to the present.

As more people understand fiat currency's fragility and utter scam, confidence will continue to erode. Eventually, all fiat currencies will be worth nothing in a catastrophic collapse.

A Brief History of Breaches of Trust & Confidence in Banking

Bankers have breached the trust of the public for millennia. Fractional reserve banking is not new, but it's far more widespread and ingrained into the financial system than ever before.

During the Renaissance in Northern Italy, precious metals were money; however, the gold florin or other gold and silver coins were often deposited with bankers in return for a paper receipt. These claims reduced the risk of being robbed and made metals more portable.

But some banks realized the lack of oversight of their gold and silver in vaults and began to issue more notes than held in reserves. As long as people had confidence in the bank, this could continue, but if a bank ran into financial trouble, a bank run would ensue, and some depositors would be left holding worthless paper.

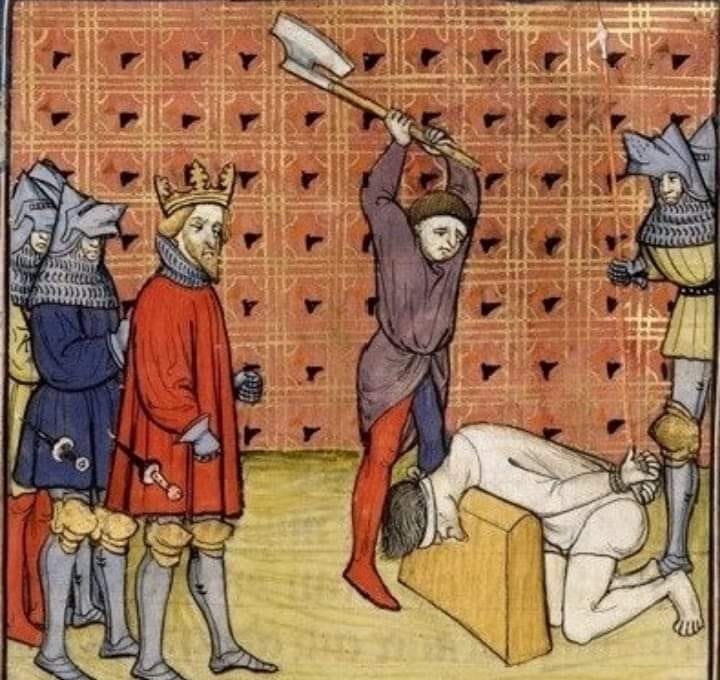

However, the bankers during the Medieval Ages and Renaissance were not bailed out when this happened. They actually faced quite a different fate. Punishments for fractional reserve banking included a life prison sentence or even the death penalty.

Even in the 1800s, during the gold standard, bank runs were commonplace. Banks that breached their depositor trusts failed. But that changed with the introduction of "the lender of last resort," the Federal Reserve, in 1913.

Banks could now engage in more speculation and risky lending practices and have confidence that their behavior would be backstopped by the Fed. Additionally, savers were forced into the banking system not too long after the creation of the Fed.

Franklin D. Roosevelt issued Executive Order 6102 in 1933, which banned private ownership of gold. So people were forced to deposit with banks or potentially be incarcerated for holding a yellow rock to protect their purchasing power.

Almost 100 years later, the global financial system is nothing but a game of confidence. That is why bitcoin was created.

Sound Money: Monetary Properties that Instill Confidence

The root problem with conventional currency is all the trust that's required to make it work. The central bank must be trusted not to debase the currency, but the history of fiat currencies is full of breaches of that trust. Banks must be trusted to hold our money and transfer it electronically, but they lend it out in waves of credit bubbles with barely a fraction in reserve. - Satoshi Nakamoto

Bitcoin's existence is needed because of the growing instability of the fiat financial system and the fact that those in control continue to breach the trust of their citizens.

Hard money speaks for itself.

Bitcoin ends the confidence game of fiat currency. When a financial system is built on hard money, confidence does not come top-down from politicians ensuring you'll be bailed out, but rather from the bottom up, knowing the system is built on a solid foundation of sound money. Just as gold was chosen as money for thousands of years for its monetary properties, so too is bitcoin being adopted in grassroots fashion around the world because of its monetary properties.

Scarcity: hard to produce and obtain.

2. Divisibility: can be easily divided into smaller units and grouped into larger units.

3. Durability: not perishable or easily destroyed.

4. Portability: easy to transport.

5. Verifiability: easy to verify that it is real.

6. Fungibility: all the same, interchangeable.

On a bitcoin standard, we don't need agencies whose sole purpose is to maintain confidence. Sound money, especially open-source software, gives us confidence that our wealth is secure.

You don't need to trust bitcoin. That's the point. The code is open source and can be verified by anyone worldwide. It's a digital monetary network with NO trusted third parties involved. It's a decentralized network.

The SVB collapse is one example of many why the world needs bitcoin.

What other options do we have?

Once you deposit money in the bank, it's no longer yours. You are handing over custody of your wealth to an institution that lends it out to another institution that lends it to another, and so on.

You could custody your own wealth in cash to hedge against a bank run, but that does not hedge you against the coming money printing.

Precious metals are a better savings option than cash, hedging against bank runs and currency debasement, but they lack portability and divisibility and must be purchased at a premium from reliable sources.

Thus, we are left with bitcoin, which enables each and every one of us to be our own bank and have true control over our wealth. A bank that is not confined to one jurisdiction. A bank that can transact globally without the permission or trust of any person or entity. Bitcoin protects against bank runs and against currency debasement.

Please heed the warning of SVB. Having a 0% allocation to bitcoin will become only more dangerous. The financial system is an interconnected web of insolvent entities relying on more debt at lower and lower interest rates.

There's simply no way out of this mess without a massive deflationary collapse worse than the Great Depression or continued inflation, or even hyperinflation. It's not coming tomorrow, but it is coming.

Thank you for reading. If you’ve found my work valuable, please consider helping me out in one (or all) of the following ways. Thank you for your support and generosity.

Share The Fiat Cave with a friend, a family member, or a colleague.

Share this post with a friend, a family member, or a colleague.

Like this post and comment any thoughts/questions.

While I enjoy writing the newsletter, creating high-quality posts is a serious time commitment, and I hope that readers who find value in my work can compensate me for my most scarce asset: time.

Part of my goal with the newsletter is to increase my financial sovereignty, not solely rely on my employer. While I don’t expect to make a living from this, each subscription helps me become more financially resilient.

Thank you for your support!