Calling the Central Bankers' Bluff

The Fed has acted as the savior in past economic slowdowns and financial crises, using lower interest rates and Quantitative Easing (money printing) to "stimulate" the economy. They have avoided economic calamity through their intervention, but all they have done is delay the inevitable.

Now there are challenging times ahead, which we will cover in this article. Fortunately for us, Satoshi Nakamoto, the pseudonymous creator of bitcoin, engineered an alternative to the fiat monetary system. He called the bluff of Central Bankers.

The Central Banker Dilemma

For decades, the Fed's "stimulus" of low interest rates and QE did not result in higher Consumer Price Inflation (CPI), which meant they could remain accommodative. Although CPI is a doctored government statistic that we should dismiss, it is the metric of the unproductive class, the Central Bankers and government officials, so we need to pay some attention to it to understand their thought process.

CPI did not reflect inflation in the real economy, but now it's well understood that suppressing interest rates artificially low and injecting money into the financial system creates bubbles in asset prices. Since 2000, there has been the Dot Com Bubble, the Housing Bubble, and the Everything Bubble. Each time a bubble popped or there was an economic slowdown, Central banks lowered rates further, and the Treasury issued more debt, leading to bigger bubbles.

However, this decade, inflation has materialized in the real economy, measured by CPI, primarily driven by two factors. First, the scale of the intervention in 2020 and 2021 was unprecedented. Second, new money was created not only in the financial system but in the real economy, sent out directly to people's homes or through augmented entitlement programs. The Federal Reserve increased the money supply by 42% in 2020/2021, over $6 TRILLION in total. Interest rates were held at 0%.

The result of this policy was sky-high asset prices across the board. Anyone with savings was looking to invest it into some financial product or real asset since the interest rate in the bank was 0%. We can remember the financial market mania well, especially in the SPAC, technology 'WFH' stocks, and crypto space. Eventually, economies began to open up after the government imposed lockdowns, which destroyed the livelihoods of millions of people, and people began to spend their money in the real economy. Obviously, a 42% increase in the money supply will lead to much higher prices of goods and services that people desire, which is what we saw and continue to see.

But no. The "experts" said the inflation was "transitory." However, the narrative lasted only a short time. After several months of CPI well above the 2% target, the Federal Reserve began to communicate its intent to hike interest rates and use Quantitative Tightening to "fight inflation." The Fed and central banks globally missed the mark on the "transitory" inflation and were forced to act to preserve any remaining credibility. Thus in 2022, the Fed embarked on the fastest interest rate hike in history.

The media, which is essentially the propaganda arm of central banks, did their part in blaming inflation on anything besides the root cause, money printing. The Federal Reserve was once again painted as a hero, looking out for the American middle class and helping them in their cost of living crisis.

While the Federal Reserve under Paul Volcker successfully reduced inflation in the 1980s, as we wrote about in a previous piece, the situation is much different today. We encourage you to read the article for a complete explanation.

The summary is that due to egregious debt burdens that nation-states have accumulated globally, interest rates cannot remain high for long. After decades of lower and lower interest rates and more and more debt, the balance sheets of nation-states are ugly. The United States has $31 trillion of federal debt, making the Debt-to-GDP ratio 120%. The excessive debt jeopardizes central banks' ability to raise interest rates to fight inflation. The looming debt spiral threatens central bank credibility. The "fight against inflation" will likely fall short because the financial system cannot handle higher interest rates.

The central banks will likely be forced to cut interest rates and begin printing money while inflation is still well above 2%. At that point, it would be clear that the "emperor has no clothes."

Since the US Government is insolvent, the two options available would be to let the financial system collapse under the weight of higher interest rates, creating a global depression, or suppress interest rates and print money.

We expect the latter. No politician wants to be in office when the Fiat Ponzi Scheme comes crashing down.

Fiat Currency: A Theft-Based Monetary System

There are clearly challenging times ahead for the financial system, and it is yet to be fully appreciated how it will all play out, but it will not be without turbulence. Either depression or more fiat currency devaluation.

History is in favor of more devaluation. Many great empires of the past, such as the Roman Empire, deteriorated and eventually collapsed from currency devaluation. According to author Saifedean Ammous, in his book "The Fiat Standard," "More than sixty episodes of hyperinflation have taken place in countries using fiat monetary systems in the past century."

Currency devaluation is nothing new, not even in the United States. Since the creation of the Federal Reserve in 1913, there has been a "mostly peaceful" heist underway.

Through the creation of the Fed, inflation became embedded in the monetary system, a constant fluctuation in the supply of money in the short term but an increase in the long term. "Moderate inflation" is ingrained in the fiat financial system. Over decades the debasement of currency has stolen from savers and enriched those who control the monetary system. We have been conditioned to think that prices go up, it's natural and a sign of a healthy economy; however, it's all a front for the central banking cabal to continue to expand the money supply and make their share of the pie larger.

We work to earn a paycheck and spend most of our week doing so, just for money to be printed on a whim by the Ruling Class, devaluing our hard-earned money. It's illegal for us to counterfeit money but perfectly fine for the government to do so.

Great tweet from

, author of The Informationist Newsletter, to reinforce the idea of time theft.

The financial system is rigged. The devaluation of currency destroys the savings of the common people and makes life unaffordable as their wages stagnant or increase slower than inflation. Since fiat currency is devalued, those fortunate to have savings look for investments to preserve their purchasing power. Most people's savings land in risky assets such as stocks, bonds, or real estate in the hopes of escaping inflation, but there are, of course, risks with these investments, and there are financial crises that are occurring more frequently at larger scales.

Financial crises tend to redistribute wealth from the lower and middle classes to the Ruling Class. Because as these financial crises emerge, many people panic and sell their assets at a discount, losing wealth. In addition, these crises are beneficial to the Ruling Class, as more money is constantly printed and thrown at the crisis. Between taxation and money printing, the commoner comes out with less, and the Ruling Class amasses more.

Calling the Central Bankers’ Bluff

Satoshi Nakamoto, the pseudonymous creator of bitcoin, released the Bitcoin Whitepaper on October 31, 2008, on a cryptography mailing list in the depths of the Great Financial Crisis.

Embedded in the code of the genesis block, the first block in the bitcoin blockchain, was the following text: "The Times 03/Jan/2009 Chancellor on brink of second bailout for banks."

As evidenced by that headline from “The Times,” his motivation to create bitcoin was primarily due to the dangers and corruption of the fiat monetary system. He understood well that central banks and governments continued to breach our trust by devaluing the currency for their benefit at our expense. A system based on ever-growing debt obligations means that currency debasement (inflation) is necessary to avoid defaulting on those obligations. It's easier to pay a fixed debt obligation if you create more currency units.

Through the engineering of bitcoin, he provided us an alternative to the fiat financial system, which extracts the wealth of productive members of society through inflation and rewards the unproductive members who pledge allegiance to the central banking cartel. The creation of bitcoin was Satoshi calling the bluff on the "omnipotent" central bankers.

He achieved this feat by understanding the history of money and the properties of sound money: scarcity, divisibility, durability, portability, verifiability, and fungibility. He combined that with cryptography, leaning on decades of work from others to create a fair and transparent peer-to-peer digital monetary system.

All fiat currencies will fail eventually. A paper currency backed by nothing aside from trust in an institution that threatens its constituents with violence will ultimately be abandoned. As trust in the US Government and governments worldwide continue to decline, so will fiat currencies' purchasing power because people will choose to adopt harder monies.

Fiat currencies collapse when enough people lose faith in the institution that issues it or when the central bank prints too much of it in too short of a period. While we do not expect a collapse of the US Dollar soon, it's inevitable, but the US Dollar is the cleanest shirt in the laundry basket. But until then, the USD will continue seeing its purchasing power decline faster.

Unlike the fiat financial system, which relies on twelve unelected officials to manipulate interest rates and money supply in favor of the oligarchs, bitcoin operates on predetermined rules, transparent to all. Humans are easily corruptible, especially by money. Satoshi knew the only way to prevent theft in the monetary system would be to create money ruled by rules, not rulers. Rather than trusting people, who have proven themselves unworthy of trust, we can choose to adopt a monetary system that does not require trust from any user of the network. There is no government, central bank, or billionaire, not even the pseudonymous creator, Satoshi Nakamoto, that controls the bitcoin network.

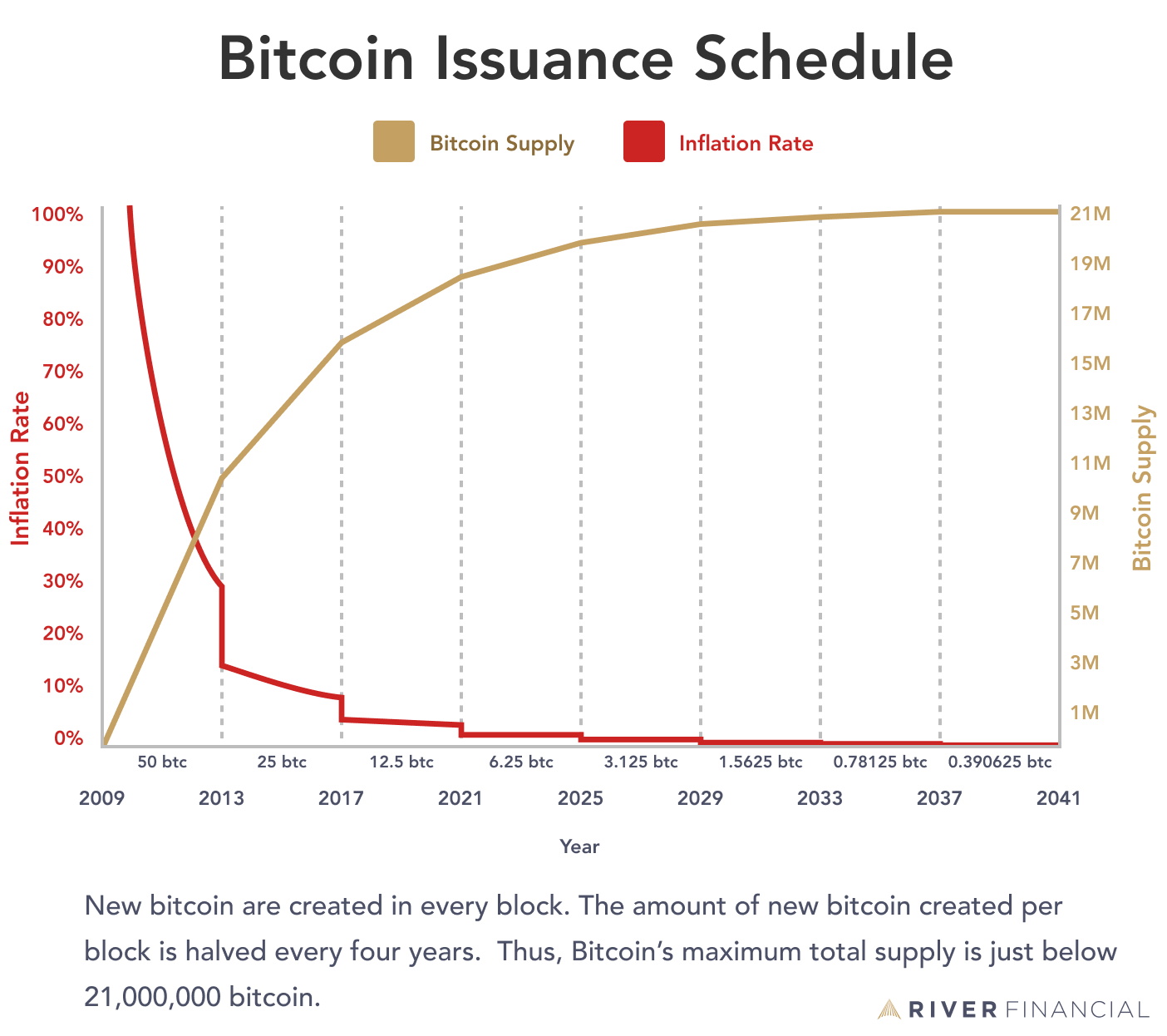

Bitcoin is scarce. There will only ever be 21 million. To achieve 21 million bitcoin, the protocol follows a predetermined issuance schedule. Every four years, the amount of bitcoin issued in each block (the block subsidy) decreases by half until 2140, when the last bitcoin will be mined. At the time of writing, January 2023, approximately 19 million bitcoin have been mined.

Satoshi knew that the financial system would eventually meet an untimely demise. Thus he engineered an alternative to protect our wealth outside of the fiat financial system. Bitcoin is a digital vault for your life's savings. Unlike fiat currencies which will continue to be devalued by governments and central banks at an increasingly rapid rate, bitcoin's inflation rate will continue to decline.

Satoshi Nakamoto called the bluff of the fiat currency system.

Thank you for taking the time to read this post. If you enjoyed it, please let me know and hit the like button. If you have any comments or questions, I would love to hear from you!