Bondholders Beware!

Are US Treasuries still risk-free when the US Government is insolvent?

Are US Treasuries still risk-free when the US Government is insolvent?

Bondholders beware. A shift in the global store of value landscape is underway, and those who fail to adapt will have their savings wiped out over the coming decades.

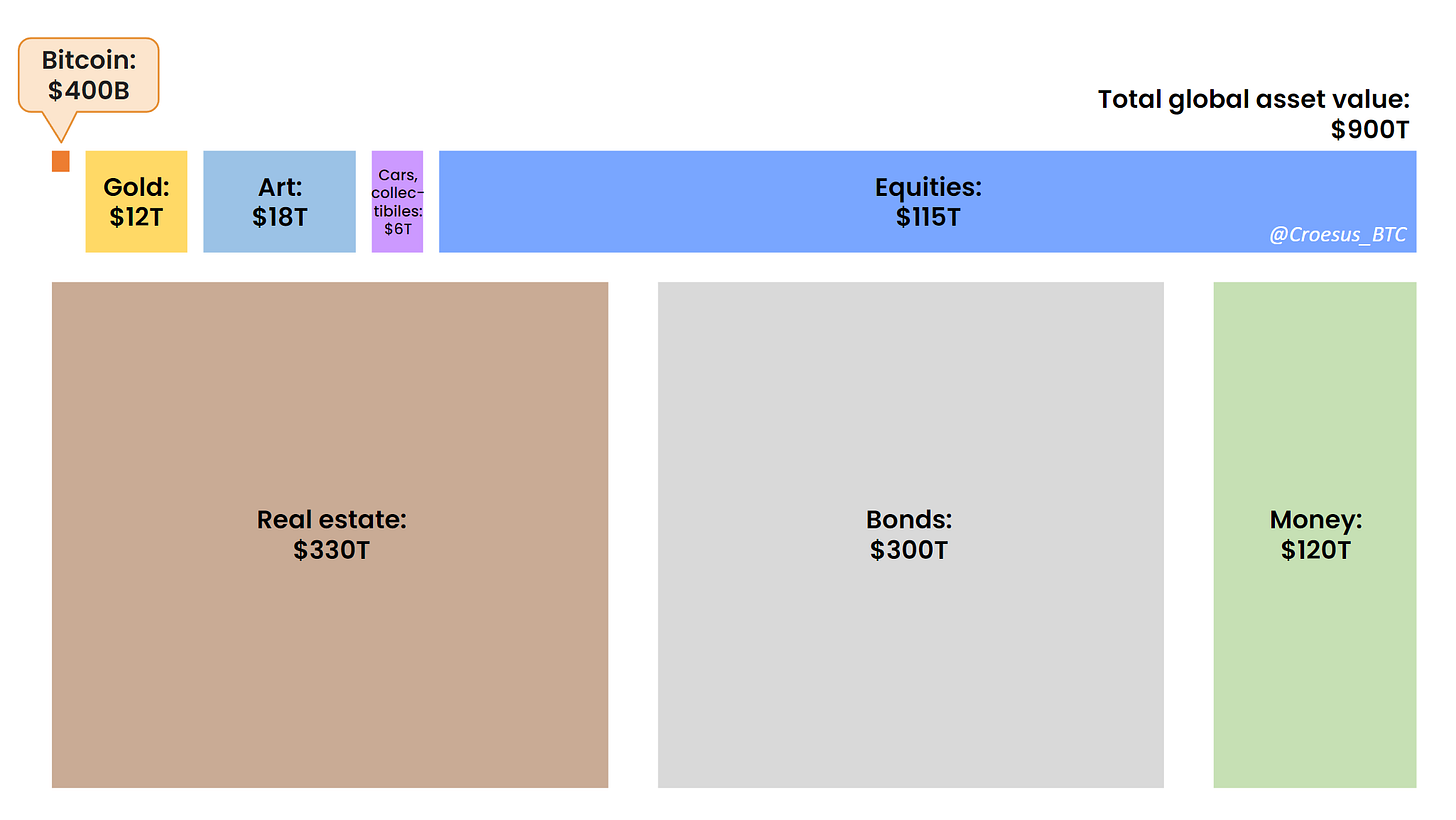

In his article, “Bitcoin’s Full Potential Valuation,”

breaks down the global asset landscape below. Today, there’s approximately $300 TRILLION stored in bonds globally. Individuals and institutions have used bonds, especially US Treasury Bills, Notes, and Bonds, to store their wealth over the past several decades.

Before examining the future of bonds, we must first look to the past to understand why bonds became the chosen store of value.

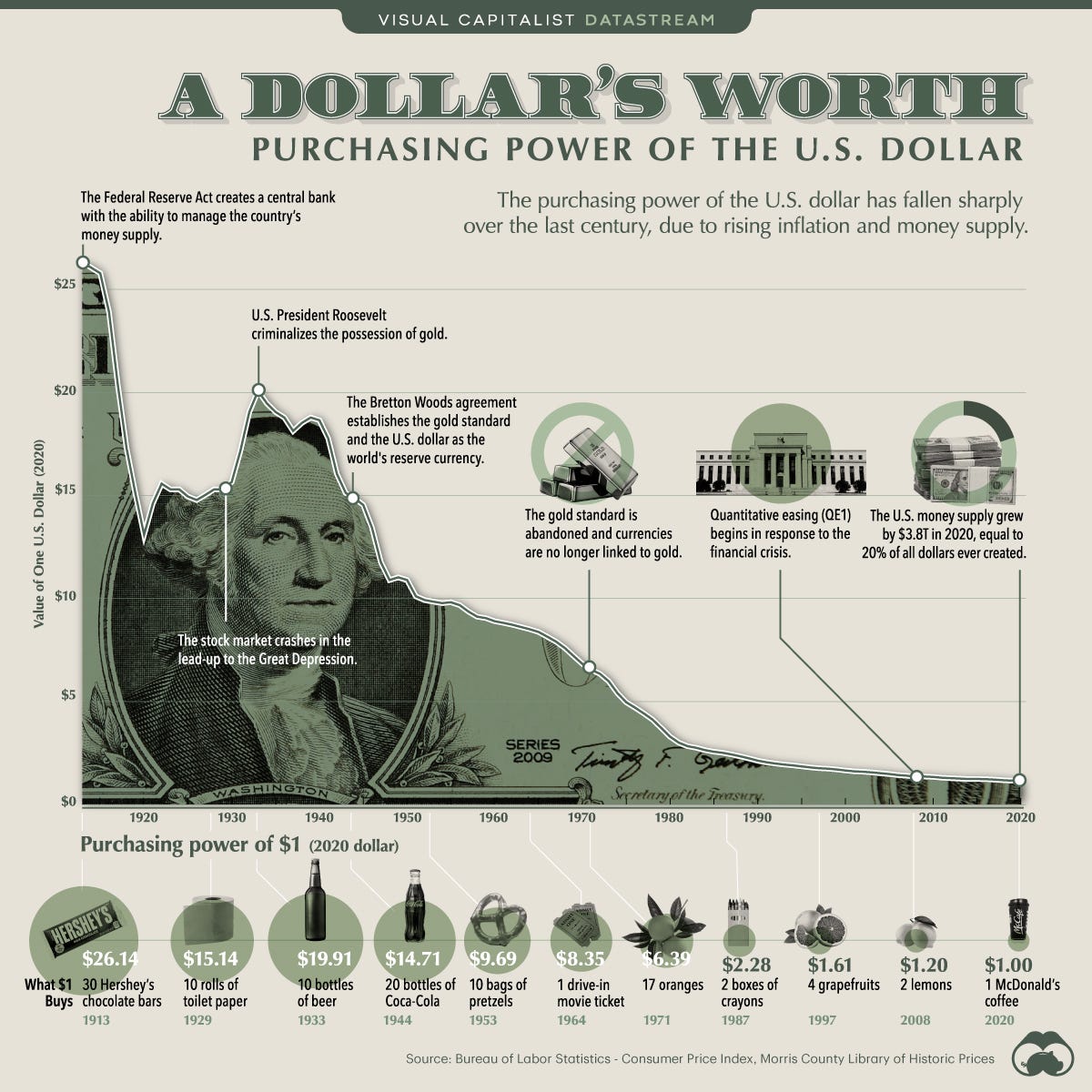

Primarily because fiat money, issued by a government and backed by nothing, has failed to preserve its purchasing power over long periods. Thus, savers have gravitated toward bonds to preserve their wealth. Despite the prevalence of government bonds as a store of value over the past several decades, it’s not always been the predominant method of saving. As the macroeconomic, political, and geopolitical environments change, savers must adapt to protect their wealth.

Certain circumstances led to bond’s rise as the global store of value, such as Executive Order 6102 issued in 1933 by President Franklin D. Roosevelt, which banned private ownership of gold in the United States. For thousands of years, gold fulfilled the role of money, serving as both a medium of exchange and a store of value.

Gold was the premier store of value. Due to its scarcity, it was sought after for its ability to preserve wealth over long periods. Yet, by government decree, and under the threat of a $10,000 fine or 10 years in prison, individuals could no longer legally hold a yellow rock - think about how absurd that is for a moment.

Not only did the US Government ban and forcefully confiscate the people’s savings mechanism, but shortly after they devalued the dollar from $20.67/oz to $35/oz.

Between the forceful confiscation of savings and following devaluation, this was a blatant robbery by the US Government.

The Quest for a New Store of Value in the 1900s

In gold’s absence, savers had to seek out a new method of wealth preservation since holding government certificates (dollars) exposed them to the risk of currency devaluation.

Executive Order 6102 led to monetizing other assets, such as real estate, equities, and bonds. Monetization simply means that people purchase these assets beyond their utility. A house’s utility is shelter, a place to gather for family and friends, yet, it has become a form of money because, in the absence of gold to store value, people used real estate to save their money.

One benefactor from Executive Order 6102 was, unsurprisingly, the US Government, which saw its bonds become a popular method of saving. While good data is hard to come by to substantiate the claim, bonds were a common way to preserve savings. I remember my grandparents saved what little they had in bonds.

While inferior to gold for several reasons, such as bearing counterparty risk, as long as bondholders were paid a positive real interest rate, meaning a nominal yield above the inflation rate, they could serve as a decent store of value. There are issues with this, of course, because the US Government is interested in understating inflation data and colluding with the Federal Reserve to pay a lower interest rate. Nonetheless, bonds became a popular savings vehicle from 1933 to 1971, and beyond.

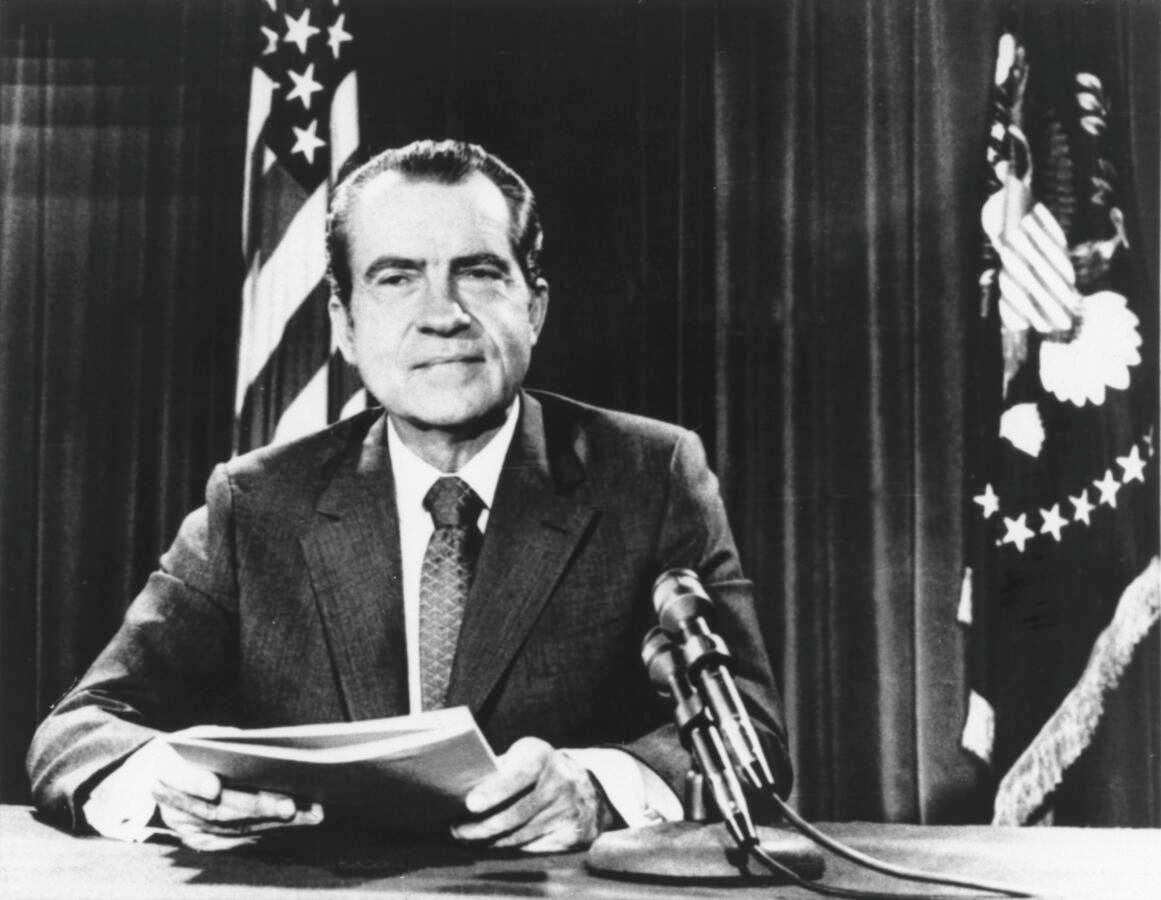

In 1971, President Nixon ended the gold standard. President Nixon blamed "international currency speculators" for his decision to "suspend temporarily the convertibility of the dollar into gold." Fifty-two years later, so much for "temporary."

Despite Treasury Secretary Yellen's remarks regarding the US never defaulting, it's clear to those paying attention that in 1971 the US defaulted on their obligations under the Bretton Woods system.

From 1944 to 1971, the United States Dollar was pegged to gold at $35/oz, and all other fiat currencies were pegged to the dollar. However, the US embarked on massive spending plans in the 1960s, creating far more debt (dollars) than gold held in reserves. Other countries called the US' bluff and sought to repatriate their gold. That's when Nixon ended the gold standard, defaulting on the US' obligations.

Since 1971, the entire world has been in a monetary experiment. Despite thousands of years of hard money (gold) as the foundation of monetary systems, today, the entire global economy is built on a foundation of funny money. No longer constrained by commitments to a gold peg, the US Government and Federal Reserve have been free to issue more debt and expand the money supply. Savers have continued to use bonds as a store of value but have since sought other assets to protect their wealth against insidious inflation.

Although the ban of private gold ownership in the US was lifted in 1975, decades had passed since 1933, and new generations were born into the fiat currency system, not understanding the role of gold historically. In our constant pursuit of money, we forget to ask, "what is money?" For some savers, gold once again became a cornerstone of their wealth-building strategy; however, the monetization of other assets, such as real estate and equities, accelerated in an effort to protect wealth on a fiat standard.

While developed by Nobel Laureate Harry Markowitz in 1952, the "60/40 portfolio" soared in popularity and became the de-facto savings account of millions of Americans and people globally in the 1980s and beyond.

Comprised of 60% stocks and 40% bonds, the portfolio worked for decades in low inflation periods when stocks and bonds exhibited a negative correlation. Stocks provided more upside and exposure to economic growth, while bonds acted as a source of income and a stabilizer as economic growth waned and recessions hit. As interest rates declined from the 1980s to the 2020s for both legitimate and artificial reasons, equity and fixed income valuations benefitted.

The Fed controls the Federal Funds Rate, the benchmark interest rate for the global economy. As part of their strategy to combat financial crises, the Fed lowered interest rates to "stimulate the economy," hoping that more people would borrow and invest to reboot the economy.

During the 2008 Financial Crisis, the Fed and global central banks launched asset purchase programs like Quantitative Easing. Their typical protocol of lowering interest rates was no longer sufficient to stave off calamity, so they started QE.

While mechanically, there's some nuance, effectively, these programs allowed central banks to create money to purchase assets such as US Government bonds and mortgage-backed securities onto their balance sheet.

During the past few decades, the US Treasury has issued more debt at accelerating rates, much of which was purchased by the Fed with money created from nothing. While this kept the economy from collapsing, it only kicked the can down the road.

After decades of intervention from governments and central banks, the US and nations globally have accumulated an egregious amount of debt, which can only be paid off by issuing more debts at lower rates. At the time of this writing, the Federal Debt to GDP is 120% and total Debt-to-GDP, accounting for state and local debts, is 134%.

Since 1980, the Federal Reserve has lowered the Federal Funds Rate from 20% to 0% in 2020. During that same period, the US Government's Debt-to-GDP ratio increased from 35% to 120%. To use the words of the United States Congressional Budget Office, the government's balance sheet is on an "unsustainable path."

It's time to face fiscal reality. The egregious amounts of debts are a massive burden to economic growth. The expenses have exceeded the revenues (taxes), rendering the US Government insolvent. Governments have backed themselves into a corner, and similar to the post-WWII period, when the US had over 100% Debt-to-GDP, they are once again determining how to deleverage without creating economic collapse.

Hirschmann Capital's research indicates that "since 1800, 51 out of 52 countries with gross government debt greater than 130% have defaulted, either through restructuring, devaluation, high inflation or outright default."

How will the US Default on their Debt Obligations?

The question is not *if* the US will default, but rather *how.*

Unless you’ve been living in a remote location without connectivity for the past several weeks, you’ve seen the debt ceiling discussions consume media headlines.

As Secretary Yellen mentions above, the debt ceiling has been raised by Congress 78 times since 1960. Although policymakers and politicians like to pretend otherwise, if the US Government can only pay its obligations (debts) by issuing more obligations (debts), it’s a Ponzi scheme. The money coming in is used to pay the return of the money going out - does that mean the criminals in Washington, which have been defrauding the American people, will go to prison like Charles Ponzi? Likely not.

The United States has been defaulting for decades by raising the debt ceiling and will continue to do so at an accelerating rate. As the debt ceiling continues to be raised, the supply of new debt will outpace the demand, which means the Fed will have to create more and more dollars to purchase the rapidly growing debts of the US.

The current drama in DC over the debt ceiling will pass soon. Congress will raise it for the 79th time, and the Ponzi will go on. We should not be concerned about the US defaulting by failing to raise the ceiling. Instead, our concern should be aimed at their implicit default, continuing to issue more debts to pay old. As the Treasury continues to gorge on debt monetized (purchased) by the Fed, the dollar will be devalued.

The graphic below from the Congressional Budget Office highlights that the US Government and Fed have lost control and are admitting openly that their only plan is to keep accumulating debt.

What they don’t admit publicly is this will destroy the value of the USD and erode the value of bonds.

Despite the chart above showing a growing Debt-to-GDP ratio, in an ideal world (for the Government), the Fed will suppress the Federal Funds Rate below the inflation rate. As inflation remains higher, GDP may grow nominally, and with rates artificially low, Debt could shrink relative to GDP.

While interest rates are much higher than they have been in the Post-Great Financial Crisis world, that will not be the case for much longer. The US Government is, in fact, insolvent, and the Fed will lower interest rates to reduce the interest expense of debts issued going forward and help the US Government reduce its Debt-to-GDP ratio, AKA liquidate its balance sheet.

The playbook I am describing is financial repression. Policies enacted by governments that result in savers earning returns below the rate of inflation. This means that bondholders will receive a negative real rate of return, and savers should seek out other ways to store their wealth given the reality of the fiscal situation. I wrote about this in more detail in my piece “Financial Repression and The Captive Saver.”

From Bonds to Bitcoin: Storing Value for the Future

I threw a lot at you. To summarize the article thus far, the US is running a Ponzi scheme, which they have no intention of ending willingly. To end, it would mean the debt ceiling would not be raised, and the US would default. Seventy-eight previous instances would say this is highly improbable. Instead, the US intends to raise the ceiling, issue more debts, and have the Fed purchase with funny money. To reduce interest expense, we can also anticipate the Fed lowering interest rates in the next 6-12 months and holding rates below the rate of inflation for a prolonged period. They’re hoping for nominal economic growth, which inflation helps with, to outpace the rate of debt issuance, thus reducing Debt-to-GDP.

In reality, bonds are a dangerous place to park wealth long term. There’s a mathematical certainty that bondholders will receive a negative real rate of return. As the US continues to issue debts and the Fed monetizes its spending, the USD will keep losing purchasing power, and bondholders will see their savings eroded. Wealth will be transferred from bondholders (savers) to the US Government.

The implications for savings and capital allocation are vast. Not only should bondholders expect that wealth will be diluted over the coming decades, but we also saw the correlation between equities and fixed income break down in 2022.

The de-facto savings account, “60/40 portfolio,” is over, and I am particularly concerned about the “40” portion - bonds. All fiat currencies will inevitably continue to lose value, and bondholders will receive a negative real return. The 40% needs to find a new home immune to the virus of government spending and currency devaluation. Failure to adapt to this reality will mean that, over time, one’s savings will be depleted and donated to the criminals in the government.

Treasuries, once the global store of value for individuals and institutions alike, will not preserve savings going forward. It’s mathematically impossible for the aforementioned reasons. Gradually, then suddenly, savers and investors around the world are waking up to this fact, searching for alternative ways to protect their hard-earned savings - the entire world needs a new store of value.

It’s no coincidence that 2022 was the largest scale of central bank gold purchases since 1967. While there are other factors to this, such as sanctions of Russian FX Reserves, there’s fundamentally a shift from fake money (fiat + bonds) susceptible to devaluation to hard money (gold) resistant to counterfeiting.

Individuals and institutions worldwide are assessing the global store of value landscape and seeking out hard money safe-havens. While bonds will not cease to exist, savings globally will seek out more secure assets to store value. A shake-up in the $300 trillion bond market. Hard assets of all kinds are poised to benefit.

Gold was the premier store of value in the analog age. The scarce metal preserved savings for thousands of years, protecting the fruits of one’s labor against the state’s currency manipulation. Gold’s not going away; it will continue to serve this role. However, due to its physical nature, its usefulness in the digital age is limited.

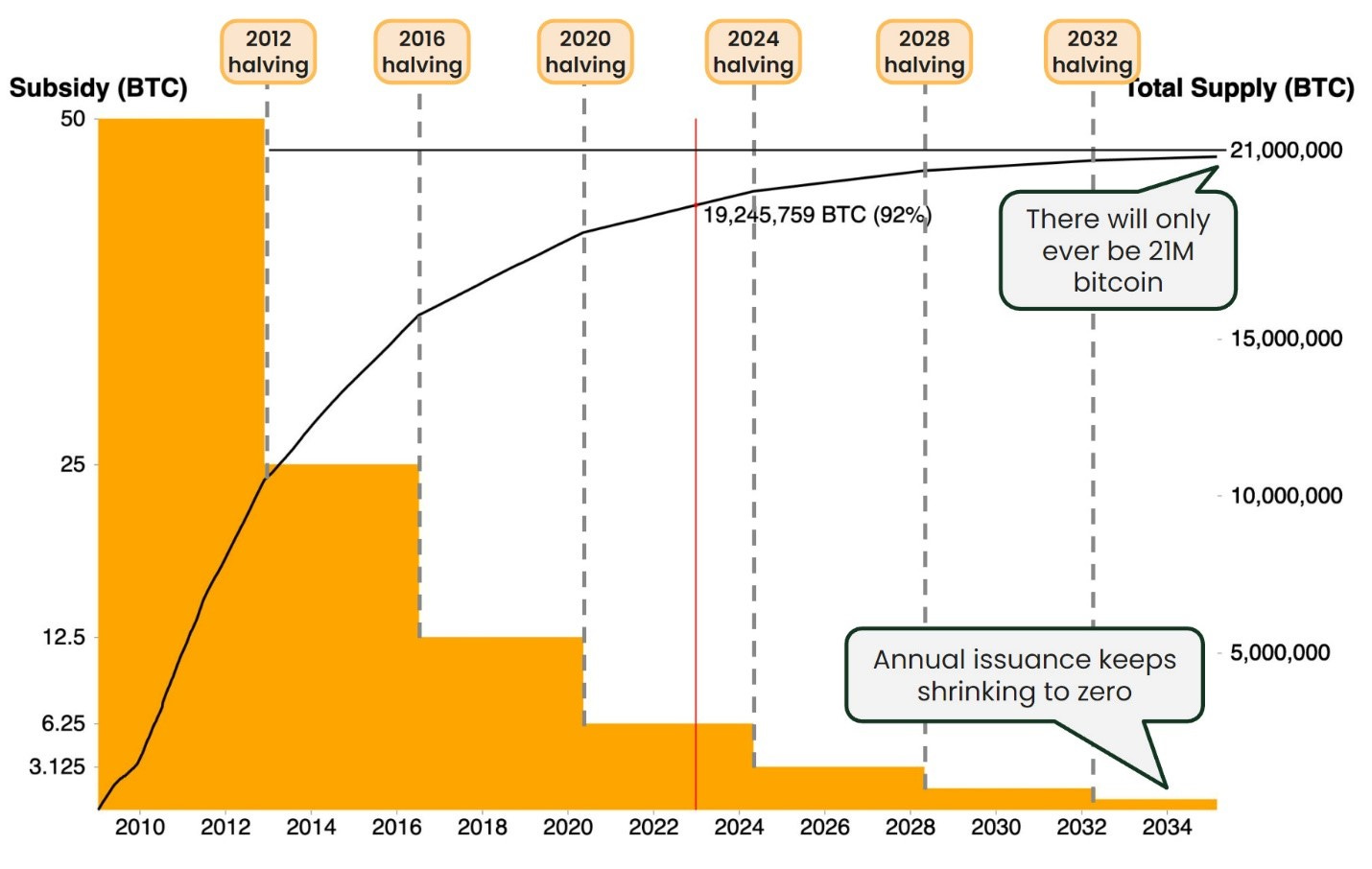

Enter Bitcoin. The premier store of value in the digital age. Bitcoin is hard money; governments and central banks cannot artificially increase the supply. Bitcoin is scarce; there’s a hard cap on the amount that will ever exist: 21 million. It’s an improvement on gold’s scarcity, as we have no certainty as to how much gold exists in Earth or in space.

Bitcoin’s 21 million hard cap is a tremendous feat in and of itself. Digital scarcity never existed before bitcoin. Anything that existed online could be copied an infinite amount of times. Currently, 19.3 million bitcoin have been mined already, 92% of the total supply, so what about 21 million? Bitcoin’s monetary policy is predetermined unlike the monetary policy of fiat money, controlled by the central bank and erratically determined in attempt to manage the global economy. In 2009, when the bitcoin network went live, each bitcoin block mined rewarded miners with 50 bitcoin. Every four years since then, the block reward has decreased by half, commonly referred to as the halving. There have been three halvings, the last in May 2020. Currently, the block reward is 6.25 bitcoins, which will decrease to 3.125 in April 2024.

The current block reward of 6.25 means that bitcoin’s supply increases by 1.8% annually, but next year in April, it will shrink to 0.9%. Gold historically has had an annual inflation rate of 1.5-2% a year. Bitcoin exhibits increasing scarcity and, based on annual supply inflation, will be more scarce than gold next year.

As government debts and fiat currencies become more abundant with time, bitcoin becomes more scarce. Bitcoin’s market capitalization is $500 billion compared to the behemoth of a global bond market at $300 trillion. Bonds had their time as a store of value globally, which is coming to an end. The bond market will not cease to exist, but instead, as savers and investors understand the dynamic at play, they will choose to store value in a hard asset that can offer wealth preservation and growth. Bitcoin is a nascent asset class, understood by maybe 1-5% of the global population.

Government bonds are no longer “safe havens” or a “risk-free rate of return.” They are more like “return-free risk,” as the holder is guaranteed to lose money. Although bonds may be stable in dollar terms, their purchasing power is declining, compared to bitcoin, which is volatile in dollar terms, but dramatically increasing in purchasing power over longer time horizons. The fluctuations in bitcoin’s dollar price reflect the instability of the fiat financial system and the fact that 99% of the world doesn’t understand it.

I am genuinely worried about retirees and savers of the world. Bondholders will have their savings wiped out, slowly but surely, over the coming decades. Governments are insolvent and will only make good on their obligations by devaluing their currencies and, thus, their bonds.

A tremendous opportunity exists in bitcoin. Bondholders Beware!

If you have been enjoying my work, I’d greatly appreciate it if you share my newsletter with friends, family, and colleagues. I believe these messages are important for all to hear and hope that by writing, I can help inform, educate, and entertain. Thank you.

Any pledges for future paid subscriptions will increase my financial sovereignty and reduce my reliance on my employer. As a paid subscriber, you will receive future pay-walled content similar to this post.

You nailed it with this piece. I didn't think to include a little back-history on how bonds became a preferred store-of-value asset in the 1900s, that was a nice added element. Great, thorough analysis here!