Bitcoin: The Next Savings “Rule of Thumb” (#3)

Three fundamental shifts at the macro, political, and geopolitical level are underway, making it likely that bitcoin is the next "rule of thumb" for savings.

The Fiat Cave is free today. But if you enjoyed this post, please help me increase my financial sovereignty by pledging a future subscription. You will not be charged until I enable payments in the coming weeks. Thank you for your support - Jackson

Since the creation of the Federal Reserve, money has been broken.

All fiat currencies, including the US Dollar, have failed as a store of value to varying degrees. Therefore, we must seek out investments to preserve our purchasing power.

Covered in Parts 1 & 2 of this series, the "rule of thumb" for managing one's savings has gone through many iterations as the world has changed, especially at the macro, political, and geopolitical levels.

In the previous post, we analyzed three fundamental shifts underway, which are crucial to understanding how to manage one's savings. Today, we will discuss how these changes will accelerate bitcoin adoption.

Bitcoin is the premier store of value, a pristine savings technology that anyone worldwide can access; however, most people have yet to realize that.

Bitcoin vs. The Fiat Thieves

Financial repression is underway and here to stay.

Governments have no choice but to reduce their debt levels. There are several ways to do that, such as an explicit default or hyperinflation; however, financial repression is the least damaging and most politically favorable way to accomplish that objective.

Financial repression is an environment of high inflation and artificially low-interest rates, a negative real rate, which transfers wealth from savers to borrowers. In the US, the Fed and Treasury used financial repression to pay debts after World War II, when Debt-to-GDP was over 120%.

Those who fail to modify their savings strategy to address this environment will have their wealth stolen over time. The previous "rule of thumb," the "60/40 Portfolio," is unequipped to preserve wealth through financial repression, especially the bond component.

As negative real interest rates continue to destroy wealth stored in fiat currencies and sovereign bonds, savers will notice a substantial loss of their purchasing power. In addition, Central Banks will have no choice but to print more of their currency to suppress bond yields, accelerating the devaluation of their currencies.

Savers will be searching for new solutions to preserve their wealth over time. During previous periods of high inflation, hard assets, such as real estate or precious metals, have been effective vehicles for protecting one's wealth. It is our expectation that a prolonged environment of negative real interest rates and currency devaluation will be accretive to bitcoin, a digital vault for one’s savings.

As governments are forced to inflate their money supply, bitcoin's absolute scarcity will attract more capital, acting as a life raft from a sinking fleet of fiat currencies.

Only 21 million bitcoin will ever be mined, and the pace at which new bitcoin is issued follows a predetermined schedule. No entities or individuals have the authority to change the supply. As more people recognize that bitcoin's scarcity allows for long-term wealth preservation and growth, wealth stored, especially in bonds, will seek refuge in this digital hard money.

Tangible assets have provided shelter in the past, which we expect to continue; however, bitcoin's inherent properties, such as its portability and divisibility, give it an edge over hard physical assets. Additionally, bitcoin's market capitalization of $450 billion is much smaller than gold's, estimated to be $12 trillion. Both are minuscule compared to the global currency, bond, and equity markets. The point is that significant capital will be reallocated in this new investment environment.

With global adoption rates of bitcoin estimated to be less than 5% depending on the method used, rest assured that it's not too late to protect your savings with bitcoin.

To hammer the point home, we expect an ongoing environment of negative real interest rates and fiat currency devaluation to contribute substantially toward bitcoin becoming the impetus for being the next "rule of thumb."

But we must acknowledge financial repression is typically a period of increased government restrictions and regulations. Governments tend to behave more authoritarian, implementing capital controls to prevent capital from fleeing their regime. They seek to "block the exit doors" of the financial system, especially to prevent sales of the currency and bonds.

In the past, governments have created new requirements for the private sector to buy their debt. For example, making institutions such as pension funds or commercial banks own a higher baseline of US Treasuries.

Another way to prevent capital from fleeing would be by creating laws to disincentivize ownership of certain assets through taxes or punitive penalties, especially those outside their purview such as bitcoin.

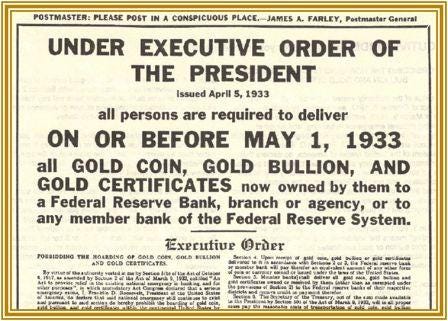

As we wrote in Part 2, an example is Executive Order 6102, issued by President Franklin D. Roosevelt, outlawing private ownership of gold.

However, bitcoin has already been adopted within circles of governments, corporations, and the like, and there are incentives for those who have a say in lawmaking to preserve bitcoin. Not only that, unlike gold, bitcoin exists digitally and can be stored in your head rather than in your home.

It's much easier for the Government to impose laws to surveil and restrict capital within their system, such as bank accounts or brokerage accounts. Capital controls, such as restrictions on where money can be moved, are easy to implement at an institutional level but much harder to implement at the individual level. Banning bitcoin purchases from JP Morgan accounts could be a possibility, but governments sending agents to knock on your door for your bitcoin private keys seems less likely.

A global bitcoin ban is unlikely and, again, would be nearly possible to enforce. As we'll cover more later in this post, trust is eroding between nation-states and institutions. We are shifting from a unipolar world to a multipolar world, and global cooperation is becoming less tenable.

Despite some measures that may be taken by governments and regulators to stifle bitcoin adoption and ownership, we do not believe they will be fruitful. More people are seeing past the propaganda of The Fiat Cave and will seek out bitcoin to protect themselves from the fiat thieves and their economic destruction.

Bitcoin is the hardest money that exists. The 21 million hard cap and inelastic predetermined supply schedule make it a secure vault for one's savings. Between bitcoin's properties, its early stages of adoption, and this backdrop of collapsing fiat currencies, it's primed to become the next savings "rule of thumb."

Bitcoin vs. The Western Tyrants

Not only is bitcoin hard money capable of storing wealth over long time horizons, but bitcoin is also the best mechanism to protect savings against tyrants who seek to control you financially.

If you hold your own bitcoin (not with an exchange), there is virtually nothing a coercive state actor could do to take it from you short of threatening your life.

Taking custody of bitcoin eliminates counterparty risk. You are not relying on any institution's financial situation or capacity to act in good faith. A primary reason Satoshi Nakamoto created bitcoin was due to the Government and central banks' continued breach of trust.

The root problem with conventional currency is all the trust that's required to make it work. The central bank must be trusted not to debase the currency, but the history of fiat currencies is full of breaches of that trust. Banks must be trusted to hold our money and transfer it electronically, but they lend it out in waves of credit bubbles with barely a fraction in reserve. We have to trust them with our privacy, trust them not to let identity thieves drain our accounts. Their massive overhead costs make micropayments impossible. - Satoshi Nakamoto

Bitcoin allows us to transact peer-to-peer without trusting any third party. The global totalitarian creep is evident. Just as censorship of speech has become pervasive, so too will financial censorship. Recent examples, such as the Canadian Freedom Convoy, highlighted the risk of financial censorship risks. Using the incumbent financial system for storing or transferring wealth creates many potential points of confiscation or censorship at the bank, credit card, or company level.

You may think it's your money in the bank, but once it's time to transfer or withdraw large amounts of money, you need their permission. Bitcoin secured in your possession allows for true financial sovereignty, not relying on anyone else's approval to store or send your money.

Bitcoin's immunity against financial censorship will continue to become more evident and increasingly important in an oppressive world.

Bitcoin's digital nature provides an extra layer of security, minimizing jurisdictional risk. Physical property is subjected to local laws and taxes. The past three years have highlighted the perils of owning property in unfavorable locations, whether that's due to excessive taxation or outright authoritarian rule. A piece of real estate's value could be impaired due to a politician's decision, and they don't have the best track record at making good decisions.

The ability to store your bitcoin seed phrase in your head or on paper and transport your wealth anywhere in the world has yet to be appreciated by the masses. As we see the rise of totalitarianism, bitcoin's mobility will be a driving factor for adoption and the transition to the "rule of thumb."

Bitcoin vs. The Fraying World Order

The third shift happening at the geopolitical level is the erosion of global trust, which accelerated in 2022 following the US seizure of Russian FX reserves.

The previous "rules of thumb" existed during the Bretton Woods and Petrodollar systems, a period of dollar supremacy. While the dollar is still the center of the global financial system, the largest adversaries of the West are accumulating "sanction hedges," specifically gold. Central banks have accumulated gold at the fastest rate since 1967.

The US Treasuries' role as the global safe haven asset is in decline, and neutral reserve assets such as gold and bitcoin are positioned for increased adoption. Bitcoin's edge over gold at the geopolitical level is its ability to be sent globally nearly instantly versus gold, which is quite clunky and costly to transact with and difficult to verify its authenticity, which is why we moved away from it.

Gold will still be a great store of value for sovereign wealth, but so too is bitcoin and not only that, bitcoin could serve as an alternative payment system to the US-based SWIFT payments in the future.

Shifting to a new world order has ramifications that we have yet to fully understand. Yet, assets that have stood the test of time, such as gold, and truly decentralized assets, such as bitcoin, will benefit.

Those who seek approval from authorities will be intrigued to see central banks and governments accumulate bitcoin this decade. As it becomes more standard for individuals and entities of all types to own bitcoin, that will play a part in bitcoin's progress toward savings "rule of thumb."

Bitcoin is Sound Money

As you can see, there are several tailwinds for bitcoin's adoption as not only a personal savings vehicle but an institutional savings vehicle.

The trends above are alarming, especially when analyzed in isolation; however, bitcoin offers hope as a savings solution insulated from the world's chaos.

Although these circumstances should accelerate bitcoin adoption, bitcoin is next in line for savings "rule of thumb" simply because bitcoin is sound money. As we mentioned at the beginning of the series, humans settled on gold as the most desirable form of money, which became widely accepted and used in many civilizations due to best embodying the six crucial properties of money:

1. Scarcity: hard to produce and obtain.

2. Divisibility: can be easily divided into smaller units and grouped into larger units.

3. Durability: not perishable or easily destroyed.

4. Portability: easy to transport.

5. Verifiability: easy to verify that it is real.

6. Fungibility: all the same, interchangeable.

Bitcoin is the next iteration of sound money, restoring humanity's path toward the hardest money to protect one's wealth. Bitcoin is the sound money of the digital age, an absolutely scarce asset, making it the premier store of value. Beyond scarcity, bitcoin's censorship resistance, near-instant global settlement, and divisibility are compelling reasons for adoption.

It's the most resilient savings account ever, impervious to Government and central bank theft.

Bitcoin makes savings simple. While people can still choose to invest in financial and real assets should they desire, bitcoin grows savings over long periods, thus not necessitating investing. Bitcoin becomes a self-fulfilling prophecy as fiat currencies continue to lose value and bitcoin appreciates in fiat terms. People are drawn to it. Increasing demand with a diminishing supply leads to a perpetual increase in its purchasing power over time.

Overall, bitcoin is a huge net positive for humanity. Because of this monetary innovation, people can focus on their skills and talents, producing goods and services the market wants. Their time and efforts can be spent on something other than evaluating investments to defeat inflation.

Ironically, each move the corrupt governments and central bankers of the world take against their citizens is an advertisement for bitcoin. And if history is any indicator, there's much more corruption and theft left before this regime crumbles. But in the meantime, we will keep our savings in bitcoin and watch from afar.

Bitcoin is the best money to ever be invented. Sound money stores value over time. Bitcoin does this well. And simply because of that, bitcoin is next to become the savings "rule of thumb."

Fiat currencies are manufactured to lose value. Bitcoin is engineered to store value.

Thank you for reading. If you enjoyed this article, please consider helping me out in one (or all) of the following ways. Thank you for your support and generosity.

Share The Fiat Cave with a friend, a family member, or a colleague.

Share this post with a friend, a family member, or a colleague.

Like this post and comment any thoughts/questions.

While I enjoy writing the newsletter, creating high-quality posts is a serious time commitment, and I hope that readers who find value in my work can compensate me for my most scarce asset: time.

Part of my goal with the newsletter is to increase my financial sovereignty, not solely rely on my employer. While I don’t expect to make a living from this, each subscription helps me become more financially resilient. Thank you for your support!

“Central Banks will have no choice but to print more of their currency to suppress bond yields“

But they will suppress yields on new-issued bonds? How will it help them then?