Bitcoin: The Next Savings “Rule of Thumb” (#2)

Three fundamental shifts at the macro, political, and geopolitical level are underway, making it likely that bitcoin is the next "rule of thumb" for savings.

As we covered in more detail in Part 1, there have been different "rules of thumb" for managing one's savings for different generations.

The Greatest Generation & The Silent Generation: precious metals, savings accounts, certificates of deposits (CDs), and government bonds.

Baby Boomers & Generation X: financial assets, specifically the "60/40 Portfolio."

Millennials & Generation Z: financial assets, specifically the "60/40 Portfolio," crypto, and bitcoin.

Those unable to adapt to the new "rule of thumb" will see their savings diluted at an increasing rate due to the stealth tax of inflation. To preserve your wealth this decade and further into the future, there are three significant developments to understand and their impact on how people should think about savings going forward.

Shifting Investment Landscape: Financial Repression

Russell Napier, a financial market strategist, researcher, and author, describes financial repression as "the art of stealing money from old people slowly."

Before diving into financial repression, we have to explain the situation which has led to the need for governments to deploy a financial repression strategy. This may be familiar to loyal readers of "The Fiat Cave," but it's essential to understand for preserving wealth into the future.

For the past 40 years, interest rates have been in a downward trend, with lower lows and lower highs of the Federal Funds rate. Lower rates were driven by deflationary forces, a combination of technology, globalization, and demographics, combined with the intervention by governments and central banks during each crisis. Since each economic contraction has been met with lower interest rates and more debt added, the global financial system is now severely over-indebted.

Governments and central banks could kick the can down the road each crisis since inflation was fairly muted, as measured by their doctored metric CPI. However, the issue is that the intervention of 2020 and 2021 created massive inflation, even showing up in fake government metrics. Higher prices have been driven mainly by monetary and fiscal measures, namely a 42% increase in the money supply in the US.

While the US has suffered periods of high inflation in the past, most recently in the 1970s and 1980s, the difference is the leverage in the financial system. The last period of high inflation in the US was during the 1970/80s. Consumer Price Inflation (CPI) peaked at 14.8% in March 1980. Federal Reserve Chairman Paul Volcker raised the Federal Funds Rate to 20% in 1981 (for comparison, today it's 4.50%). Volcker's fight against inflation was successful, but not without its costs. Inflation fell below 3% by 1983, but unemployment rose to over 10%.

At the time of Volcker's fight against inflation, Debt-to-GDP was approximately 35% compared to 135.5% today. The excessive debts in the system will serve as a hindrance to the Federal Reserve in their attempt to reduce inflation, which, remember, they created.

So, going back to financial repression. What is it exactly? It's an environment of artificially low-interest rates due to Government/Central Bank intervention paired with higher inflation. Why does this need to happen? Because of the Debt-to-GDP in the global financial system.

Hirschmann Capital's Q2 2020 Investor Letter details that "Since 1800, 51 out of 52 countries with gross government debt greater than 130% have defaulted, either through restructuring, devaluation, high inflation or outright default."

That's right, there is no easy path forward. The terrible fiscal situations globally will have to be resolved with defaults, either outright or via inflation. Countries like the US, with debts denominated in their own currency, will continue to print that currency.

We can deduce from this that for a government, such as the US government, which issues debt in its own currency, the best choice moving forward to decrease its debt is to inflate it away. Inflation will need to remain high for several years (decades) while interest rates will again be suppressed through Quantitative Easing (money printing). A rate of inflation higher than interest rates is a negative real interest rate. This decreases the Debt-to-GDP ratio of the sovereign nation.

A similar playbook was run after the Second World War when the US Debt-to-GDP ratio was over 120%. Per Lyn Alden, Founder of Lyn Alden Investment Strategy, from 1945 to 1980, real interest rates were negative half the time. A massive heist of savings as money is printed to suppress interest rates to pay off debt. Ten years of yield curve control reduced the Debt-to-GDP ratio from over 120% to 60% in roughly a decade.

Similar to QE, but slightly different, Yield Curve Control is a monetary policy that targets a specific yield in a government's bond. Rather than a particular dollar amount of liquidity injected into the financial system, which back in 2021 was $80 billion a month, the central bank targets an exact yield. To maintain that peg, for example, 2.5% on the 10-Year, the Fed would purchase all debt issuance, whether it's $100 billion or $500 billion. Enough money is printed to make sure the peg holds. This is a currency devaluation.

Interest rates are held below the inflation rate during financial repression - a negative real yield. Therefore, the "rules of thumb" of the past, including saving accounts, CDs, and bonds, will no longer be effective.

Should you decide to keep your wealth in bonds, you will be bled out of purchasing power over time or could be a victim of a hyper-inflationary event depending on which countries' bonds you own. Of course, we don't provide financial advice, and depending on your financial situation, some allocation to bonds may make sense, but it would not be wise to store much wealth there due to the investment environment we are in.

Even equities, which have held a predominant position as a "rule of thumb" included in the "60/40 Portfolio," have not performed well during high periods of inflation. Below is a chart that shows the performance of equities vs. gold in the 1970s, illustrating that equities' performance was minimal.

It does not help the case for equities that entering this period of financial repression, equities are far overvalued based on the Buffer indicator.

Negative real interest rates will prevail this decade, and those who fail to adapt their savings strategy to the financial repression underway will be victims of the heist.

Shifting Political Landscape: Tyrants of the West

This shift is summarized as "broke countries do bad things."

As mentioned above, countries around the world are insolvent. We outlined the financial repression strategy, which we expect to play out over the next decade and beyond.

Governments are going to up the ante, stealing as much as they can through higher levels of inflation and taxation. So much has happened this decade already, and much of it is a blur, yet we cannot forget the actions that our politicians, who are supposed to be servants of the people, took against us.

The pandemic, like any crisis, was used as an opportunity for governments to increase their power over their citizens and for the oligarchs to increase their wealth, benefitting massively from the deluge of money creation and government policy favoriting large businesses.

The pandemic illuminated how corrupt our public and private institutions are and the level of propaganda and coercion they are willing to use to achieve their ends. We learned that the world as we know it can change overnight, and governments are eager to take our freedoms away, especially in their weakened fiscal position.

The trap many have fallen into is thinking that the COVID crisis has come and gone. But we can be assured that governments will continue on their tyrannical path this decade and try to clamp down the hatches as they impose more restrictions.

A big lesson learned from the pandemic is the risk of owning physical assets in the wrong jurisdiction. The dichotomy between different states and countries was apparent. Being a business owner in California may have meant that you went out of business, and a business owner in Texas may have benefitted from Californians escaping oppression.

While not everyone may be able to pack up and move somewhere, at a minimum, people should realize that owning real estate in the wrong area could mean subjecting themselves to excessive regulations and potentially more taxation in the future. Be careful with illiquid assets in the wrong jurisdiction. Those savings could be better protected in property that has mobility.

Another worrisome development is the rise of financial censorship in the West. In 2022, Canadian Truckers formed the Freedom Convoy to protest against the Canadian government's excessive COVID policies and mandated vaccinations.

People who supported the truckers' fight for freedom created a GoFundMe account, which raised over 10,000,000 Canadian dollars from over 100,000 donors worldwide. GoFundMe received a tap on the shoulder from the Canadian government and removed the campaign from the platform, and held the donors' funds. GoFundMe issued the following statement:

Following a review of relevant facts and multiple discussions with local law enforcement and city officials, this fundraiser is now in violation of our Terms of Service (Term 8, which prohibits the promotion of violence and harassment) and has been removed from the platform.

After shutting the fundraiser down and seizing assets, GoFundMe was actually going to steal the donations:

Given how this situation has evolved, no further funds will be directly distributed to the Freedom Convoy organisers – we will work with organisers to send all remaining funds to credible and established charities chosen by the Freedom Convoy 2022 organisers and verified by GoFundMe.

GoFundMe was going to donate the funds to "credible" charities. After receiving pushback, they did return the money to their rightful owners. However, this should highlight that governments are increasingly unhinged and unafraid to crush dissidents who disagree with "the party."

Financial censorship is a growing trend that will worsen as broke governments continue to find ways to steal from and oppress their citizens.

Don't forget the 87,000 IRS agents hired as part of the "Inflation Reduction Act" and that the government wants to know why you are sending more than $600 on a Venmo payment.

All of this shows you that your money, if held in a bank account or within the fiat financial system, is not yours. You need permission to move $10,000 of your money within the banking system, or if you want to withdraw it, the bank wants to know why.

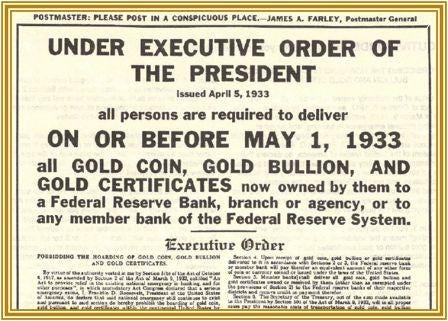

It's been a while since governments of "free" countries were willing to attack individuals' private property so directly. On April 5, 1933, President Franklin D. Roosevelt issued Executive Order 6102.

All persons are required to deliver on or before May 1, 1933 all gold coin, gold bullion, and gold certificates now owned by them to a Federal Reserve Bank, branch or agency, or to any member bank of the Federal Reserve." Should anyone be found with gold in their custody, the penalty was a $10,000 fine or ten years' imprisonment or both.

We are in a similar environment now, where governments are ready to take confiscatory measures against your money. At least make it challenging for them by storing wealth outside of their financial system.

Shifting Geopolitical Landscape: A Multipolar world

The third shift we'd like to highlight is at the geopolitical level. The fraying of the US Dollar hegemony.

The US Dollar became the world reserve currency following the "United Nations Monetary and Financial Conference" held in Bretton Wood, New Hampshire. The US Dollar was pegged to gold, and the other fiat currencies were pegged to the dollar. It's important to highlight that historically world reserve currencies last 80-100 years, which means we should expect the end of the US Dollar as the center of the financial system in the next 20 years.

There was a pivotal event last year which has massive implications for the future of the US Dollar-based financial system. Some analysts have been covering it, but overall, it has flown under the radar.

In response to Russia's invasion of Ukraine, on February 26, 2022, the West announced that not only would Russia be disconnected from SWIFT, the international payments network, but also sanctioned Russia's foreign reserves. Russia had been sanctioned from the SWIFT network in the past; however, the move to sanction their foreign reserves was new territory.

Foreign reserves may not be familiar to everyone. A quick explanation from Fortune,

Foreign reserves are a government's holdings of gold, foreign debt, and foreign currency, which is usually denominated in the world's most popular coins—dollars, euros, pounds, yen, and yuan. Although a country can hold foreign reserves in its own banks, governments often choose to keep their reserves overseas to avoid costly cross-border transactions and gain direct access to foreign currency and debt markets. Foreign reserve holdings are especially useful for managing domestic inflation, as central banks can buy and sell foreign reserves to control the value of their currency. If a central bank sells its foreign reserves to purchase more of its own currency, the value of the local currency goes up. If a central bank sells its local currency to increase its reserves, the value of the local currency goes down.

Whether or not the seizure of $600bln of Russia's foreign reserves is "good" or "bad" does not matter. It was a wake-up call to countries globally, especially those adversaries of the United States, such as China and Russia.

It was no coincidence that there was an increase in discussions between BRICs nations (Brazil, Russia, India, China, and South Africa) to explore alternatives to dollar trade and the highest demand for gold by central banks in 55 years. According to BullionVault, the flight to central banks to gold "would suggest the geopolitical backdrop is one of mistrust, doubt and uncertainty," in the wake of the US & Western Allies deciding to sanction Russia's reserves.

Countries are asking themselves the same question at a geopolitical level that we are at an individual level, "what do I actually own?" While Russia and China have been de-dollarizing for over a decade, the confiscation will accelerate that trend.

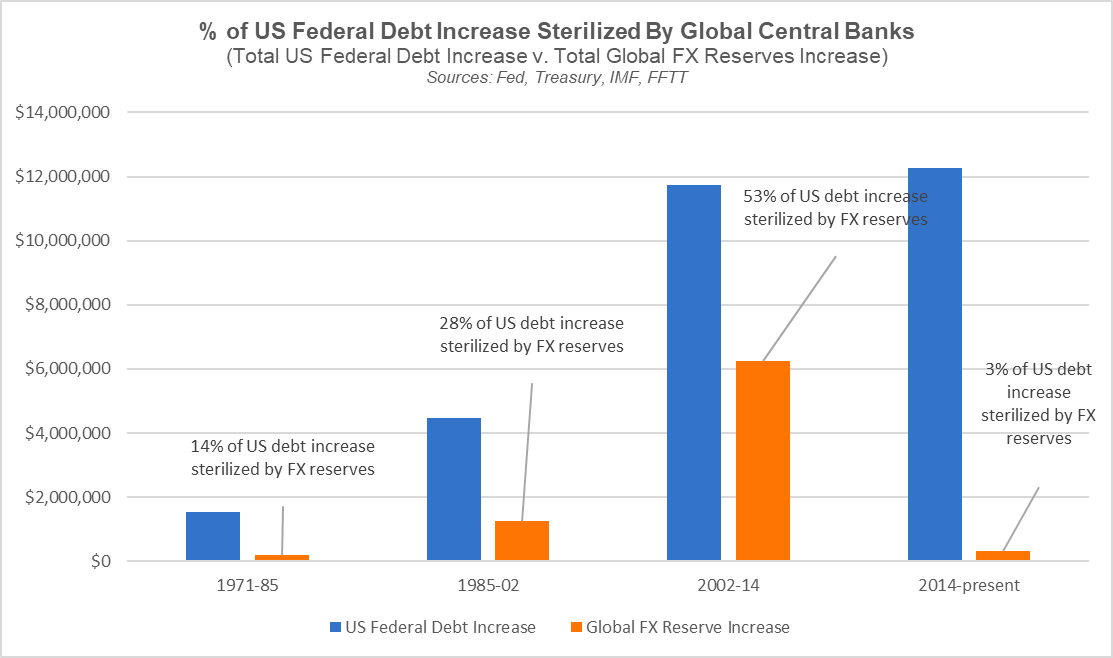

Forest for the Trees (FFTT) Founder Luke Gromen illustrates that central banks appetite for US Treasuries has declined substantially since 2014. Gromen notes that from 2002-2014, foreign central banks financed 53% of all UST issuance; from 2014-2022 only 3% of a much larger UST issuance.

With the US Federal Debt at $31 Trillion and a growing interest expense due to higher interest rates, the Federal Reserve will likely be forced to lower interest rates and begin Quantitative Easing (QE) to finance the growing deficit of the US Government. In plain English, that means more currency debasement.

As we highlighted earlier, financial repression is underway and here to stay. We should expect inflation to remain higher than interest rates, which means foreign central banks can purchase USTs and receive a negative real yield, exposing them to counterparty risk or purchase hard assets like gold or bitcoin.

As evidenced by central bank purchases of gold in 2022, they chose the latter. With the fraying global trust and the negative real interest rates, central banks are shifting away from dollar-denominated assets.

Although China and Russia are primarily leading the charge on de-dollarization, as this excellent report from

notes, the US Dollar is still deeply entrenched in the global financial system.So while the dollar's demise is not imminent as some may believe, a shift is undoubtedly underway at the geopolitical level for countries to favor neutral reserve assets over US Treasuries.

This massive change at the geopolitical level has important implications for the savings "rule of thumb." A multipolar world favors neutral assets that cannot be confiscated or weaponized against them. The result is that US Treasuries will increasingly be purchased by the Fed, meaning more devaluation in the dollar and a bull market for real assets.

The previous generations' "rules of thumb" relied on the US Dollar Hegemony and relative stability globally. As the dollar slowly loses its strength on the global playing field, we need to adapt our savings to the new environment.

We believe these three shifts have already changed the savings "rule of thumb," making bitcoin the premier store of value.

Enjoyed reading the article. Important that people stay nimble and are willing to change their mind when new facts are presented. It's clear the dollar is dying, but the question is how long will this take to play out, 1 year, 10 years, 50 years? Many thought it was over in 2008 and here we are 15 years later. Don't underestimate the kleptocrats ability to keep kicking the can down the road, but do not store all your wealth in an asset that is guaranteed by math to lose value like cash and treasuries🫡🤝😎