Bitcoin ETFs: The "Reverse IPO"

How does the bitcoin ETF compare to an IPO?

The long-awaited bitcoin ETFs may finally be approved in January 2024.

Thirteen firms, including BlackRock, WisdomTree, and Invesco, have pending applications with the SEC for spot bitcoin ETFs (not futures-based). Bloomberg's ETF analysts assign a 90% probability of approval by the January 10th deadline, anticipating several approvals in one day.

The floodgates are opening… As Grayscale's CEO said earlier this week, a bitcoin ETF opens the asset's doors to approximately $30 trillion of managed wealth.

Although most of you reading may not be buyers of a bitcoin ETF, it's still a monumental event that will be a significant positive catalyst for the bitcoin price this cycle.

On a recent episode of TFTC, Fred Krueger, former prop trader at Salomon Brothers and Greenwich Capital, likened the bitcoin ETF to an IPO.

It's an interesting thought… in traditional markets, IPOs can be highly anticipated; it's the day that allows for broader participation in the company's ownership and the potential return stream associated with that investment.

In many cases, IPOs see large inflows of capital. Bitcoin's ETF should be no different. There are predictions that $2-4 billion will flow into the bitcoin ETFs on their first day of trading. And as Krueger noted, a recent sale of $1.5 billion sent the bitcoin price from $44,000 down to $40,000, which means $2-4 billion of purchases could mean close to a $10,000 increase in the bitcoin price a single day.

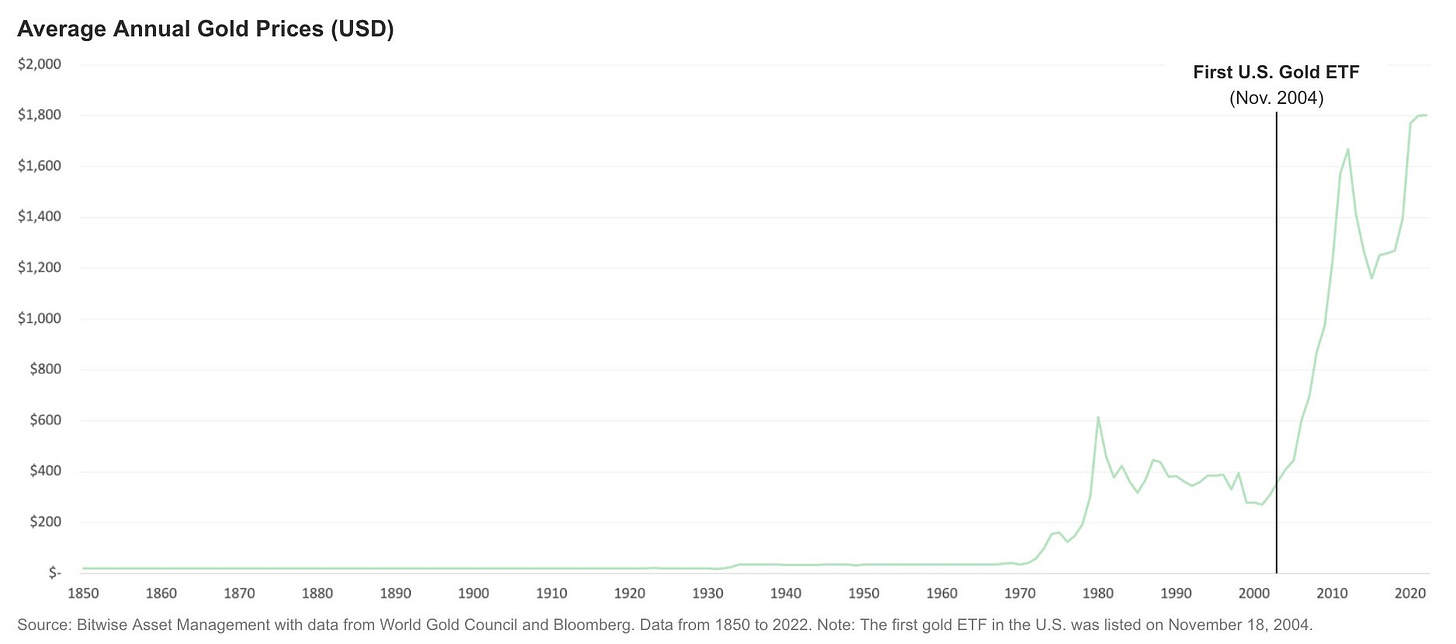

According to Galaxy Digital research, bitcoin ETFs could see $14.4 billion of inflows in the first year and $27 billion and $39 billion of inflows into bitcoin ETFs in the second and third year, respectively. And to use gold as a historical precedent, following the first ETF approval in 2004 the price rose by 350% from $450/oz to over $1,900/oz in 2011.

That's all to say if bitcoin ETFs begin trading in January, buckle up. Given the high likelihood of approval, the next couple of weeks could be the best opportunity to make an initial allocation or increase an existing allocation to bitcoin.

Trends in Private Markets

Bitcoin's "IPO" may be around the corner, but this is quite different than an IPO (in fact, it's not an IPO, but the comparison is helpful). I think of the launch of bitcoin ETFs as almost like a "Reverse IPO." But what does that even mean?

In traditional equity markets, an IPO marks the end of a company's era in private markets. For venture-backed start-ups, large funding rounds are typically raised in private markets - Pre-seed, Seed, Series A, Series B, etc.

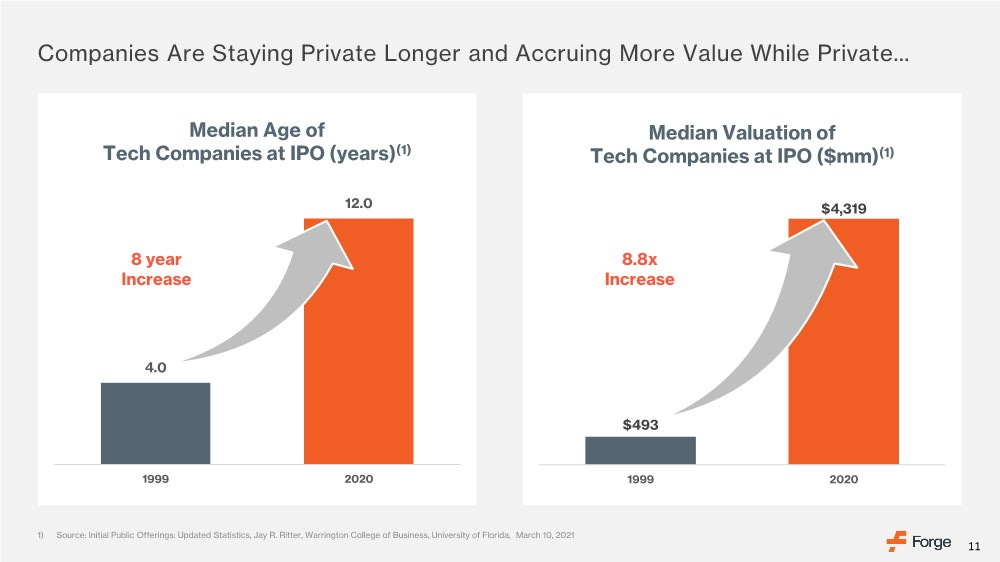

Companies have been staying private for longer. In the technology sector, for example, the average age of a new public company had gone from 4.5 years in 1999 to more than 12 in 2020. To that point, we've seen companies raise hundreds of millions of dollars in late-stage rounds before going public.

The trend of private for longer means that much of the outsized returns are realized in the private markets by institutional investors & HNWIs via venture capital funds. And while it's not always the case, by the time the company reaches the public markets and retail investors can participate, returns tend to pale in comparison.

So, in the traditional world, professional investors and those with access to capital and a vast network can fund the best opportunities early on and use retail as exit liquidity. Don't get me wrong, there have been some massive success stories post-IPO - Amazon and Google are obvious ones. But perhaps 2021's IPOs (and SPACs) left a bad taste in my mouth…

Coinbase is an excellent example of today's private and public market dynamic in the American venture ecosystem. Coinbase's first funding round was on September 26, 2012. CEO and Founder Brian Armstrong received $150,000 from start-up accelerator Y Combinator. Following that, in May 2013, they raised a $5 million Series A and then $25 million in December.

Coinbase raised more than $500 million in private markets, including a $100 million Series D in 2017 and a $300 million Series E in 2018, which pushed the company's valuation to $8 billion. By the time of Coinbase's direct listing (similar to IPO, but no new shares are issued) in April 2021, the company's valuation was $85.8 billion. Its stock price was $250 when the market opened but rose 24% on its first day, reaching an $87 billion valuation.

Almost three years later, Coinbase's share price is $168 - 50% lower than its all-time high of $332. To be fair, from its direct listing to now, FTX collapse occurred, along with among many other insolvencies, blow-ups, and frauds, and the cyclical bear market in bitcoin and crypto.

However, it's representative of the trends in private markets, i.e., private for longer, massive late-stage funding rounds, outsized returns for institutional investors. And by the time the company goes public, retail may be left holding the bag.

Bitcoin’s Reverse IPO

Bitcoin’s “private market” days are coming to an end… The ETFs will lead to a surge of investment, similar to an IPO; however, it’s a distinctly different dynamic — the “Reverse IPO.”

As we approach January 2024, fifteen years since bitcoin’s inception, it’s worth reflecting on its adoption and journey to its “Reverse IPO.” Unlike startups that rely on ever-increasing funding rounds led by VCs and HNWIs, bitcoin’s open-source code allowed virtually anyone to participate in its growth from the outset.

Many early adopters of bitcoin, who remain some of the largest holders today, were talented cryptographers, software engineers, and even hobbyists.

In the early years of bitcoin, adoption happened in more obscure areas of the internet such as cypherpunk and libertarian circles. In most cases, those who adopted bitcoin early on were in it for the groundbreaking technology or the implications for non-state money… very few, I’d imagine, expected to amass the wealth they have today. There were, of course, still speculators who saw it as an asymmetric investment opportunity, yet it was not the consensus view.

This contrasts sharply with traditional markets, where funding early-stage companies is a closed system, and the objective is to find the 100x investment. While some VCs are passionate about the industries they invest in, it’s still, at the end of the day, about maximizing returns for the investors.

Bitcoin’s global and open-source nature has led to a remarkable trajectory in adoption, which is starkly different from traditional markets. Its adoption has proliferated globally over fifteen years, not sheltered in Silicon Valley.

In the past decade, practically anyone with a smartphone and spare savings could participate in bitcoin and benefit from its hard money properties and exponential adoption.

In many ways, retail investors and people worldwide have been able to front-run institutional investors, venture capitalists, and professional money managers. But it’s not that they didn’t have the opportunity to buy bitcoin; they did, but many were too uncomfortable, skeptical, apathetic, or outright hostile to learn about bitcoin and purchase some.

Enter the era of bitcoin ETFs, a new chapter in bitcoin’s adoption. Participation from influential figures such as Larry Fink and BlackRock signal bitcoin’s acceptance into traditional finance. The $30 trillion managed wealth industry will now have regulator-approved and familiar vehicles for investing in bitcoin. The introduction of ETFs is bound to unlock a tremendous amount of capital, propelling bitcoin to all-time highs.

Fortunately, for those who will participate in Bitcoin’s Reverse IPO (ETFs), the fundamentals continue to improve. Unlike a tech startup with an astronomical valuation due to 0% interest rates and seemingly unlimited VC money crashing down on retail post-IPO, bitcoin remains an excellent investment with an asymmetric upside.

And while it may not feel it, it’s still early for bitcoin. It’s a fifteen-year-old technology that will transform every aspect of our lives. The internet of money, as it’s often referred to, will become as ubiquitous as the internet is today, and it’s about to be easier than ever to participate.

Next year, we will see the mainstream adoption of bitcoin in investment portfolios. And while the ETF is inferior to owning the underlying bitcoin, it's a step in the right direction. Now everyone can get a taste of the best performing asset.

Thanks for being here. If you enjoy The Fiat Cave, you can support me by pledging a paid subscription and/or sharing, liking, and commenting on this post.

Merry Christmas & Happy Holidays!