Bitcoin and the States: The Race to Redefine Economic Power in America

Over the past two decades, Silicon Valley and Washington, D.C. have dominated wealth concentration—but the next wave belongs to states that embrace Bitcoin.

Over the past two decades, the concentration of wealth in the United States has shifted dramatically. A comparison of the richest counties in 2005 versus 2025 reveals a clear pattern: Washington, D.C. and Silicon Valley have emerged as the major money hubs.

Five of the top ten wealthiest counties in 2025 are located in the D.C. metro area, while three are in Silicon Valley. This starkly contrasts with 2005, when more wealth was centered around the New York metro area.

What explains this shift? The massive expansion of government spending has turned Washington, D.C. into a money (leech) magnet, fueling an ecosystem of contractors, lobbyists, and government-adjacent industries.

Meanwhile, the tech boom has transformed Silicon Valley into an economic power hub. The internet was one of the most transformative innovations in history, laying the foundation for entire industries to emerge—software, social media, AI, and all the associated venture capital.

This pattern suggests a broader theme: economic incentives drive wealth concentration. As government spending ballooned post-2008 and Silicon Valley cemented itself as the backbone of the digital economy, capital flowed into these regions.

Washington, D.C. benefited from a considerable expansion of federal spending and forever wars, drawing in those who sought to profit from government contracts and policy influence rather than true innovation.

Meanwhile, Silicon Valley attracted entrepreneurs and investors who built on the internet’s foundation to create new industries.

But this trend is not static. If the last 20 years were shaped by the expansion of government influence and the dominance of big tech, the next 20 could be defined by the rise of Bitcoin and the decentralization of economic power, shifting wealth to jurisdictions that embrace financial sovereignty and technological innovation.

If we fast forward to 2045 and analyze the wealthiest counties in the U.S., I’d wager that many of them will be in cities and states that embraced Bitcoin early.

Just as Silicon Valley grew in prominence with the rise of software and the Internet and D.C. expanded in wealth due to an ever-growing government, jurisdictions that adopt Bitcoin as a strategic reserve asset and have a pro-Bitcoin policy will attract capital, talent, and businesses seeking financial sovereignty.

The Reversal of D.C.'s Dominance & Government Excess

D.C.'s wealth concentration is a symptom of an era of unchecked government expansion fueled by deficit spending and money printing. Since 2008, stimulus programs, quantitative easing, and monetary policy interventions have funneled vast amounts of capital into financial markets and government-driven industries, disproportionately benefiting Washington, D.C.

The reliance on federal spending and debt has led to a form of artificial wealth creation that primarily benefits those closest to the source of money printing.

However, as Bitcoin adoption accelerates, power dynamics will shift. States that adopt this new technology and align with its principles of financial sovereignty will become economic powerhouses.

This represents a long-term bet against government bloat and a bet in favor of financial innovation at the state level. The Department of Government Efficiency (DOGE) is only the start.

States that integrate Bitcoin into their financial infrastructure, encourage business and individual adoption, and provide a stable regulatory environment will position themselves as leaders in the next era of economic growth.

The Race for the First State Bitcoin Strategic Reserve

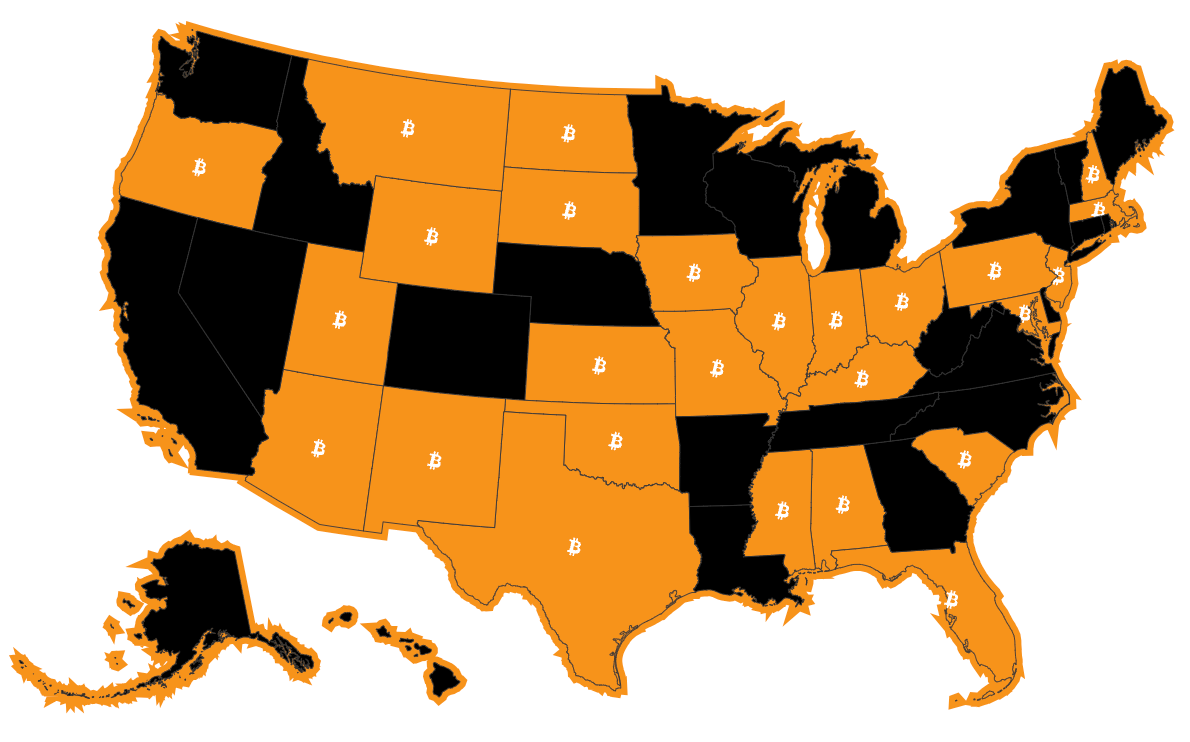

As of this week, now over half of U.S. states have introduced some form of Bitcoin-related legislation. A total of 27 bills have been introduced, including 19 State Bitcoin Reserve (SBR) bills.

Utah (current leader): Passed a Bitcoin reserve bill in the House, allowing up to 5% of the state’s treasury to be allocated to Bitcoin.

Iowa: A bill proposing to allow 5% of public funds to be invested in digital assets with a market cap greater than $750 billion (Bitcoin only).

Arizona: A proposal to allocate up to 10% of the state’s treasury and retirement reserves into Bitcoin. This bill has already passed the Senate Finance Committee.

Missouri & Oklahoma: Exploring Bitcoin-backed municipal bonds as a way to strengthen local treasuries.

New Hampshire: Developing legal frameworks for Bitcoin-backed loans and financial services that incorporate Bitcoin into state-level economic policies.

The jurisdictions that move first will have a significant economic advantage, as they will attract businesses, entrepreneurs, and investors looking for financial-friendly regulatory environments.

Bitcoin as a Megatrend: The Next 20 Years

If history is any indication, the next two decades will follow a similar trajectory to what we saw from 2005 to 2025: economic power will shift toward industries and technologies that define the future. In the same way that Silicon Valley became the center of gravity for software and D.C. became the capital of government largesse, Bitcoin-friendly states will become economic powerhouses.

Bitcoin’s adoption at the state level will be the tipping point. As capital flees high-tax, high-regulation jurisdictions in search of economic freedom, Bitcoin-friendly states will emerge as the new centers of wealth.

By 2045, I expect we will see a new set of wealthiest counties (and states)—ones that prioritized financial sovereignty and embraced Bitcoin as the bedrock of their treasury reserves and economy.

The U.S. wealth map is set for another seismic shift, and Bitcoin will be at the heart of it.

If you’re interested in any of the following, subscribe for more:

Bitcoin investment research

Bitcoin personal finance

Building a bitcoin business

Practical ways to invest in bitcoin

Practical ways to secure bitcoin