A "Mostly Peaceful" Heist (Part 2)

In “A “Mostly Peaceful” Heist Part 1,” we discussed the deception in our monetary system, namely that we have been led to believe that "moderate inflation" is natural and healthy for an economy. This "moderate inflation," arbitrarily decided and ambiguously defined, is a "mostly peaceful heist." A corrupt partnership between central banks and governments has developed a monetary system that gives them a monopoly on the issuance of money. The monopoly on money allows the Fiat Jailers, central bankers, and governments to issue more money to enrich themselves at our expense, keeping us prisoners of the monetary system. Through the expansion of the money supply (inflation), our cost of living increases, savings decreases, and the Fiat Jailers grow their share of wealth.

The Blueprint of the Heist

Remember, inflation is "the expansion of the money supply." The increase in money supply could come naturally and require work and capital, such as discovering a gold deposit, extracting that gold, and bringing it to the market. Alternatively, it could be as easy as printing bills or making keystrokes on a computer.

The increase in the price of goods is determined by the expansion of the money supply relative to production (economic activity). For example, prices were relatively stable during the gold standard as the gold supply grew by approximately 2% each year, and so did economic activity. Today, we have much higher prices because Central Banks and Governments have expanded the money supply much above the production of goods and services.

This is possible because fiat money is decreed by the Government, issued by central banks, backed by nothing, and enforced by violence. The Central Bank and Government (Fiat Jailers) expand the money supply (inflate) for their benefit, continuing to extract the wealth of productive members of society.

The creation of the Federal Reserve in 1913 was the first step in establishing a monetary system based on theft; however, the removal of gold from the monetary system in 1971 enabled the stealing of savings to a greater degree.

Below is the US M2 money supply chart from August 1971 to October 2022. During the first three decades of fiat money, the expansion of the money supply (inflation) was pretty consistent. As we turned the corner of the millennia, we saw that the money supply growth accelerated, most notably in the 2020s, which explains the higher prices we are confronted with today.

After the Government severed the US Dollar's tie to gold in 1971, the Fiat Jailers were unconstrained in their ability to create new money. The chart below depicts the US Governments' surplus or deficit each year since 1900. A government operates like any other business. There are revenues and expenses. Taxes are the Government's revenues to fund its expenses.

The deficits and surpluses of the early and mid-1900s are barely a blip on the chart. While there were deficits, especially during economic contractions, such as the Great Depression, or during wartime, such as World War II, there was a degree of budget balance. The gold standard limited, to some degree, the number of new dollars that the Fiat Jailers could create.

Following 1971, the Government no longer had to extract the wealth of its citizens explicitly through taxes to fund spending. Taxes are unpopular, especially high taxes, so the Government found a better way to fund their endeavors, a more subtle way.

I will preface this by saying that there are additional complexities out of the scope of this article, such as the petrodollar system. Since the mid-1970s, rather than gold backing the dollar directly, oil has backed the dollar indirectly.

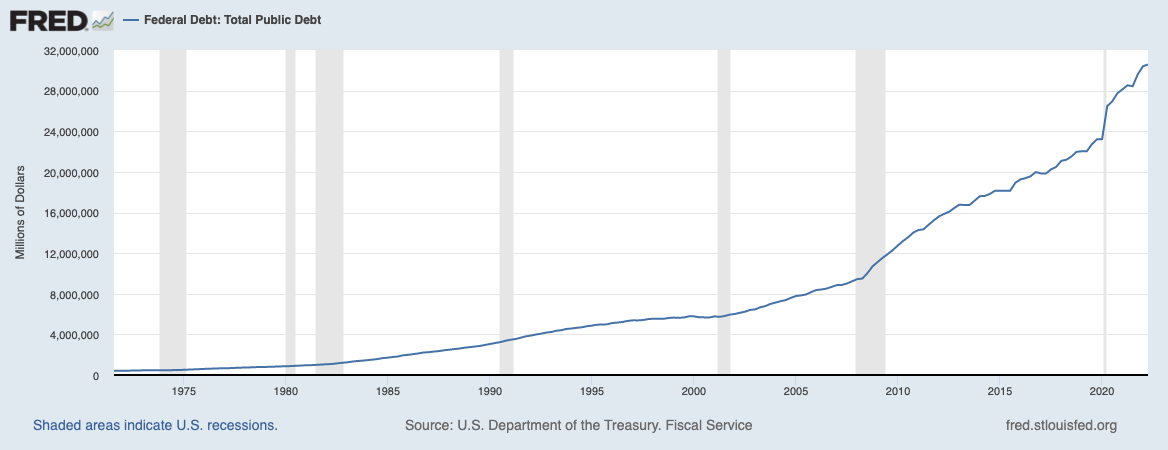

In the fiat money era (Post 1971), US Government Debt increased precipitously. Rather than taxing constituents for spending, the US Government issues debt, which many foreign countries purchase with their surplus. Since the dollar is the world reserve currency, there is a need for dollars globally to trade. Thus, the US Government has grown its spending program to a greater degree, funded significantly by foreign debt buyers.

However, US Government spending has increased in recent decades, and foreign buyers have yet to keep up. Thus, rather than the US Government raising taxes domestically to fund more spending, the Federal Reserve has stepped in to purchase any excess US Treasuries. Therefore, the US Government can issue as much debt as it would like, the Federal Reserve will create the money to buy the debt, and then the Government will have the money to spend as they see fit. This scheme of Federal Deficits funded by the Federal Reserve is called Quantitative Easing.

Below is a chart that represents the Federal Reserve's balance sheet. We can see that following the 2008 Financial Crisis when the Fed lowered interest rates to 0% and Quantitative Easing began, the Federal Reserve began purchasing large amounts of US Government debts and other securities.

What does this all mean? Essentially, removing gold from the monetary system removed the limitation on government spending. Since fiat money is not backed by anything, the Fiat Jailers have been able to increase the money supply as they see fit. And being able to create money with a keystroke is quite tempting. Government spending, often justified by crises, ultimately benefits those controlling the money.

Simply put, when the Government & Federal Reserve creates money, they steal from you. They are diluting your share of the total money in circulation.

Higher Stakes

For a century now, Fiat Jailers have spread propaganda to brainwash the masses with the idea that "moderate inflation" is healthy and normal for an economy.

When the expansion of the money supply by the Fiat Jailers only resulted in 1% or 2% higher prices per year, that was less noticeable. The general public accepted that prices go up, but the stakes weren't high enough to pay much attention to the increase in prices.

While theft of any kind is immoral, the heist of savings at this moderate rate was "mostly peaceful." For the most part, people could still support themselves by working, saving money, purchasing a house, and striving for "the American Dream."

But what happens if the expansion of the money supply is much more elevated?

We are discovering that right now. A total of $6.4 TRILLION was printed in 2020 and 2021, an 42% increase to the US money supply. As we mentioned in the last section, the US Government issued US Treasuries (Debt), and the Federal Reserve conjured money from nothing and purchased those Treasuries on their balance sheet. The Government was then able to allocate the proceeds as they saw fit.

If you can think back a year or two ago (I know it's hard with the deluge of information nowadays), interest rates were 0%. Yet, a massive barrage of money entered financial markets and the real economy.

While people received 0% on their savings, a 42% increase in the money supply drove prices much higher. Those who did not own assets such as stocks or real estate were not protected against money printing. Their savings were devalued, a blatant robbery of the working and middle class.

It should not be shocking to know that while people were robbed of their savings, that wealth was transferred to the Elite class. According to Forbes' 35th Annual World's Billionaire List, there were 2,755 billionaires, 600 more than the previous year, in aggregate worth $13.1 trillion, which was an increase of $5.1 trillion in one year.

Not so Peaceful Anymore

Now millions of people in the United States and billions globally face worsening living conditions. Wages have not kept up with the higher prices. I don't know anyone making 40% + more than they were pre-2020.

The "mostly peaceful" heist of savings is now tearing the fabric of society.

As expected, politicians and media on both sides of the aisle are aiding societal decay. While it is apparent to those who pay attention that the substantial increase in prices is mainly due to all the money printing by the Elites, politicians/media are inciting more hatred, divisiveness, and violence.

As we wrote in "The Fiat Cave: An Allegory of Monetary Deception (Part 2)," the Fiat Jailers keep us prisoners of the monetary system through the expansion of the money supply and then point at the shadows on the walls, the donkey and elephant. The media tell us that we should hate the prisoner next to us for our struggles.

But in reality, the oligarchy has siphoned wealth from us to benefit themselves. Yet anyone who watches/reads Mainstream Media will receive vastly different explanations for the deteriorating quality of life that you are facing.

Politicians on the left, such as Elizabeth Warren, accuse Oil & Gas companies of "price gouging," which has led to higher prices in energy.

Similarly, on the right, news anchors like Sean Hannity blame it all on Joe Biden. Let's not forget that the massive increase in the money supply began under Trump.

You may also remember that politicians and the media were eager to blame the high prices on Russia's invasion of Ukraine. Biden used the term "Putin’s Price Hike,” which was rapidly spread by the media.

Recently published in the NY Times, “Inflation Has Arrived. Here's What You Need to Know." Directly from the article, "What causes inflation? It can be the result of rising consumer demand. But inflation can also rise and fall based on developments that have little to do with economic conditions, such as limited oil production and supply chain problems."

It is all fake news meant to distract and confuse us. Regardless of who is in office, we are prisoners of a corrupt monetary system that steals our wealth by expanding the money supply. By obfuscating the truth, the Fiat Jailers have successfully stolen the savings of civilians and escaped in the getaway van.

Without fixing the monetary system that allows these parasites to extract our life's work, our savings, via money printing, it's almost inevitable that the US and the West will continue declining.

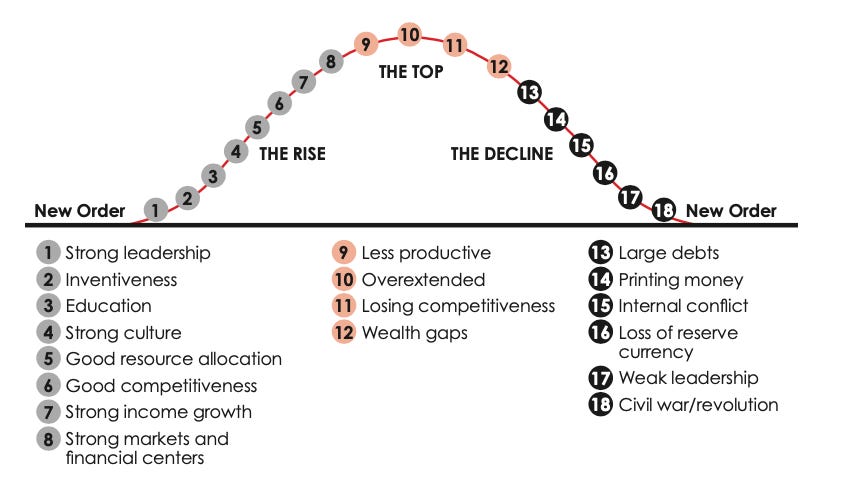

In his latest book "Principles for Dealing with a Changing World Order," Ray Dalio shares a framework to illustrate the rise and fall of an Empire. We are clearly in decline, with "large debts, printing money, internal conflict." Next usually comes a loss of reserve currency, weak leadership (which we already have), and civil war/revolution.

As the rate of monetary expansion increases, so too does the rate of societal deterioration. While the heist continues, we become more divided. Political extremism is increasing. Violence is increasing. Poverty is increasing. Famine is increasing. Doesn't seem peaceful to me.

In Part 3, we cover the consequences should we continue on this path and explore how bitcoin could protect us from this "mostly peaceful" heist.