On December 29, 2022, President Biden signed the $1.7 TRILLION bipartisan omnibus bill, "ending a year of historic progress."

Historic progress? Toward what exactly? The destruction of the American middle class?

The hubris of politicians never ceases to amaze us, but to call 2022, a year defined by the highest inflation in forty years, an abysmal year in financial markets, and negative real economic growth, "historic progress" is next level.

While Americans and people globally have struggled with higher prices for all their essential goods and services, President Biden signs a spending bill for another $1.7 trillion while vacationing on St. Croix in the U.S. Virgin Islands. While we cannot imagine many readers of this publication are fans of President Biden, we do want to be clear that the destruction of the middle class does not fall on the Democrats or Republicans alone.

Certainly, in the United States, and we'd be confident to say, in any “democratic” country, the political system may work to achieve some ends, but overall, due to the broken monetary system, voting does not matter much.

Regardless if Orange Man or Sleepy Joe is in office, the oligarchical class continues to extract the wealth of productive members of society through more taxation and monetary debasement (inflation).

It's an outrageous claim that anything besides the wealth destruction and blatant robbery this year was "historic progress." If we can agree that a "mostly peaceful" heist has been underway since 1913 with the creation of the Federal Reserve, then we can agree that some solid progress was made to increase the stakes of the heist this year.

If the Elites' goal is to keep us prisoners of their financial system, they have achieved significant progress in 2022. But only to that extent should they be given any credit.

However, not only was 2022 a year of "historic progress" toward destroying the common man, but the decade thus far has achieved a great deal of success toward that end. 2023 may even set a new record for “historic progress” made in a single year.

Business Closures & Money Printing: Starting to Make Progress

The "historic progress" began in 2020 with the onset of COVID-19. A pandemic ravaging the world with a rapid uptick in case count, hospitalization, and deaths spooked the world and the inept (or corrupt) "leaders" of the world. Without much public discourse to determine the best approach to handle the virus, these leaders decided to lockdown the global economy. Between the virus and the politicians' response to it, economic activity and financial markets cratered. Interestingly enough, as with any crisis over the past several decades, the decision was made to lower interest rates to 0% globally and embark on the largest money-printing program ever.

In the United States alone, a total of $6.4 TRILLION was printed in 2020 and 2021, an 42% increase to the U.S. money supply.

Such an expansion in the money supply without a commensurate increase in the output of goods and services is bound to result in higher prices. However, there was no concern at the time for price inflation because all "expert" economic forecasts predicted economic calamity and, more likely, deflation than inflation. Since interest rates were at 0%, savers earned no interest on their accounts while asset prices began to skyrocket.

When money is abundant, it will chase anything relatively more scarce to preserve purchasing power. However, only some are fortunate enough to have extra money to pile into asset prices, but those who did saw their wealth increase at record rates, at least at the time. Those with savings were forced out into the risk curve to abandon safer investments in search of higher returns that could shield them from the monetary debasement. While they were able to seek asylum temporarily, the story is much different now.

Asset prices continued to climb to new highs in 2020 and those in the working and middle classes, commonly referred to as "Main Street USA," had their livelihoods destroyed. Millions of people who owned or worked at small businesses saw their revenues crushed due to government lockdowns imposed across the board.

And yes, some checks were mailed out to encourage people to stay home, not that they had much choice. Here's your $1,200 now shut up. Now those people are much worse off as their businesses have shut doors permanently or have gone back to work with the same wage despite everything being much more expensive.

Once the economy began to reopen in 2021 from the government-imposed lockdowns, price inflation, measured by the consumer price inflation (CPI) metric, began to reflect the consequences of the actions of the central banks and governments.

As the doctored and manipulated metric began to reflect higher prices, all the "experts" insisted that it was transitory and continued to do so for several months. “Don't believe your lying eyes,” they said. We can all think back to 2021 and remember the substantially higher prices of our most basic needs, such as food and energy. Yet, the government tells you that it's much lower based on their phony metric, and actually, it's transitory, so don't worry about it.

Again, if we are talking about "progress" toward destroying the middle class, there's much to be proud of in the first two years of the decade. Significant headway was made between the money printing, which grew the wealth gap in favor of the ultra-wealthy, and the destruction of small businesses. And not only that, but their actions set up the perfect rug pull in 2022.

And It’s Gone (Your Wealth)

Eventually, the experts came out and told us, peasants, that inflation was not transitory. It should not have surprised anyone that increasing the money supply by 42% without a similar increase in the production of goods and services would lead to much higher prices.

To salvage what credibility remains, central banks, led by the Federal Reserve, began to hike interest rates in March 2022. Following the most recent FOMC meeting in December 2022, their target rate was 4.25%-4.5%; the Fed remains steadfast on hiking rates further. The fastest rate hikes ever pursued have unsurprisingly created turmoil in financial markets and will soon ravage the economy.

Since the Great Financial Crisis, the economy and financial markets have been built on ultra-accommodative monetary policy. For most of those years, interest rates have been at 0%, or close to it, and there have been constant liquidity injections in the form of Quantitative Easing. The financial system became addicted to cheap money and does not fare well during tighter financial conditions. At this point, the Fed's only option to reduce inflation is to create a recession; however, as we discussed in recent articles, their ability to keep interest rates high and decrease liquidity via Quantitative Tightening will ultimately be challenged by the fiscal situation. We covered this in more detail in the article below.

However, let's focus on the wealth destruction of 2022. The most aggressive interest rate hiking campaign from the world's central bank (effectively), the Federal Reserve, crashed asset prices.

Across the board, wealth has been significantly destroyed in crypto, stocks, bonds, and real estate. And it was a particularly challenging year because both equities and fixed income experienced steep corrections as the benchmark interest rate increased. Ironically, despite the highest inflation in forty years, holding cash was the best way to preserve wealth. MarketWatch reported that "Household wealth dropped by $13.5 trillion from January to September, second-worst destruction on record."

Because central banks and governments lowered interest rates to 0% and printed trillions of dollars and other fiat currencies in 2020 and 2021, people who have money to preserve felt pressured to take more risk. The S&P 500 recorded 70 closing highs in 2021, according to S&P Global. But all good things must come to an end. Financial and real assets that benefitted from the monetary expansion have experienced severe pain in 2022 as the Federal Reserve has reversed course to save its reputation.

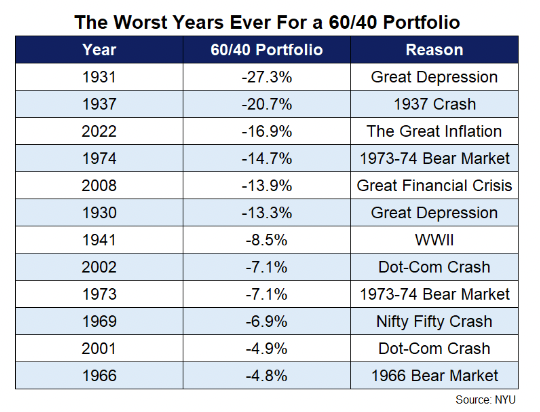

Since the 1980s, the defacto savings account, the 60/40 portfolio, offered appreciation, income, and downside protection because interest rates were in a secular downtrend. However, the 60/40 savings account recorded its third worst year in recorded history in 2022.

According to Ben Carlson of "A Wealth of Common Sense," "There has only been one double-digit calendar year loss for 10-year U.S. treasuries since the 1920s. That was an 11.1% loss in 2009. Now we have two," as the total bond market index returned -13% in 2022.

So, we must ask ourselves, what do President Biden and the oligarchical class know that we don't? Well, I am sure there is too much and far more than we care to know.

But what was the "historic progress" made?

To us, it's clear that the only reasonable progress that has been made so far this decade is destroying wealth and creating a cost of living crisis.

2023: Even More Historic?

In December 2023, do not be surprised to hear President Biden say it was another year of "historic progress" toward destroying the middle class.

As we wrote about in the two-part series "The Fed's Big Decision: Destroy the Middle Class or Destroy the Middle Class (Part 2)," there are only two paths forward: a brutal recession or high inflation. Either outcome will further destroy the middle class and will be easily navigated by the Elite class.

The caveat to these two paths forward is that the debt spiral challenges the Fed's ability to raise interest rates to defeat inflation. Due to the excessive amount of debt on the balance sheet of the United States and countries globally, our expectation is that financial repression is the 2020s’ playbook, which means high inflation and artificially low rates. Negative real rates (higher inflation than rates) steals wealth from savers.

The U.S. Government, and most developed countries, are insolvent and will only be able to pay their bondholders with newly printed fiat currencies, which is a default on their obligations. This is nothing new.

Per Hirschmann Capital's Q2 2020 Investor Letter, "Since 1800, 51 out of 52 countries with gross government debt greater than 130% have defaulted, either through restructuring, devaluation, high inflation or outright default." The United States already defaulted twice, 1933 and 1971, which we covered in “The Fiat Cave: An Allegory of Monetary Deception (Part 3).”

However, before the money printing and 0% interest rates come again, we expect the recession to become acute. Under the weight of higher interest rates, not only will people watch their net worth continue to decline, but layoffs will begin en masse. As mentioned, since the Great Financial Crisis, companies and countries have relied on 0% interest rate financing and money printing, and without that constant intervention, many will struggle to survive.

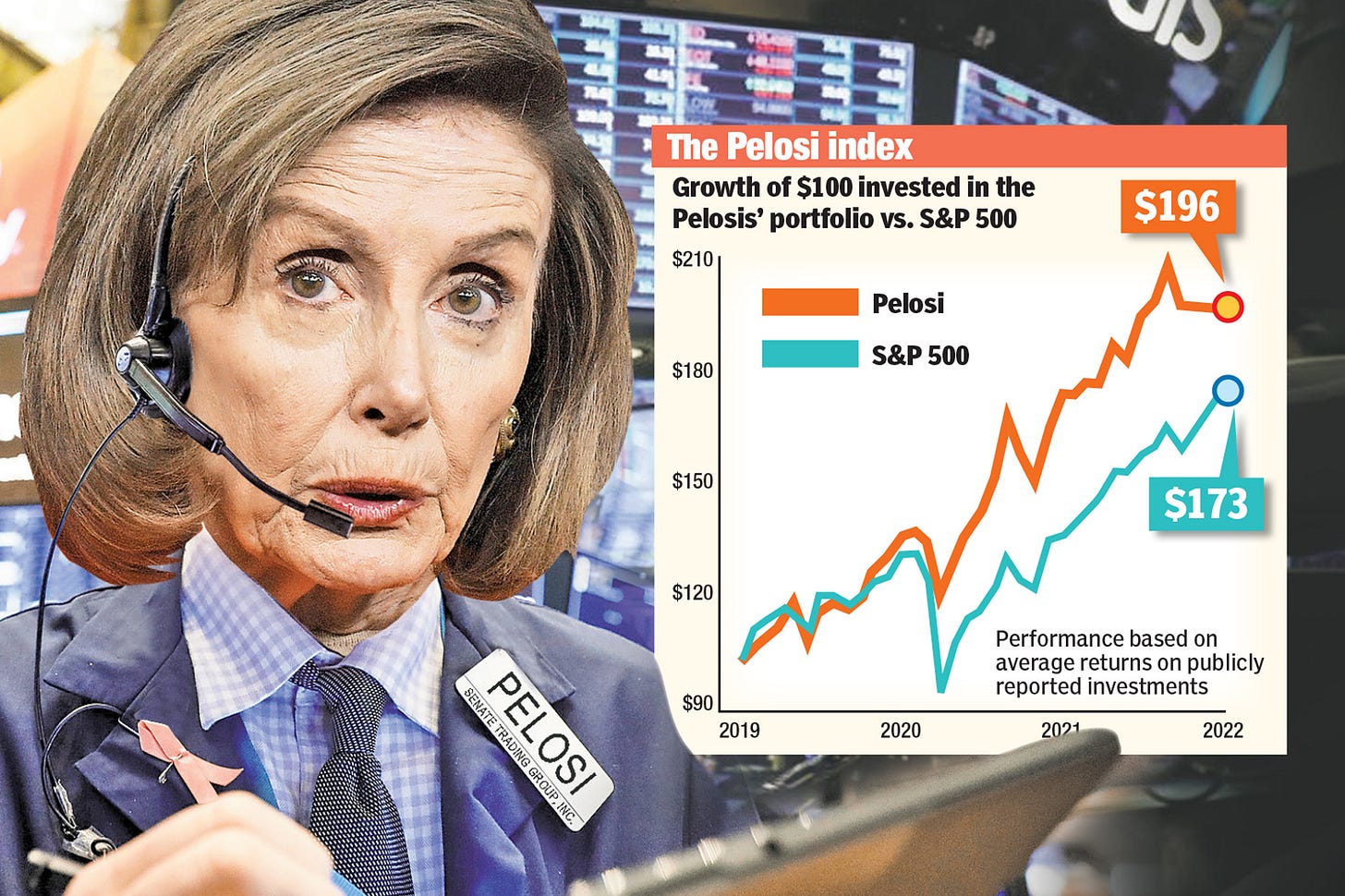

We would bet money that the Elites are currently cash heavy, ready to swoop in on cheap assets before the money printing continues. After all, Nancy Pelosi may be the best trader to ever live.

A Decade of Historic Progress

The United States is following in the footsteps of the Roman Empire, which collapsed for many reasons, two of which were excessive taxation and monetary debasement.

For the remainder of the decade, we expect Elites to continue to make substantial progress in destroying wealth and creating more cost-of-living crises. The only way for a government as indebted as the United States to reduce its Debt-to-GDP ratio is through financial repression. The ideal situation for those in control, the government and central banks, would be for sustained inflation for the next decade, with interest rates below that rate. While a catastrophic episode of hyperinflation would also do the trick to reset their balance sheet, that would also destabilize the nation and could spark a revolution.

To avoid a peasant revolt, the Elites are currently trying to reduce inflation measured by their Changing Propaganda Index (CPI) with interest rate hikes; however, do not be duped. The long-term trend for this decade and beyond is negative real interest rates. Anyone holding bonds and fiat currencies can expect their savings to continue to be destroyed by the "leaders of the free world" who want to keep you a prisoner of their monetary system. Think of it as a charitable donation, but instead to a bunch of criminals who hate you.

Unfortunately, the Elites will likely get away with the heist once again as long as they can avoid collapsing the financial system and can rather slowly bleed out savers and induce cost-of-living crises over the next decade. Most people are complacent in their "reality" in the Fiat Cave. They are stuck in the two-party political system, too distracted by the latest celebrity gossip, new consumerist trend, or their favorite NFL team.

Meanwhile, the state continues to steal by expanding the money supply and aggressively taxing its constituents. The central banks will continue to fund mass propaganda, such as the media, to brainwash people into hating each other and the other political party. It seems unlikely that people will wake up this year; thus, it may very well be another year of "historic progress."

We believe turbulent and chaotic times are here to stay. The current state of the world is bound to worsen before it improves if history is any indicator. The money printing will accelerate over the long term, and eventually, fiat currency will collapse. While we are not optimistic about the direction of the world as a whole, there are pockets of hope. As the Elites push for more centralization and control through the destruction of wealth and cost of living crises, we can take individual actions to decentralize our lives. Localism is the counterpunch to the globalist future the Ruling Class envisions. That's why it is imperative to store wealth in bitcoin, outside the fiat financial system, and seek ways to increase your resilience. If you follow us on Twitter, you know we are proponents of "shaking a rancher's hand." More on that in future pieces.

The good news is that if you have found this newsletter, you are spending time in the right places on the internet. Well ahead of most in terms of thinking for the long term and understanding what's at stake. And I am blessed to be in a position to write this every week and meet other people who share similar ideas and values. Thank you.

If you enjoyed this post, please let me know and hit the like button. If you have any comments or questions, I would love to hear from you!